Bitcoin Again Rebounds From Strong Price Support

View

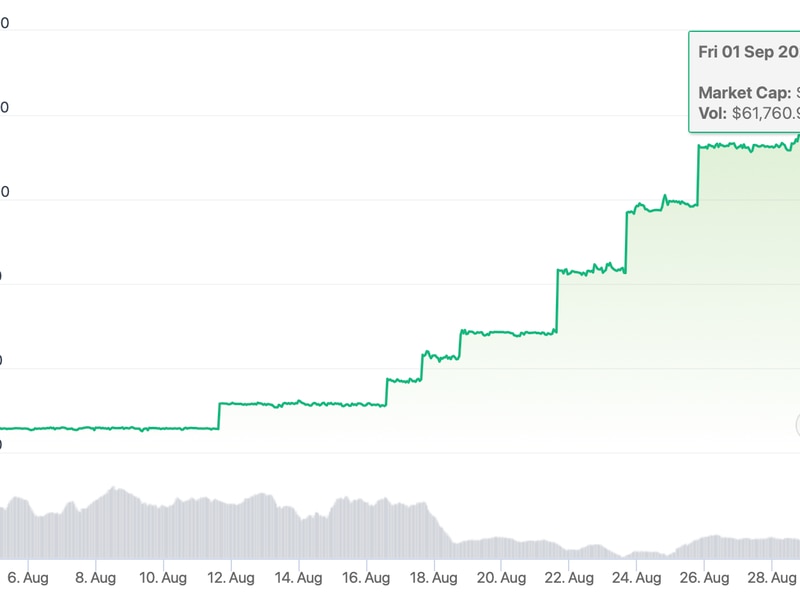

- Bitcoin has again created a higher low along the 30-day moving average line, neutralizing Monday’s bearish close below $3,920.

- A move above $4,055 (March 21 high) is still needed to revive the short-term bullish setup. That could be followed by a rally to resistance levels lined up at $4,190–$4,236.

- A UTC close below the 30-day moving average, currently at $3,889, would put the bears in a commanding position, opening the doors for a drop to support levels at $3,775 (March 14 low) and $3,658 (Feb. 27 low).

Bitcoin (BTC) has once more rebounded from the 30-day moving average, thwarting a bearish move that saw prices drop below $3,920 on Monday.

The move sees the crypto market leader return from uncertain ground 24 hours ago, having dived out of the $3,920-$4,055 trading range on Monday. That range breakdown coupled with the signs of bullish exhaustion on the longer duration charts had opened the doors for a deeper drop below the 30-day moving average (MA) at $3,883, as discussed yesterday.

The MA support, however, held ground despite the bearish setup, allowing BTC to climb back to $4,000. Essentially, the cryptocurrency has established a bullish higher low along the key average for the third time this month.

While the bearish case has weakened, the short-term bullish view put forward by the long-tailed doji created on Feb. 27 would only be revived if there is a strong follow through to the rebound from the 30-day MA support, preferably a break above the recent high of $4,055 hit on March 21.

As of writing, BTC is changing hands at $4,015 on Bitstamp, representing a 2.6 percent gain on a 24-hour basis. A high of $4,031 was clocked soon before press time.

Daily chart

As seen above, BTC has picked up a bid following the defense of the 30-day MA, currently at $3,889. The higher-low pattern would gain credence if the bounce ends up establishing a higher high above the March 21 high of $4,055.

That would expose the February high of $4,190, above which a major hurdle is seen at $4,236 – the bearish lower high created on Dec. 24.

On the downside, a UTC close below the 30-day MA is the target for the bears.

8-hour chart

On the 8-hour chart, BTC has breached the falling channel on the higher side and the breakout is backed by a bullish relative strength index (RSI) reading of 61.00.

So, prices may find acceptance above $4,040 in the next few hours. The bullish case, however, would weaken if the rising trendline hurdle proves a tough nut to crack.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Bitcoin image via Shutterstock; charts by Trading View