Binance’s VC Arm Dominated Funding Rounds Last Week Even as Regulators Scrutinized the Crypto Exchange

Binance Labs, the venture capital arm of the world’s largest crypto exchange, was the most active investor among the funding rounds announced last week even as its parent faced increased regulatory scrutiny – and possible fraud charges – by law enforcement agencies in the U.S. and abroad

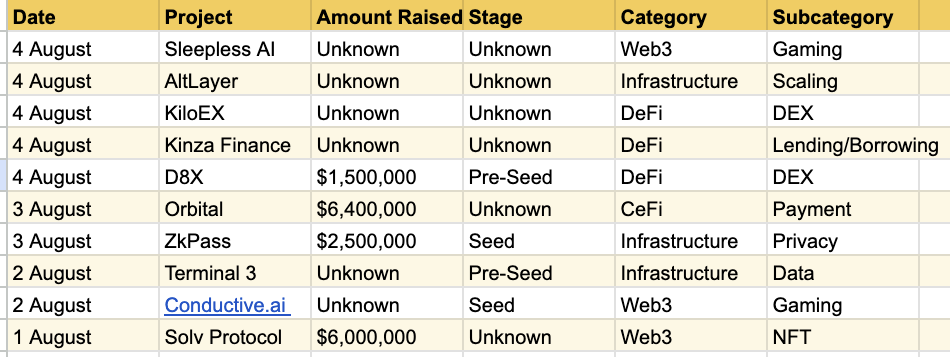

The unit announced four investments at one time on Friday: blockchain scaling startup AltLayer, decentralized exchange KiloEx, decentralized finance lending platform Kinza and Web3 gaming company Sleepless AI. The investments were made through the sixth season of the Most Valuable Builder (MVB) incubator program.

Last week included an unusually high number of fundraises that didn’t include a monetary amount, so it’s not possible to tally up the overall amount raised with any accuracy. Conductive.ai was one of the unspecified rounds, launching an engagement platform for game developers with the financial backing of Web3 gaming giant Animoca Brands.

Companies that did disclose the amount raised included D8X, a Polygon-based and backed DEX that raised $1.5 million in a pre-seed round. Privacy-focused infrastructure provider ZkPass raised $2.5 million in a seed round that included Sequoia China and Binance Labs. CeFi payments platform Orbital raised $6.4 million. Solv Protocol, which allows institutions and venture capitalists to sell tokenized financial products, secured $6 million in a round that included a subsidiary of banking giant Nomura Securities.

The data in the table below includes information that was current as of 5pm ET on Friday, Aug. 4. Any deals announced after that time will go into next week’s roundup.

UPDATE (Aug. 7, 15:24 UTC): Changed lead image; original photo was of a former executive.

Edited by Sheldon Reback.