Binance Visa Card Guide: Read Before You Order

Spending cryptocurrencies such as Bitcoin and Ethereum in shops and restaurants is getting easier by the day. More and more merchants grasp the potential of cryptocurrencies and adopt them in one way or another.

Several cryptocurrency debit cards have recently popped up to help businesses offer digital assets as a payment method. Just like any other conventional ones, cryptocurrency debit cards allow you to conduct day-to-day transactions using BTC, ETH, XRP, and other altcoins.

Binance – the world’s leading cryptocurrency exchange by trading volume – has also joined the fray and has recently launched a new crypto-based Visa debit card. It enables real-time conversion of cryptocurrency to EUR when a user makes a transaction.

Binance has been striving in making cryptocurrency usage as widespread as possible,, and the latest Visa debit card is a testament to that.

What is Binance Visa Card?

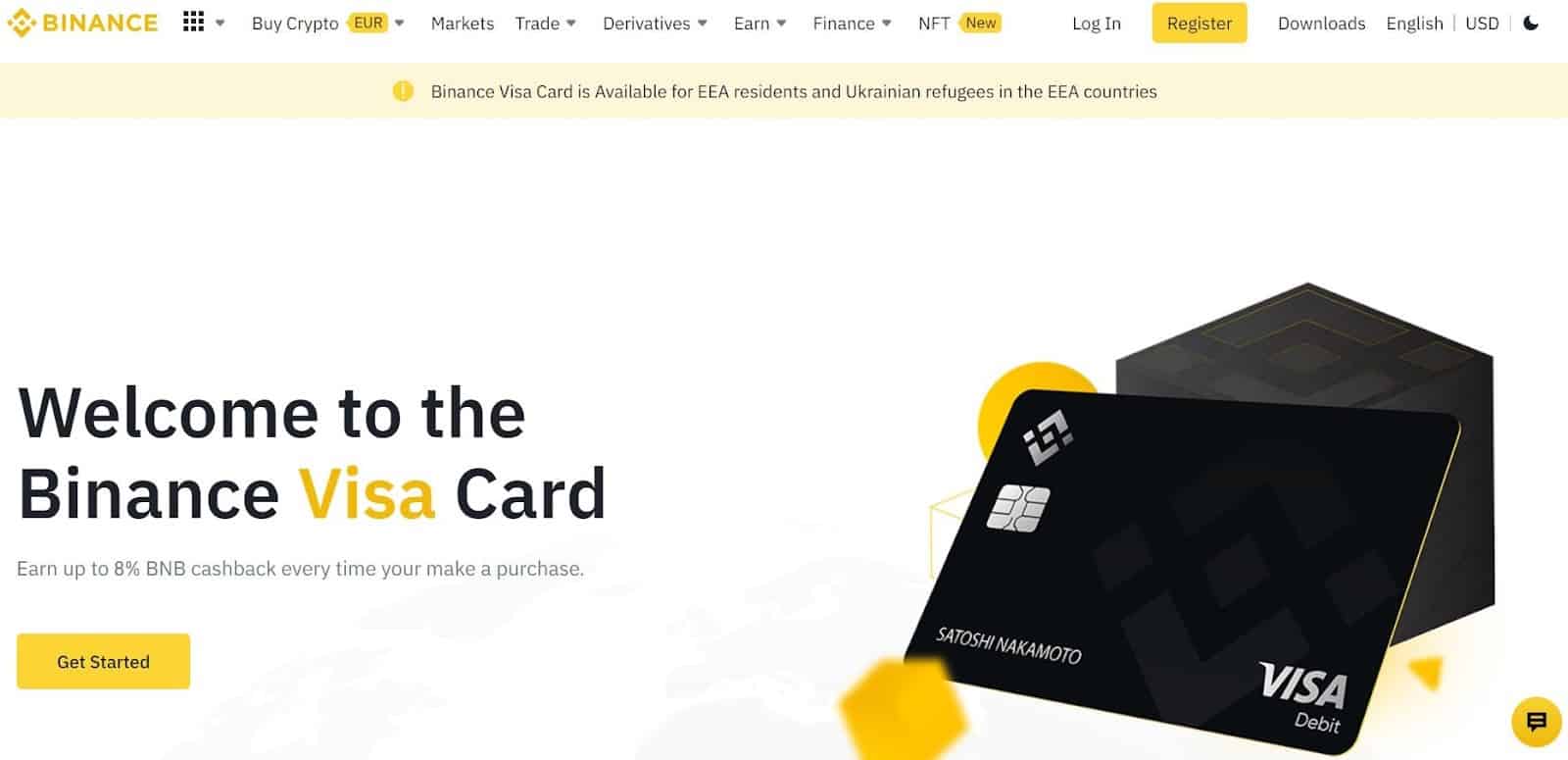

Binance Card is essentially a Visa debit card that is linked to your Binance account and allows you to spend crypto anywhere that Visa is accepted. It is a prepaid card just like a regular debit card and has to be pre-loaded with crypto beforehand.

Currently, it is available to Binance users in selected European countries such as Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.

It can be used at more than 60 million merchants across 200 regions and territories around the world which accept Visa cards.

So far, Binance Card only supports the conversion and spending of the following cryptocurrencies: BNB, BUSD, USDT, BTC, SXP, ETH, EUR, ADA, DOT, LAZIO, PORTO, and SANTOS.

Why (or Why Not) to Order Binance Visa Card?

The Binance Visa Card provides a convenient way to spend your crypto profits.

Pros

- Low transaction and processing fees

- You can use your crypto-based Visa card worldwide wherever Visa is accepted.

- Binance is among the most popular and secure crypto platforms.

Cons

- Taxation: For each country, you should check and make sure how crypto is taxed (if there is any and how much) because to spend your crypto, you sell it for fiat and then spend the fiat.

Features of the Binance Visa Card

In addition to furthering utility and adoption, Binance Visa Card has introduced a few more features:

- Binance does not charge any administration nor transaction fees.

- You don’t need to exchange your crypto asset into fiat for purchasing purposes. Binance converts it exactly when you need to, thereby, the crypto is converting only at the moment needed,, and you can HODL until then.

- You can get up to 8% cashback depending on your monthly average balance of your Binance Coin (BNB). This cashback is offered in BNB and credited to your Binance account.

Now, let’s have a look at how to apply for a Binance Visa Card.

Binance Card: How to Get One?

Non-Binance Users

Unless you already have an account with Binance, you will have to create one first. Signing up takes a few minutes. Click here to go to the Binance registration form, and follow the sign-up instructions.

Another pre-requisite before ordering the card is that the user account will need to be KYC level 2 verified.

Existing Binance Users

For existing Binance users, here are the necessary steps to receive your brand new card:

Step 1: Apply for the Binance Visa Card by visiting the website.

Step 2: Click “Get Started”

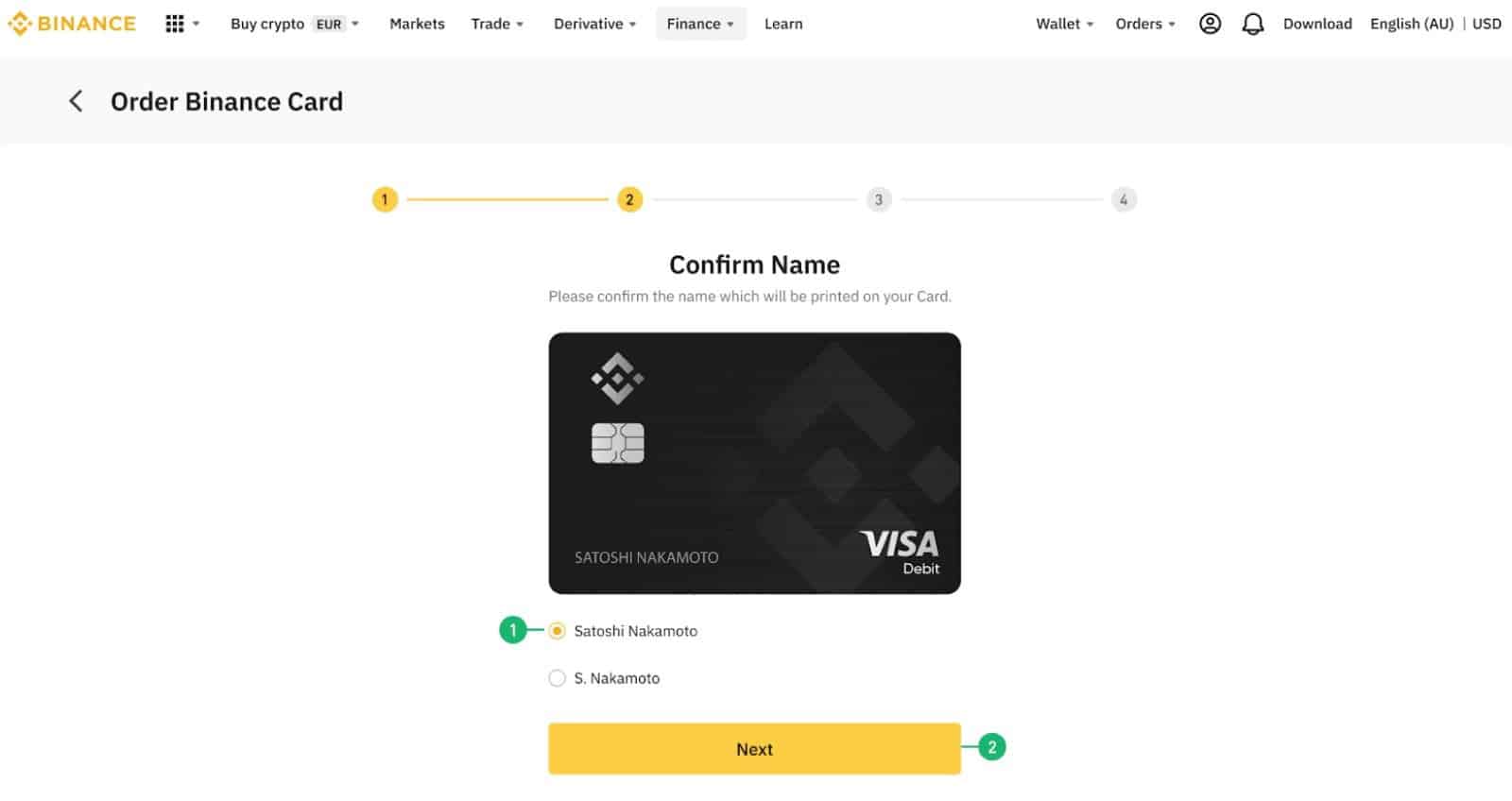

Step 3: Once you are redirected to the Binance Card’s order page, you can choose how your name appears on the card. Click “Next” after confirming it.

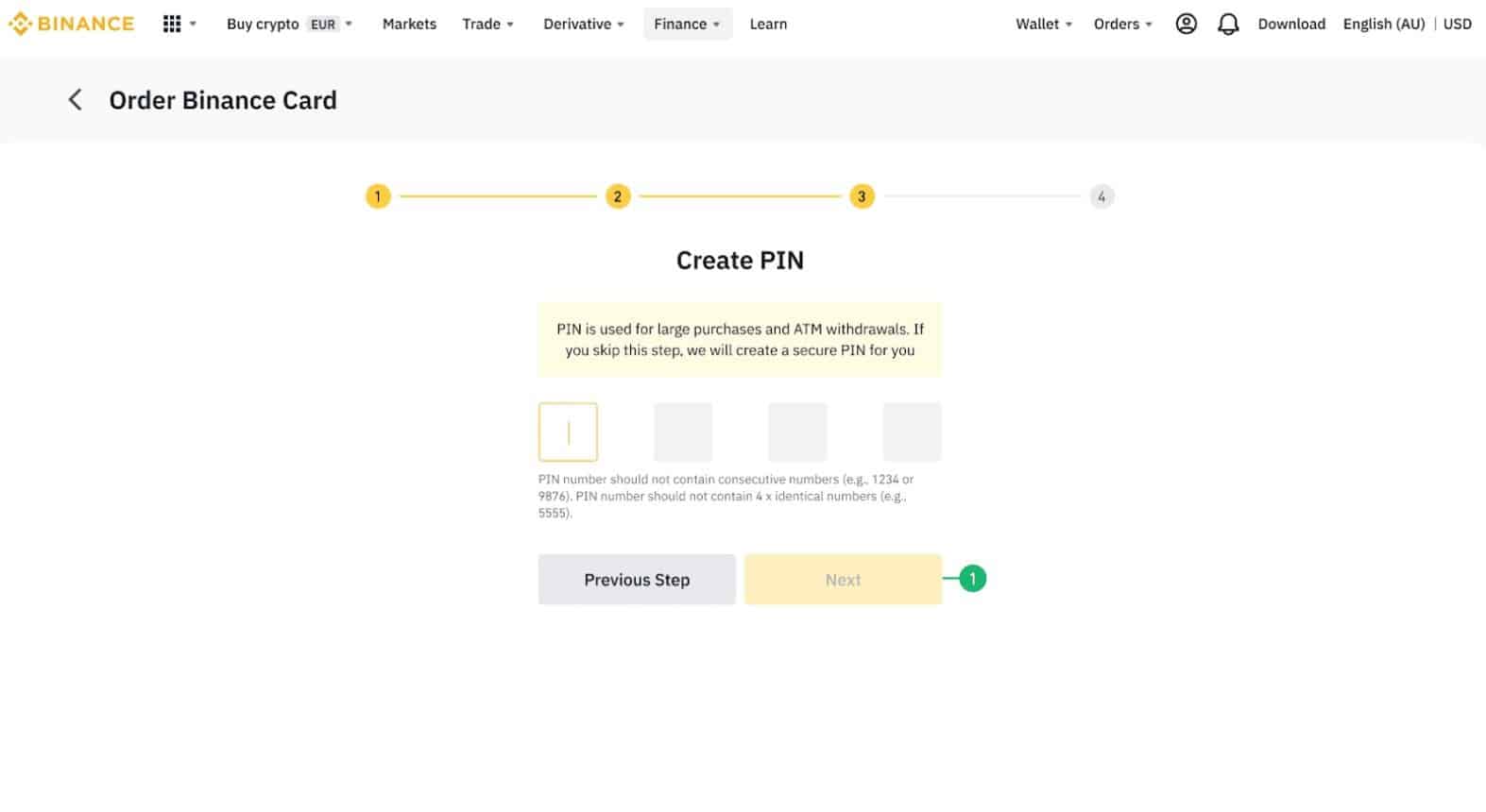

Step 4: Next up is creating a PIN for your Binance Visa Card. There are two security measures to keep in mind. When creating a PIN, it’s advisable not use four consecutive numbers,, such as – 1234 or 6789. Do not use sequences such as 7777.

Note: if you skip this step, your PIN will be auto-generated. You can later change it using an ATM.

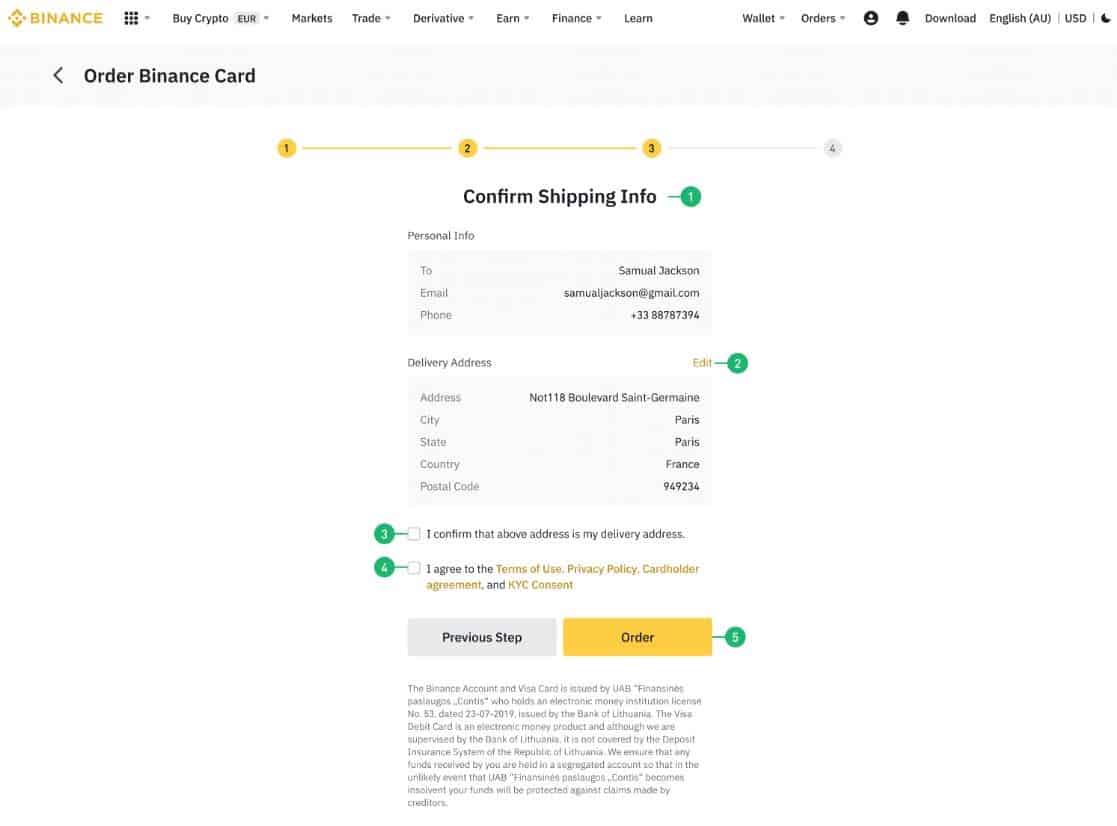

Step 5: After the PIN generation, you can confirm the delivery address for the card. Binance will automatically prefill the address with the one you registered at the exchange’s website. You should check thoroughly and add any missing information if needed.

Step 6: Confirm all your details and agree to the Terms of Use, Privacy Policy, Cardholder Agreement, and KYC consent.

Step 7: To complete the process, click “Order.”

Depending on the country of residence, it generally takes about 1-3 weeks for the Binance Visa Card to get delivered. But if you wish to start using your Binance Card, you can do it via Google and Samsung Pay.

Activating the Binance Visa Card

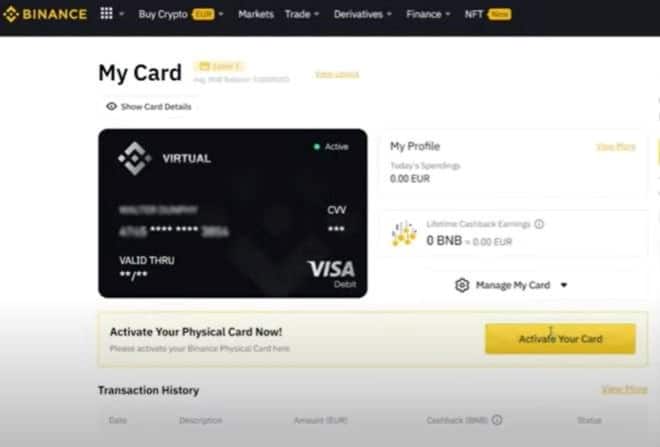

After you successfully place your order, your virtual Binance Visa Card will be activated automatically.

To activate your physical card, however, go to the Card Dashboard. Remember – the section in yellow, which says “Activate You Card,” will be grayed out and inaccessible until the status of the card has transitioned from “Pending” to “Shipped.”

Only when the status is marked “Shipped” you can click on the“Activate Your Card” icon. For security measures, it’s better to receive the physical card before activating it.

Checking your Binance Visa Card Details

You can check your details after you activate the physical Binance Card. The view Details function only supports virtual Binance Cards.

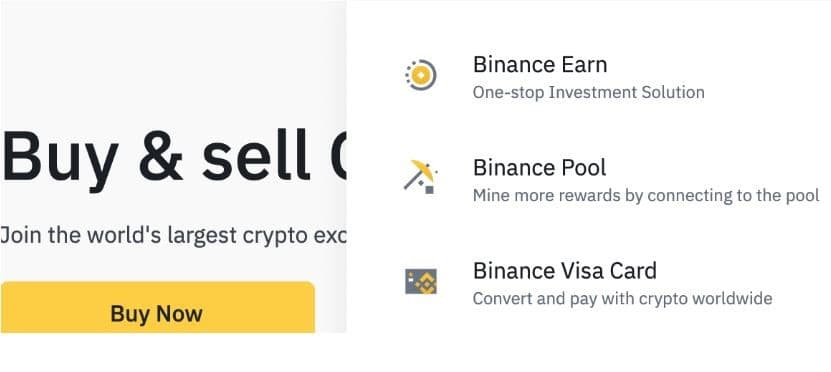

Step 1: On the Binance website, hover over the navigation menu that says “Finance” and click on the “Binance Visa Card” on the dropdown menu.

Or scroll down to the bottom of the screen and click on “Cards” below the “Products” section.

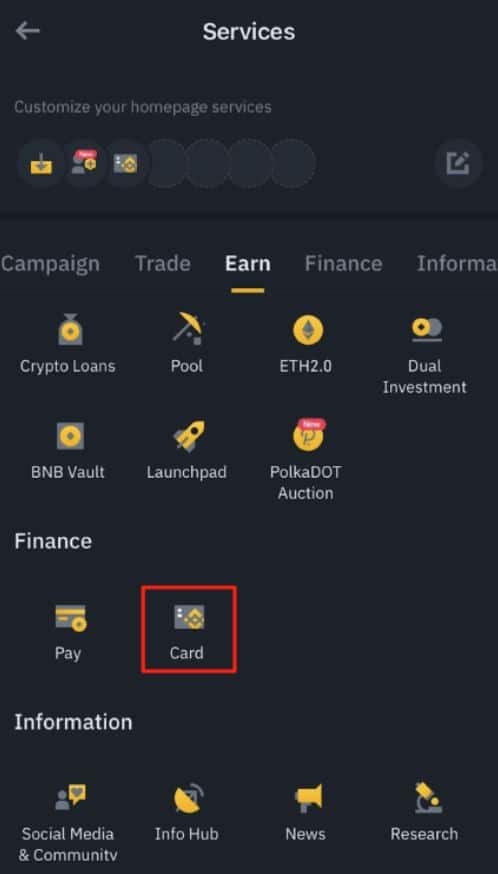

Alternatively, you can also log in to your Binance app and select “More.” Below “Finance,” tap the “Card” option.

Step 3: To view card details, click on “Show Card Details,” then enter your 2-Factor Authentication (2FA) code.

Step 4: To view your PIN number, click on “View PIN” and enter again your 2FA verification code. It is important to note that the number will be displayed for a limited time only.

Furthermore, the PIN number is only applicable while using a physical Binance Visa Card. As for your Virtual Visa Card, no PIN number will be required for payments once it is linked to Google Pay or Samsung Pay.