Binance May Consider Pushing for Bitcoin Rollback Following $40 Million Hack

UPDATE: After this article was published, Zhao said in a follow-up tweet that after speaking with various parties, the exchange decided it will not pursue the rollback approach.

Crypto exchange Binance founder and CEO Changpeng Zhao said the team is deciding on whether it will push for a rollback on the bitcoin network following a $40 million hack on the exchange earlier Wednesday.

Zhao hosted an Ask-Me-Anything live session at 3:00 UTC on Wednesday to address various questions from the community including the hack that stole some 7,000 bitcoin from the exchange just a few hours ago.

Answering questions on whether the firm considers rolling back bitcoin network transactions, which would require pushing for consensus from major miners and mining pools to gather over 51 percent of the network’s total hashing power, Zhao said:

“To be honest, we can actually do this probably within the next a few days. But there’re concerns that if we do a rollback on the bitcoin network at that scale, it may have some negative consequences, in terms of destroying the credibility for bitcoin.”

He added that he has also seen a lot of people objecting to rollbacks since there are the “ethical and reputational considerations for the bitcoin network.”

“The team is still deciding that, and we are running through the numbers and checking everything,” he said. “It’s interesting that it’s a tech solution [suggested] to us by the community, including some of the core members of the bitcoin development team. We will consider that very, very carefully, with the feedback we are receiving.”

Zhao added the company is now focusing on rebuilding and recovering the system, and has hence suspended all withdrawal and deposit, which he said is estimated to “take about a week” to resume.

So far, Binance has not found any other of its hot wallet addresses that are compromised. Zhao said the hackers used sophisticated methods to gain access to users’ accounts and orchestrated the hack patiently, in the sense that “they don’t move as soon as they have one account but have waited until they have a large number of high net worth accounts.”

Elsewhere in his session, Zhao said Binance has enough resources from its Secure Asset Fund for Users (SAFU fund) for recovering the loss of $40 million for users, though “it does hurt very much.”

Binance started allocating 10 percent of its trading fees every month since July last year to the SAFU fund. The firm hasn’t responded to a CoinDesk enquiry regarding how much exactly the fund has.

Based on the amount of the Binance BNB tokens burnt using 20 percent of its quarterly profits, Binance generated about $210 million in profits from July last year to March.

Editor’s note: This article has been updated with new information.

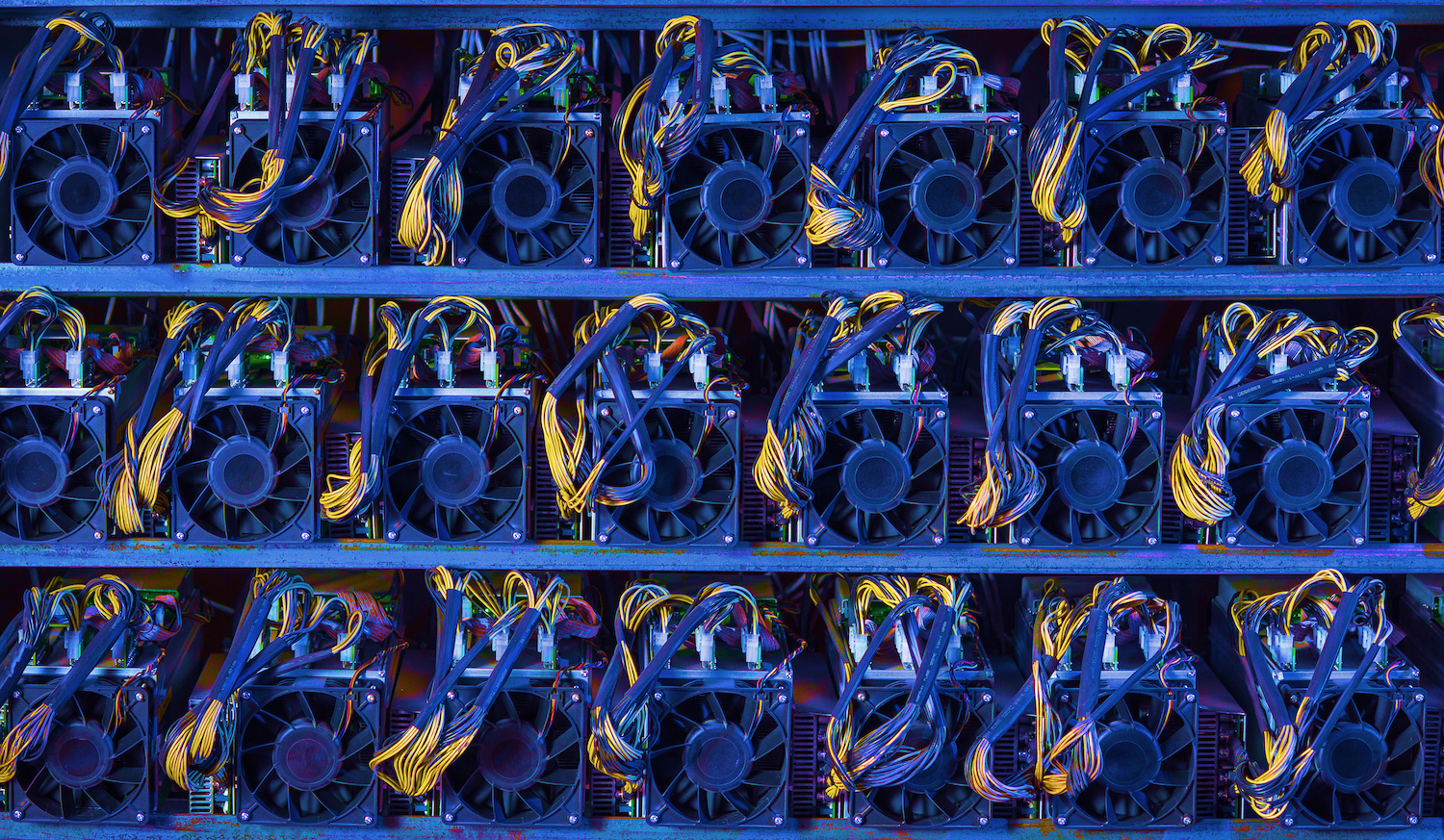

Binance image via Shutterstock