Binance Market Share Hits Lowest Since November After CFTC Lawsuit, End of Zero-Fee Trading

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Binance remains the world’s largest crypto exchange by volume, but it’s seen a dramatic drop in market share after a U.S. regulator accused it of fraud and the exchange eliminated zero-fee trading for some trading pairs.

Its market share relative to other crypto exchanges has sunk to 54% from 70% two weeks ago, according to data from research platform Kaiko. That’s the lowest since Nov. 5 and the lowest sustained market share since August, Kaiko said.

The U.S. Commodity Futures Trading Commission (CFTC) sued the exchange and founder Changpeng Zhao on March 27, alleging they offered unregistered crypto derivatives products in the U.S. against federal law.

Binance also witnessed its lowest bitcoin (BTC) trading volume since July 2022 on March 27 after it halted its no-fee trading promotion for 13 bitcoin spot trading pairs. “Binance’s excess volume largely vanished with the end of zero-fee trading, which was reflected in an even dispersal in market share among the remaining exchanges,” according to a Kaiko report.

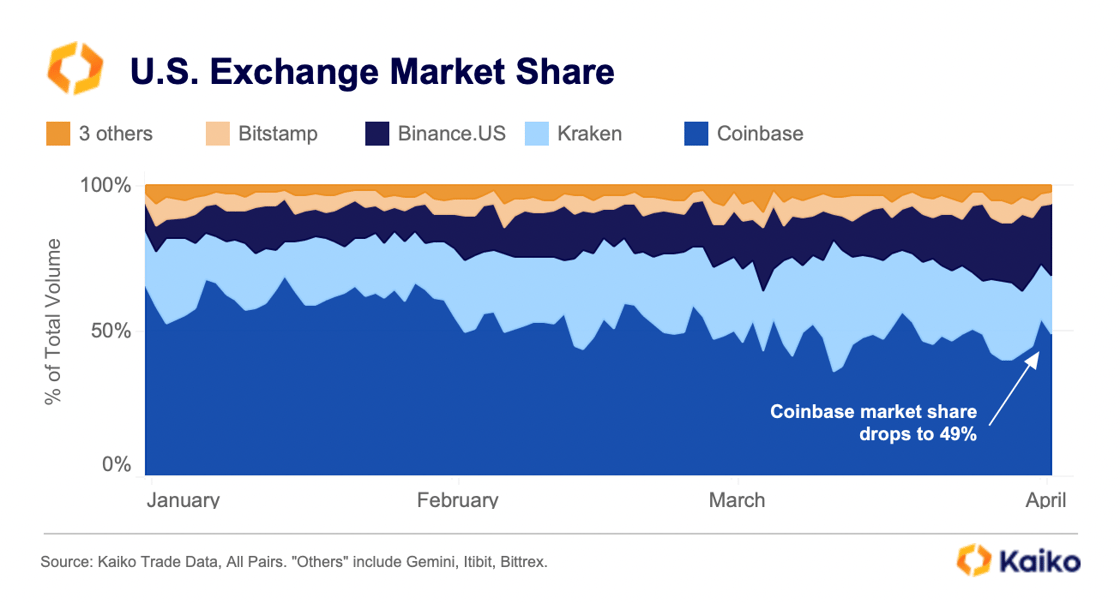

Kaiko noted that as global exchanges are increasingly getting targeted by regulators, the U.S. market is particularly fragile right now for the remaining crypto exchanges.

In the U.S., crypto exchange Coinbase also saw its market share drop in the first quarter. Coinbase went from a weekly average of 60% to 49% while Binance.US picked up the slack, surging from 8% to 24%, Kaiko said.

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.