Binance Futures Records All-Time High Volume Following Bitcoin’s Price Action

After a few weeks of sideways action, Bitcoin’s price plunged yesterday, falling to its lowest price since May of this year. The trading volume picked up with the rising volatility. Binance’s futures exchange seemingly caught the tide, as its volume reached an all-time high.

Binance Futures Volume Increasing

Back in September, Binance announced the acquisition of a futures exchange. Shortly thereafter, the company launched Binance Futures, allowing Bitcoin traders to use leverage of up to 125x for both short and long positions.

Despite being the new kid on the block, the futures platform’s trading volume has already surpassed that of the associated spot exchange. It seems that the latest price action in the cryptocurrency market has had an impact.

According to Aaron Gong, the head of Binance Futures, the daily volume reached 108,500 BTC, which is roughly $850 million.

It’s worth noting that trading fees on the Binance Futures platform are lower than those on the other margin exchanges; this could be related to the higher level of leverage that it offers.

CryptoPotato readers can enjoy a 20% discount on all Binance futures trading fees by registering with this link. Please note that margin trading is considered very risky and is not recommended for beginners.

Playing Catch-Up

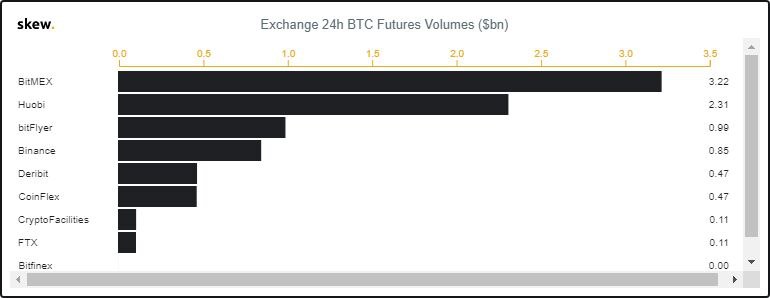

Looking at the bigger picture, which includes other well-known cryptocurrency margin trading exchanges, it’s safe to say that Binance still has a ways to go.

The graphic above shows that BitMEX sits atop the pack. BitMEX is the only futures exchange with 24-hour Bitcoin volume above $3 billion, and Huobi follows with $2.3 billion.

Binance, however, is catching up fairly quickly. Reaching an all-time high volume during yesterday’s market crash is a step in the right direction. The company recently made a change by allowing traders to set leverage between 1x and 125x as opposed to the previously automatic 20x leverage.

Bakkt Volume Follows Along

Despite its minimal initial volume, Bakkt also reached a new all-time high yesterday in this regard. A total of 640 contracts were traded on the Bitcoin futures platform, which was an increase of 650% from the previous day. Given that one contract contains one Bitcoin, those contracts were worth $4.8 million or almost three times more than the previous all-time high.

The post Binance Futures Records All-Time High Volume Following Bitcoin’s Price Action appeared first on CryptoPotato.