Binance Futures Beginner’s Guide & Exchange Review: How to Trade

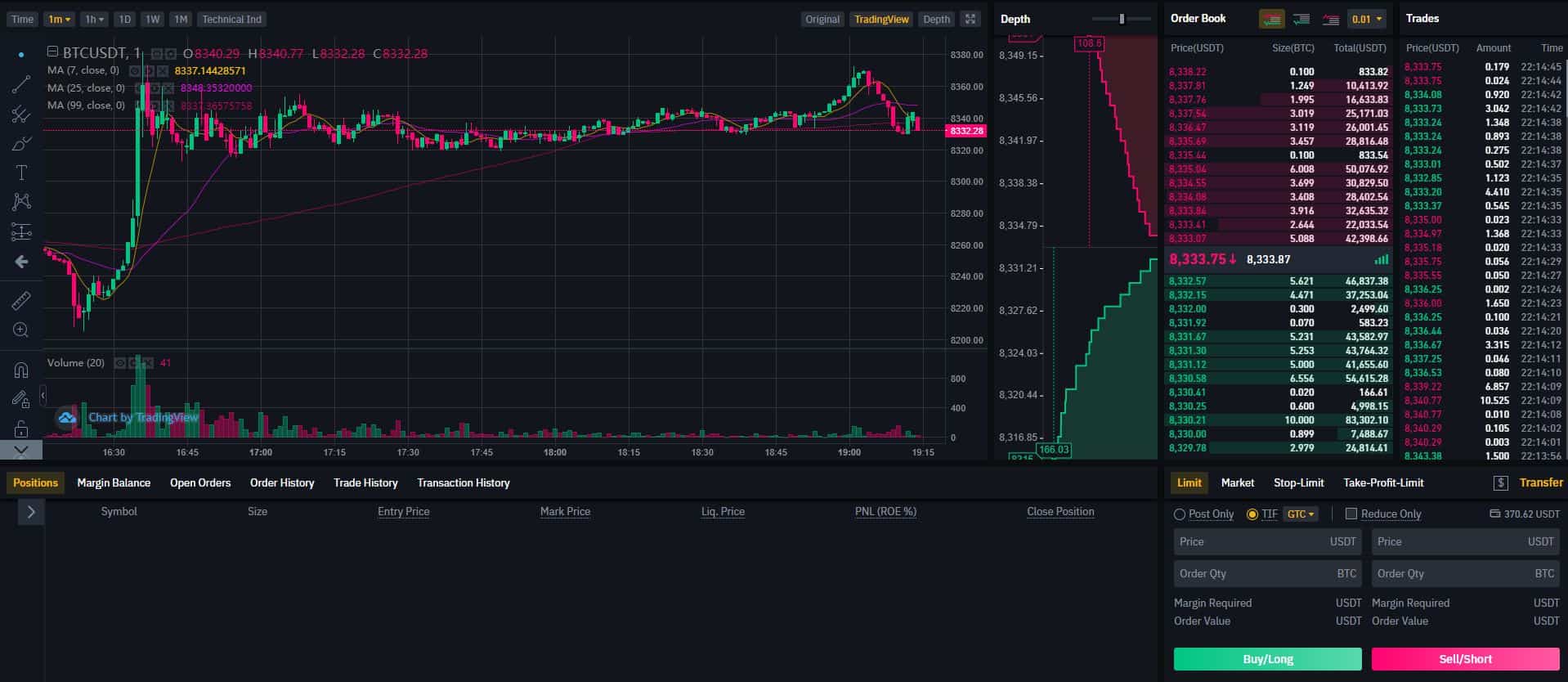

Binance recently launched a futures trading platform – Binance Futures – that allows traders to use leverage and to open both short and long positions. After our first look and test positions, we can say that the platform is very similar to that of Binance’s spot exchange, which makes the transition very easy. The user experience is just as smooth, and trading is relatively simple.

Quick Navigation

- Why Trade on Binance Futures?

- What are Bitcoin Futures?

- Binance Futures: Start Here

- Leveraged Trading on Binance Futures

- How to Trade Bitcoin Futures on Binance Futures

- Opening a Short or Long Position

- Closing a Position

- What are Binance Futures’ Trading Fees?

- Security: Is Binance Futures Safe?

- Binance Futures Support

At the time of this writing, the daily volume of the Bitcoin futures platform is around 72,000 BTC, which is more than twice the volume of the spot BTC/USDT trading pair on the primary Binance platform. This shows that the platform is growing relatively quickly, and it might be a matter of time until Binance leads the way in the area of Bitcoin leveraged trading.

“We do have plans to introduce more features and more trading pairs, but they are still under development,” told us Aaron Gong, Head of Binance Futures. “We will introduce a cross collateral feature in the future, as such tokens can be used instead of just Tether.”

Why Trade on Binance Futures?

There are a few reasons why one might consider trading Bitcoin futures:

- Shorting Bitcoin and other cryptos: Hedge your positions and improve your risk management to protect your crypto portfolio during bear markets

- Opening a leveraged position: trade without really owning the funds

- No need to keep large amounts of BTC on the exchange because of the leverage

Bitcoin futures on Binance can be traded with up to 125x leverage. However, you should keep in mind that margin trading is not recommended for beginners since it involves a significant amount of risk, and you can lose your capital a lot quicker than you otherwise would. Hence, margin trading is usually not recommended for beginners, but rather for experienced traders with extensive knowledge on the matter.

Now that we’ve gone through some of the basics, let’s dive deeper into Bitcoin futures on Binance and how to trade them.

What Are Bitcoin Futures?

Bitcoin futures allow the trader to buy or sell Bitcoin at a predetermined price at some point in the future (“settlement”). The buyer of the contract is obligated to buy the asset when the contract expires, whereas the seller is obligated to provide it.

Binance employs so-called perpetual contracts, which are a bit different from traditional futures contracts. These sorts of contracts don’t have a preset expiry and settlement date. They are anchored to the spot index price, and the trader can terminate them whenever he or she wants to.

In other words, when purchasing or selling a perpetual contract, the trader is not obligated to sell or buy the asset at a preset date. Instead, they can close their position whenever they want to.

Bitcoin futures on Binance are traded against Tether (USDT).

Binance Futures: Start Here

First things first: you’ll need to create a Binance account. The registration process is fairly straightforward, but it requires quite a bit of identity verification because of Binance’s KYC requirements. You can learn how to register and deposit Bitcoin in our Binance trading guide.

Once your funds are deposited, you will have to transfer them to your futures trading wallet. On the top navigation menu, there is a “Futures” button. Click on it and select the “Futures” option.

On the bottom right, right under the order book, there is a “Transfer” button. To start trading Bitcoin futures, you’ll have to transfer some USDT to your Futures account.

Doing so is pretty straightforward. Once you click the button, you will be asked how much USDT you want to transfer and from which account. Simply specify the amount and hit the “Confirm” button. The transfer happens automatically.

Leveraged Trading on Binance Futures

Binance allows traders to place trades with a leverage of up to 125x. As a matter of fact, setting your leverage is fairly simplified.

On the top left corner there is a button right next to the BTCUSDT symbol that can be clicked and it will pull up the following slider:

From here, it’s pretty straightforward. The slider can be used to set whatever leverage is preferred from 1x to 125x.

So, for example, if you decide to use 100 USDT with leverage of 100x, this will open a position worth $10,000 and you’d only have to post 100 USDT as a margin.

How to Trade Bitcoin Futures on Binance Futures

Trading Bitcoin futures on Binance is simple. However, at the time of this writing, the platform only allows trading with up to 125x leverage.

In contrast, other margin exchanges allow leverage of up to 100x.

There are four types of orders that you can place on the platform:

- Limit Order

- Market Order

- Stop-Limit Order

- Take-Profit-Limit Order

Opening a Short or Long Position

Limit Orders

Limit orders are used when you want to buy at a specific price.

To set a limit order, you’ll have to specify the price at which you want to buy or sell. On the Order Quantity tab, input the amount of BTC that you wish to buy. In this case, we’ve set a target price of $8,400 and a quantity of 1 BTC. So as soon as Bitcoin’s price reaches $8,400, we will have an order to buy/long. Note below that the margin required for this order is only 420 USDT, because we’ve used a 20x leverage.

As soon as you hit the “Buy/Long” button, your position will be opened. Below, we will show you where to monitor it and how to close it.

Market Orders

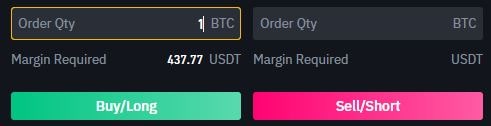

The most basic order type, market orders are used to buy Bitcoin at a spot price.

All that has to be entered is the order quantity. Again, note that the margin required is 20 times less than the actual value of the order.

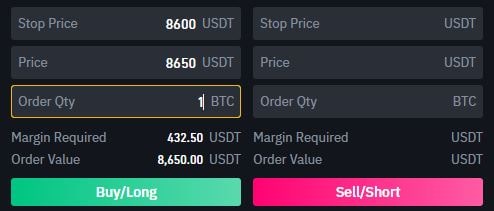

Stop-Limit Orders

These are typically used as a stop-loss mechanism, but not always.

The stop price is the price at which your order will become a regular limit order. The price tab indicates when you want to buy.

Imagine that you expect Bitcoin to face significant resistance at $8,600, and if it breaks above it, that will give confirmation that the trend is bullish. You would want to set your stop price at $8,600, because as soon as it’s hit, your stop-limit order will be converted to a regular limit order to buy at $8,650. You can also use this as a stop-loss mechanism to reduce your level of risk.

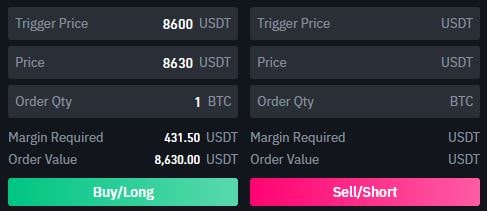

Take-Profit-Limit Orders

As the name suggests, this is mainly used to set the price at which you wish to collect your profits.

Your trigger price establishes the price at which your order will be placed in the order book. The price tab shows the price at which you want to buy.

Closing a position

As soon as your position is opened, you will be able to monitor its status. For the sake of this guide, we’ve opened a long Bitcoin position using a standard market order, as shown in the example above. Here’s where we can track it:

As you can see, we’ve bought 0.1 BTC at an entry price of $8,273. In other words, we have opened a long position of 0.1 BTC. Since it is 20x leveraged, the required margin on this trade is only around 43 USDT.

If you wish to close your position, you have two options. A market close is instant, and you close at the best available spot price. In contrast, a limit close lets you specify the price at which you would like to close the position.

As you can see, the position tracker also contains a liquidation price. This is the price that, if reached, will see your position liquidated due to insufficient margin. Keep in mind that the entire amount in your futures wallet is used as collateral. Hence, if the price doesn’t go in the direction of your trade, the platform will use your remaining capital as collateral.

As soon as you hit the “Market” button, your position will be closed and you will see the funds return to your margin account.

What are Binance Futures’ Trading Fees?

One of the more crucial things to consider when selecting a futures exchange is its trading fees. This is especially important if you are day trading, as the fees can pile up fairly quickly.

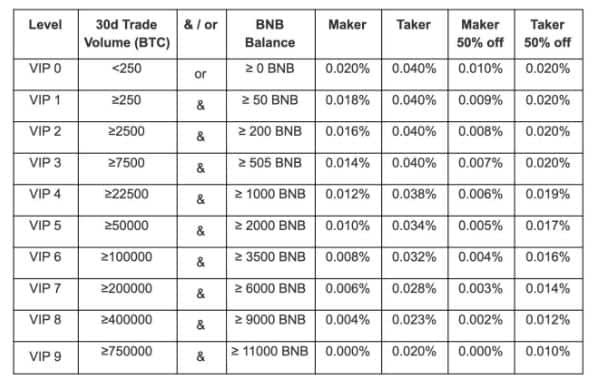

As is almost always the case, Binance has done a great job of visualizing its fee structure.

Long story short, the default level (VIP 0) carries 0.02% maker fees and 0.04% taker fees. In order to enjoy reduced fees, Binance requires you to both hold its native Binance Coin (BNB) and maintain a decent amount of turnover volume (in BTC).

All of the VIP benefits of the spot market exchange apply to the futures market. What is more, the fees are generally lower than those on the spot market. However, the volume requirements for each of the VIP tiers are 5 times larger than those on the spot market because of the leverage.

Security of the Binance Futures Exchange

Needless to say, Binance is probably the most secure cryptocurrency exchange out there. Naturally, it’s not immune to hackers, but the company is doing a splendid job of keeping users’ funds protected.

Even if the exchange were to get hacked, which it has in the past, Binance has introduced a so-called SAFU fund. Beginning last July 14th, the exchange has allocated 10% of all trading fees into its Secure Assets Fund for Users (SAFU) in order to offer additional protection to users in extreme cases. Those funds are stored in a separate cold wallet.

Moreover, Binance has a very rigorous KYC process that applies to its futures exchange platform.

Binance Futures’ Support

Unsurprisingly, the Binance Futures exchange shares the primary spot exchange’s emphasis on support, and users can rely on a team of experienced and highly adequate international support staff.

The post Binance Futures Beginner’s Guide & Exchange Review: How to Trade appeared first on CryptoPotato.