Binance DeFi Index Tumbles Over 50% on Its First Month and There Is Even Worse News

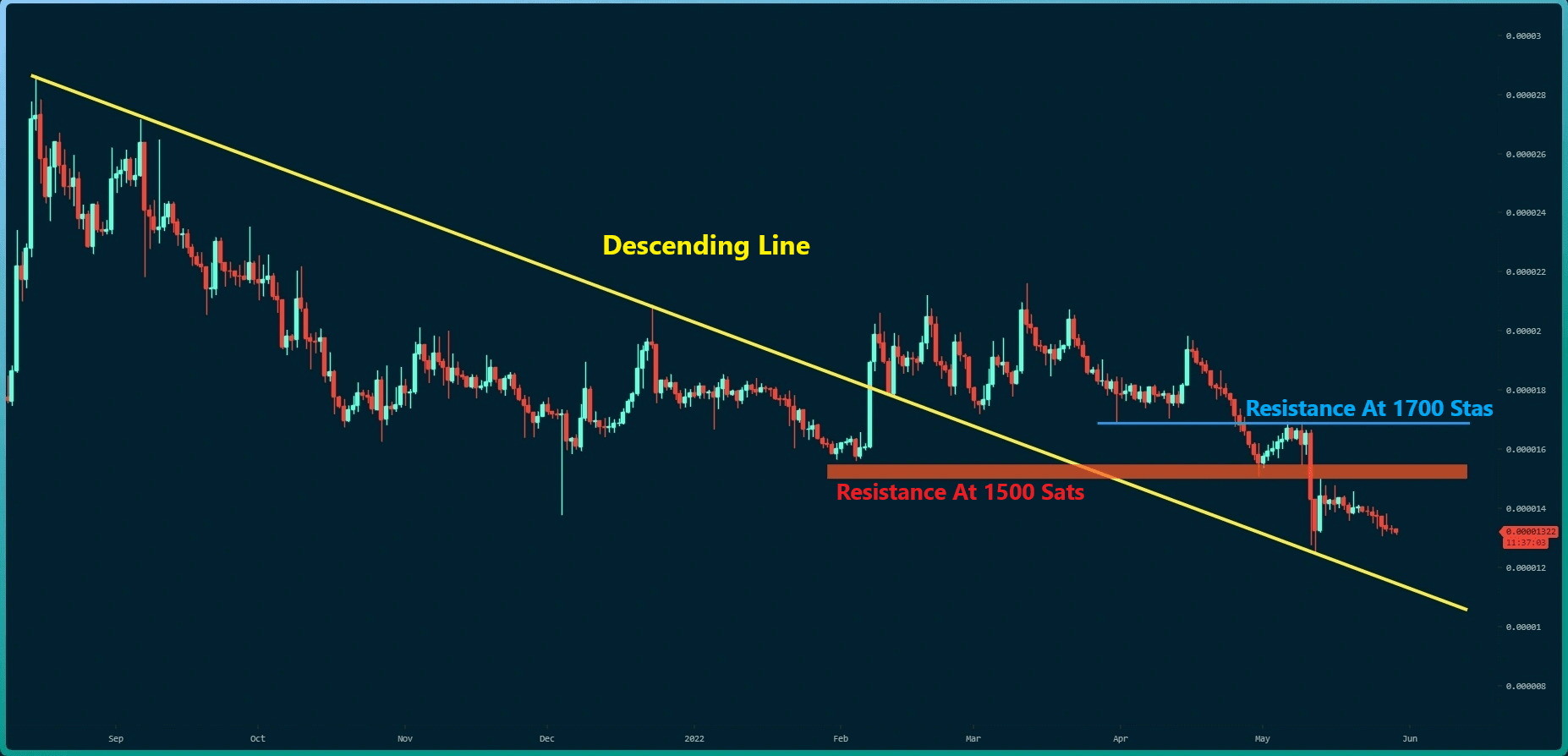

In late August this year, Binance launched its DeFi Composite Index. Trading under the DEFIUSDT symbol, it’s currently down over 50% in a little over a month.

Unfortunately, there is even worse news for the young index.

DeFi Composite Index Down Over 50%

At this point, it’s quite clear that DeFi is where all the rage is in 2020. The field has seen exponential growth over the past few months, as the total value locked in protocols has increased from about $500 million in March to almost $11 billion at the time of this writing.

With it, we saw the creation of various tokens largely oriented towards DeFi, much of which turned to be nothing but blatant scams.

In any case, toward the end of August, Binance launched its DeFi Composite Index. It “tracks and measures the performance of a basket of assets in a standardized way.” Trading under the DEFIUSDT symbol, it’s currently down over 50% since its announcement.

In the beginning, the DEFIUSDT index peaked at a high of 1189 USDT, while it’s currently trading at around 530 USDT.

Naturally, this is because the value of the currencies selected for the underlying basket has depreciated over the selected period.

At the time of this writing, the selection of DeFi coins includes some of the most popular ones such as COMP, BAND, KAVA, YFI, RUNE, UNI, BAL, ZRX, and so forth.

The Bad News

The bad news in all this is that there are some relatively large-cap and also some very popular cryptocurrencies that got the community’s attention but are not in the basket. Their value has depreciated even more.

One of these is SUSHI – the popular decentralized swap protocol that’s a fork of Uniswap with an added governance token. Having peaked at around $5 at the beginning of September, the token now trades at around $0.90, charting an 82% decline.

Another token that’s not on the list is YF Link (YFL). At one point in September, YFL was trading at around $1,000, while its current value hovers above $350 – a decrease of 65%.

In other words, the DEFIUSDT index is down over 50%, and it doesn’t even include some of the popular coins that have charted substantial losses.

The post Binance DeFi Index Tumbles Over 50% on Its First Month and There Is Even Worse News appeared first on CryptoPotato.