Binance CEO: Ethereum is For The Rich Guys, But Soon They’ll Be Poor

This is Binance Smart Chain’s time to shine, and the Binance CEO CZ knows it and is ready to take advantage of it.

The increasing use of DeFi protocols, dApps, and applications built on top of Ethereum, has overloaded the network to the point where its fees are almost unsustainable. Several blockchains are vying to emerge as the new Ethereum killer, and CZ is rooting for BSC as the best option.

CZ has been known to be a funny yet respectful guy when it comes to measuring his words. Still, his latest tweets have shown that the boundaries are more flexible when it comes to promoting Binance’s services.

Binance vs Ethereum

In a recent tweet, CZ attacked Ethereum, pointing out its Achilles heel: fees. For the man in front of Binance, only the wealthy can afford the fees to trade Ethereum:

ETH is a network for the rich guys now, but soon those guys will be poor. 😂

— CZ 🔶 Binance (@cz_binance) February 27, 2021

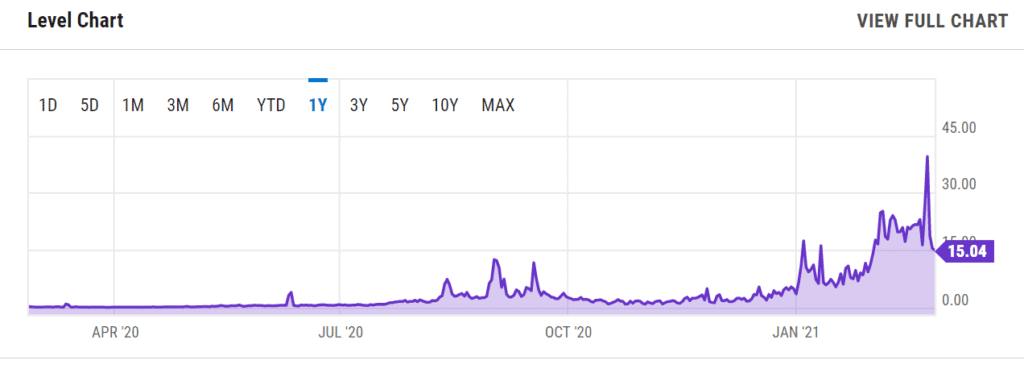

And he is somewhat right. Over the course of 2021, the average transaction cost on Ethereum has catapulted just as fast as the price of ETH (its native token), going from less than $5 on average last year to about $15 today. Just 4 days ago, the network fees reached an ATH of nearly $40 on average, according to ycharts data.

However, this is the price per transaction. Traders operating on DeFi or yield farming platforms have to deal with the possibility of paying $100+ for each trade they make on a daily basis.

CZ didn’t stop there. A later tweet said he was no longer using Ethereum. Binance is developing two projects to compete directly with the two largest blockchains in the ecosystem.

I like ETH, I just don’t use it anymore.

— CZ 🔶 Binance (@cz_binance) February 27, 2021

Binance Chain was designed to enable extremely fast payments with minimum fees. It would be a direct competitor to Bitcoin because of its narrow focus on sending and receiving funds.

The Binance Smart Chain, on the other hand, is a bit slower but allows for the execution of smart contracts more efficiently and cost-effectively than Ethereum.

A Competition to Become The Better Ethereum

The rise of projects such as Polkadot, Binance Smart Chain, and Cardano is a sign of the increasing interest in finding a blockchain capable of replacing Ethereum. Yesterday, Cardano ranked third among cryptocurrencies with the largest market capitalization, dethroning BNB from its recently taken position.

Like Binance Smart Chain, Cardano seeks to execute smart contracts quickly, cheaply, and securely. Still, as a difference, Cardano has a somewhat more complex design and a much longer roadmap.

However, Ethereum developers are working on the second version of the blockchain. Ethereum 2.0 will have several layer 2 implementations. According to some enthusiasts, the new blockchain will process thousands of transactions per second —even a hundreds of thousands once fully deployed, according to Vitalik Buterin.

ETH2 scaling for data will be available *before* ETH2 scaling for general computation. This implies that rollups will be the dominant scaling paradigm for at least a couple of years: first ~2-3k TPS with eth1 as data layer, then ~100k TPS with eth2 (phase 1). Adjust accordingly.

— vitalik.eth (@VitalikButerin) June 30, 2020

Perhaps, once Ethereum 2.0 is complete, it will go back to being a blockchain for the poor guys, and the crypto billionaire CZ will like it again.