Binance CEO Changpeng Zhao Pleads Guilty, Steps Down

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In a shocking development to the international Bitcoin community, Binance founder and CEO Changpeng Zhao is stepping down from his role as part of a guilty plea on criminal and civil charges in the US.

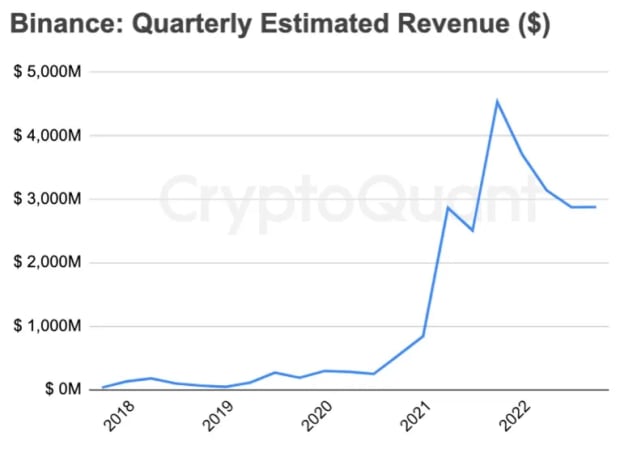

Binance, the largest digital asset exchange in the world by volume, has seen its very future come into question as the result of a legal battle with the US Department of Justice (DoJ). Founder and CEO Changpeng Zhao, also known as CZ, pled guilty on September 21 to money laundering violations, and agreed to both resign from his post and pay a $50M fine, which may be reduced. Binance will also pay a whopping $4.3 billion fine, and this penalty seems fairly set in stone. This agreement comes at the end of a monthslong legal battle in which the DoJ charged him of several serious violations: Not only facilitating transactions with sanctioned groups such as Russian mercenaries fighting in Ukraine, but even encouraging users to cover their tracks on potential violating money-laundering statutes.

Bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

Since its founding in 2017, Binance has steadily grown over the years to become the world’s most popular Bitcoin exchange. The firm was initially founded in China, but has moved locations several times over the years, even to different continents, and currently does not have an official headquarters. It has grown in notoriety despite requiring a different platform, Binance.US, to offer services of any sort inside the United States, but its biggest windfalls came as it absorbed FTX customers in the wake of that exchange’s apocalyptic collapse. CZ had long been one of the industry’s biggest players, but especially since FTX fell, Binance has indisputably been the largest in the space. And now, CZ’s deal seems like a last-ditch move to keep the company operational.

In his resignation letter, published one day after he pled guilty in Seattle, CZ claimed that “Binance will be fine. I will have to deal with some pain, but we will survive. We will get through, although with some changes in structure. It might not be a bad thing when we look back in a few years’ time,” adding that he “needed a break anyway.” Publicly, he tried to present an optimistic face, expressing confidence in his employees and encouraging a smooth transition for the new head, Richard Teng. Despite this confident facade, there are still new difficulties brewing for CZ and his company.

For one, since Binance needed to spin off a subsidiary to operate inside the United States, Binance.US is not strictly covered by the initial plea agreement with the Department of Justice. Indeed, as of November 27, the Securities and Exchange Commission (SEC) is actively investigating the US branch for misuse of consumer funds and a possible backdoor that CZ could use to continue accessing Binance.US assets. Binance lawyer Matthew Laroche claimed that the company “has withered under the stress and cost of the SEC lawsuit. The average monthly value of Binance.US assets is down almost 90% and Binance.US has lost almost half of its monthly users since the SEC filed its case.”

In addition to this continued attempt to limit CZ’s potential resources, his movements are also being curtailed. Changpeng Zhao has established ties in several nations: Having been born in China, his family immigrated to Canada during his childhood and he has citizenship there. Additionally, he is a citizen of the United Arab Emirates, and resides there with his wife and children. Considering that the latter nation has no extradition treaty with the US, and that CZ has massive resources to draw on, Seattle District Court Judge Richard Jones labeled him a flight risk. As part of his bail agreement, CZ is temporarily forbidden from leaving the United States, as the government claims that a multi-billionaire with foreign citizenship, a guilty plea and a possible prison sentence would be detained “in the vast majority of cases.” In other words, the fact that he’s free from jail in the US is itself a stretch, let alone leaving the country.

Clearly, the presumption that the company’s founder and head would engage in this sort of behavior does not portend well for the business. Already one of its main competitors is seeing a major boost in the same way that Binance benefitted from FTX’s collapse: Since CZ announced his resignation, the exchange Coinbase has seen a stock price growth of around 20% in five days. This boost for Coinbase comes on top of a very profitable year, as the company’s stock valuation overall has jumped nearly 90% in the last six months. Coinbase is itself even engaged in a legal battle with the federal government, but evidently it has been faring better in this respect.

Still, despite all these setbacks, the company is looking forward. New CEO Richard Teng told the press that he has a “robust timeline” for moving forward with company compliance. Stressing that “Binance is a six year old company—it’s a relatively young company by any measure,” he claimed that he intends to direct a change from the “disruptor” attitude of many tech startups and situate the firm into the world of traditional finance. A former banking regulator, Teng hopes to bring this moderating experience into the future for Binance. Additionally, even though other firms may stand to benefit from their competitors’ failure, a sense of solidarity does exist: Former BitMEX CEO Arthur Hayes called the treatment of CZ “absurd” compared to other money-laundering violators like former Goldman Sachs CEO Lloyd Blankfein, and questioned what these developments could mean for all digital asset exchanges.

Stepping away from Coinbase itself, one must take into account how Bitcoin as a whole has been taking these developments. Which is to say, it’s been fine: The price rally that began in October has continued unabated. Comparing this to the five-alarm fire that took place when FTX collapsed, it’s easy to see how the industry has matured: Commentators have taken notice of the general confidence that Bitcoin is here to stay. Several of the biggest crashes in Bitcoin’s history have coincided with the downfall of major exchanges, but headlines are full of general optimism and Bitcoin’s rally hasn’t even faltered. The state of things in 2023 seems clear: Although individual businesses may rise and fall, Bitcoin has achieved enough adoption and notoriety that it’ll take more than one business to seriously harm it. Binance may very well bounce back from setbacks like this, and if it does, there will be a bustling industry waiting for it.