Binance Adds New Fiat Payment Options Through Integration With P2P Exchange Paxful

Binance has teamed up with peer-to-peer bitcoin exchange Paxful to add new ways to purchase bitcoin.

Announced Thursday, Paxful’s Virtual Bitcoin Kiosk will exclusively serve Binance as an additional fiat-to-crypto on-ramp for its users, joining services such as Koinal and Simplex.

Through the kiosk, Paxful can facilitate fiat payments in over 167 currencies. To start with, Binance users will have access to the Russian ruble, Vietnamese dong, Indonesian rupiah, Nigerian naira, Colombian peso, British pound, Mexican peso, Canadian dollar, euro and Argentine peso, with more possibly to come later.

Paxful users will also have direct access to Binance, further opening up digital asset trading – and therefore price arbitrage – to Paxful’s P2P network. While Paxful had offers from some of the top-10 crypto exchanges, the P2P exchange is exclusively providing its kiosk service to Binance, Paxful CEO and founder Ray Yousseff said in a telephone interview.

Founded in 2015, Paxful connects traders in a peer-to-peer fashion through its API service and has recently been conducting some $25 million in trades per week, according to UsefulTulips.

Binance also allows P2P trading on its platform for Chinese users and through WeChat and AliPay, although the latter company monitors the platform for trading, which is illegal under the companies terms and services.

Fiat-to-crypto purchases for both the dollar and euro through the Gemini Dollar (GUSD) and Paxos Standard (PAX) are supported too. The exchange has slowly added stablecoins to its platform under its “Venus” initiative and currently supports the euro, ruble, Turkish lira, Nigerian naira, Ukrainian hryvnia, Kazakhstani tenge and Indian rupee as fiat options, according to Binance.

The firms’ integration highlights a mutual interest in philanthropy, according to Yousseff. Noting bitcoin’s use cases in Africa, he said the exchange was rebuilt after discussions with locals across the continent. Binance maintains a philanthropic venture arm, Binance Charity Foundation (BCF), which has worked in Uganda.

While the U.S. takes up the lion’s share of Paxful’s market, researcher Matt Ahlborg at startup accelerator dlab said the exchange is becoming a meaningful alternative in sub-Saharan Africa as ex-pats look to send funds back home.

In the continent’s largest economy, Nigerians are exchanging gift cards sent by relatives in the U.S. for bitcoin and exchanging that for the national currency on Paxful. The process, which can be completed in half an hour, appears to be an effort to avoid more traditional remittance services, Ahlborg said in a blog post.

Paxful has shown resilience even when other exchanges have struggled, in what Ahlborg attributes to its integration on a local level.

“Paxful is able to onboard financially disconnected citizens of developing countries on a level that non-P2P OTC exchanges like Coinbase simply cannot,” Ahlborg said. “Gift card remittance works 24/7 whereas Western Union only works during business hours of Nigerian Banks.”

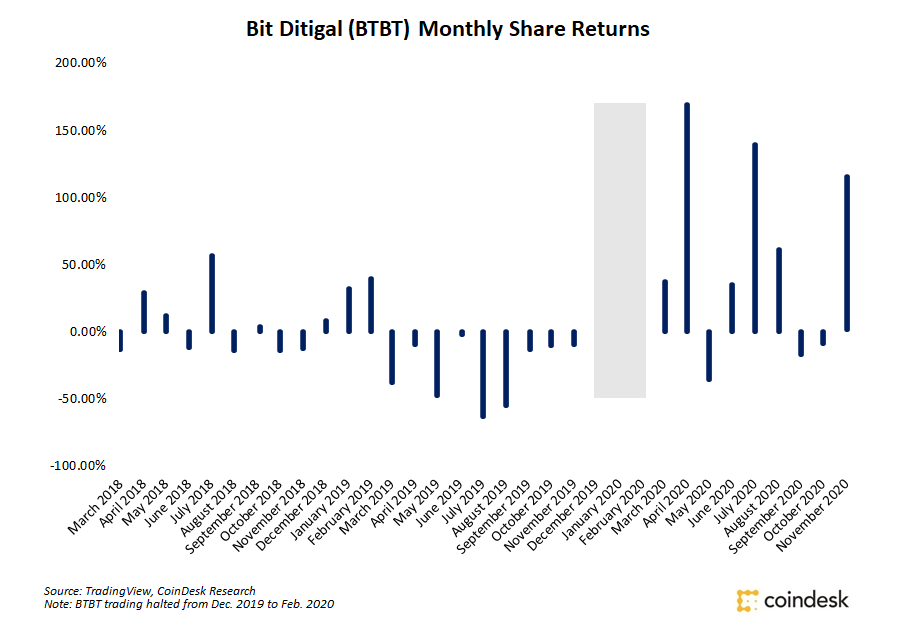

Comparisons between rival P2P exchange LocalBitcoins and Paxful (see charts below) show more continuous growth for the latter platform through the 2018 bear market, even if total volumes remain far lower.

“The lack of bitcoin liquidity was the first obstacle to solve to introduce bitcoin to Africa,” said Youseff in an email to CoinDesk. “We found a way for them to export an asset, which is gift cards, as a way to go around financial restrictions. Now, bitcoin is flooding out of Nigeria and into other African countries.”

Disclaimer Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

This article is intended as a news item to inform our readers of various events and developments that affect, or that might in the future affect, the value of the cryptocurrency described above. The information contained herein is not intended to provide, and it does not provide, sufficient information to form the basis for an investment decision, and you should not rely on this information for that purpose. The information presented herein is accurate only as of its date, and it was not prepared by a research analyst or other investment professional. You should seek additional information regarding the merits and risks of investing in any cryptocurrency before deciding to purchase or sell any such instruments.