Billionaire Investor Eyes $1 Billion Crypto Hedge Fund

The billionaire head of Brevan Howard hedge fund, Alan Howard, is launching a crypto portfolio platform that aims to make stable investments in a notoriously volatile market.

The platform is geared towards institutional clients and will make strategic investments in other crypto hedge funds, becoming a kind of fund of funds, according to a Financial Times report on August 30.

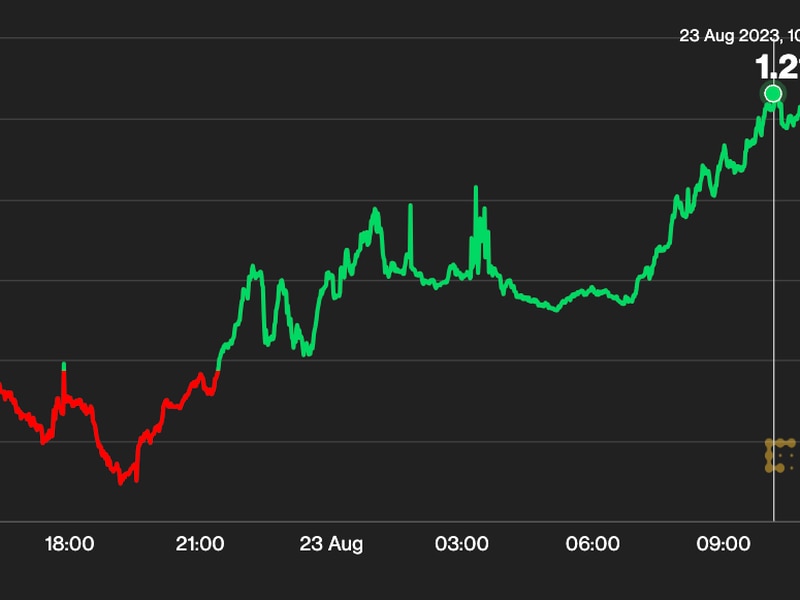

The fund is projected to manage as much as $1 billion in investments. This venture comes amid a tempered bull run lead by bitcoin’s surge in price. According to data firm Hedge Fund Research, crypto-focused investment pools are up nearly 60 percent over the first two quarters this year.

Elwood Asset Management, the firm that manages Howard’s personal digital assets, will oversee the launch, construction and direction of the new fund. The aim is to find firms that satisfy Elwood’s due diligence in order to avoid so-called blow ups.

“Losing traditional assets in the real world is hard. In the digital world, it’s very easy to lose assets — put in the wrong address for a bitcoin transfer and it’s gone forever,” said Bin Ren, CEO, blockchain funds specialist at Elwood.

Ideally, Howard’s venture will identify enough firms to invest in to offer their own clients portfolio options that satisfy their risk profiles, liquidity needs and diversity requirements.

Details are forthcoming, but Elwood may design bespoke portfolios for each investor. For the service, Elwood will charge an undisclosed management fee, in addition to a fee to access the underlying funds.

Previously, Elwood and investment management company Invesco co-launched an exchange-traded fund (ETF) with stakes in companies developing blockchain technology.

In an interview with Bloomberg in March, Ren said: “The only way for institutions to get meaningful exposure to digital assets has been to buy Bitcoin, but many are reluctant or unable to buy Bitcoin — and for good reason.”

Howard has invested in cryptocurrencies since 2017, including an early investment in Block.one, the corporate parent of EOS. He is not involved in the day to day operations at Elwood.

Business miniature via Shutterstock