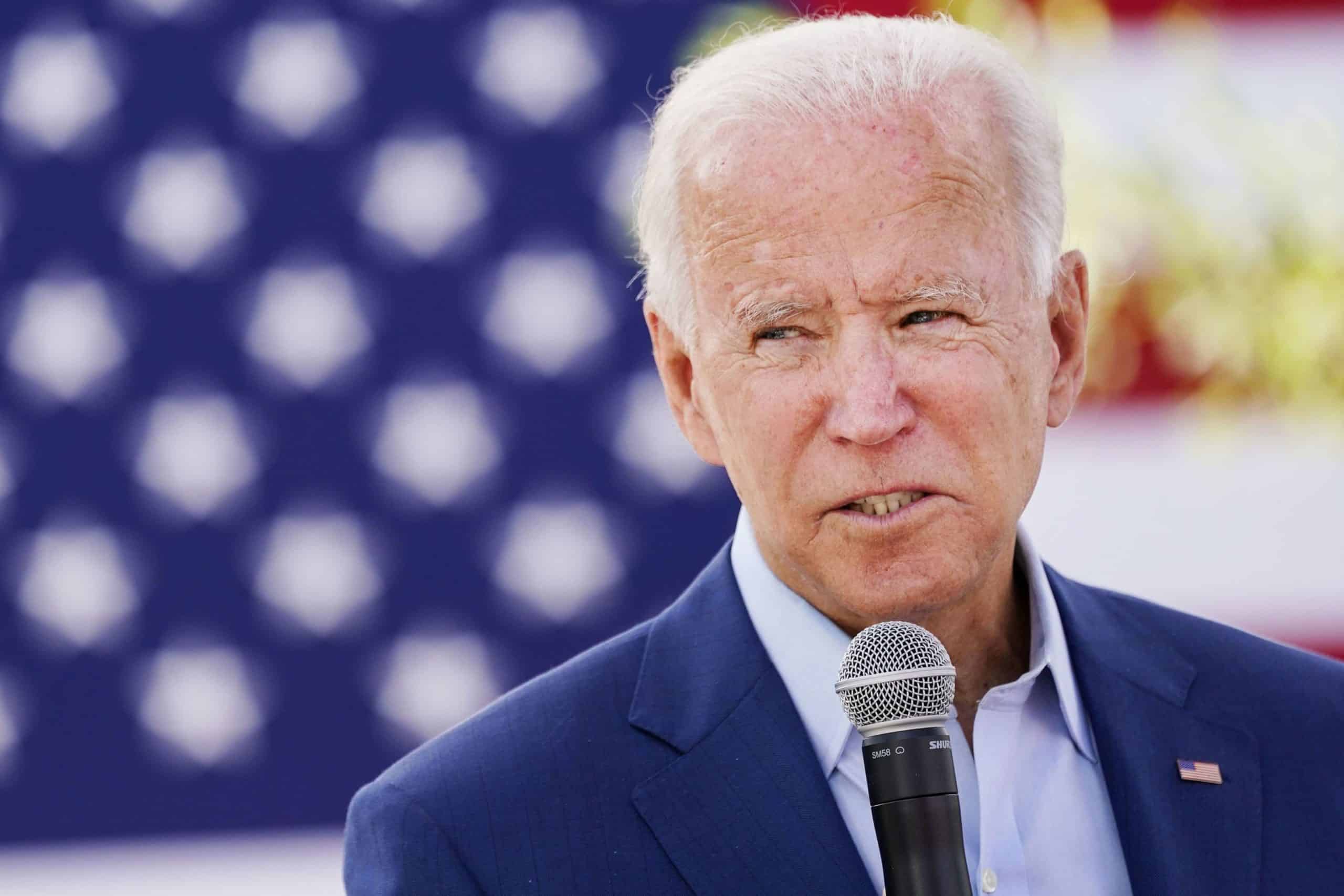

Biden Advocates for an End to Tax Loopholes That Benefit ‘Wealthy Crypto Investors’

U.S. President Joe Biden is advocating for an end to tax loopholes that benefit what he described as “wealthy crypto investors.”

In a Twitter post late Tuesday, Biden shared an infographic that read: “We think Congress should cut tax loopholes that help wealthy crypto investors.”

According to the post, these loopholes have cost the government around $18 billion in revenue. In his tweet, the president mentioned “MAGA House Republicans” as opposers of his tax plans.

Biden Reprimands Republicans

Biden stated that while he is calling for these changes, the MAGA House Republicans are in support of the tax loopholes and, in contrast, advocating cutting food safety inspections.

President Biden’s post sparked a lot of reaction from the crypto community on Twitter, with many wondering what tax loopholes he was referring to.

Adam Cochran, a managing partner at digital asset-focused Cinneamhain Ventures, replied to the post, saying that “crypto actually suffers compared to other assets on how gains are taxed on transfer between asset types.” He added that he would “challenge absolutely anyone to cite this supposed loophole.”

Biden Proposes Changes to Crypto Taxation

The latest tax plan is part of Biden’s recently proposed fiscal year 2024 budget, which has not received support from Republican opposition in the U.S. House. The budget proposed a change to crypto taxation rules to target wash trading.

The administration noted that crypto assets were not initially subject to the same wash trading rules that apply to stocks and bonds. However, implementing these changes to apply to this emerging asset class could raise $24 billion in revenue.

Biden’s administration has not been supportive of crypto and has continued to introduce new harsh tax rules for the sector. For instance, the White House’s Council of Economic Advisers (CEA) is seeking a punitive tax of up to 30% of mining firms’ electricity costs in the U.S. – a move that could negatively impact the profit of such operators.

The post Biden Advocates for an End to Tax Loopholes That Benefit ‘Wealthy Crypto Investors’ appeared first on CryptoPotato.