Beyond Bukele: Sustaining El Salvador’s Orange Wave of Freedom

Is El Salvador’s Orange Enlightenment Only One Leader Deep?

The world is witnessing a miracle unfold in the beautiful country of El Salvador. In just the first four years of president Nayib Bukele’s presidency, the smallest Central American country and recurring murder capital of the world, plagued by civil war, endemic corruption, and generational poverty, not only reformed its justice system and neutered its terrorizing gangs resulting in unprecedented public safety, a surge in tourism, and foreign investment, but began casting off its neocolonial yoke, paying its latest bond debt on schedule and declining further IMF assistance. Equally impactful for its future: President Bukele defied the U.S.-dominated IMF and declared bitcoin legal tender—the world’s first nation to do so. But he will one day step down as president. Will his successor be equally committed to the potential of bitcoin and continue his work? Further, how will a bitcoin-flourishing El Salvador protect itself from the globalist empire to the north given its sordid history of CIA interventionism? If Salvadoreños are to fully benefit from the bitcoin monetary standard it must become securely anchored in law safe from an array of potential threats, domestic and foreign. For El Salvador’s bitcoin revolution to endure it must transcend not only the administration of but one visionary president.

From Impoverished Vassal to Budding Sanctuary of Freedom

On 7 September, Bitcoin Day, Salvadoreños not only celebrated their second year of bitcoin joining the USD as legal tender, but they celebrated the visionary leader who made it possible. Upon winning the presidency in 2019, Nayib Bukele could have taken the road oft-traveled by his corrupt predecessors, to wit: continued to pursue IMF loans with their subjugating strings1 and wildly enrich himself while saddling his impoverished, gang-exploited citizens with the banker’s bill. Such has been the recurring pattern.

Instead, in an act of political selflessness and temerity rarely seen today, he rejected the self-enriching path of his predecessors. He pushed back against Washington and its coercive institutions, demonstrating a morally-principled leadership focused solely on his citizens’ welfare. Refusing to obediently align with the strictures of the Washington-dominated International Commission against Impunity in El Salvador (CICIES) he terminated involvement in the group, purged the endemically-corrupt justice system, and installed trusted officials which had been curiously blacklisted by the U.S.2

Next, triggered by a spike of 92 homicides over three days in March of 2022, and with the justice apparatus now presciently reformed, he declared a state of emergency, launching an operation which imprisoned over 65 thousand known and suspected gangsters.3 With astonishing speed, the nation morphed from murder capital of the world—a title it held most consistently since 1991—to a level of security comparable with most, and lower than some, European nations.4 As a result, tourism exploded5 and foreign investors materialized, most notably Google Cloud which signed a multi-year agreement in August bringing Google Distributed Cloud (GDC) services to the nation.6

Against IMF admonition, El Salvador adopted bitcoin as legal tender alongside the U.S. dollar. Subsequently, and against all predictions, in January of this year it repaid an $800 million bond on time.

Despite the benefits quickly accruing to the Salvadoran citizenry, such brazen acts of sovereignty by a non-compliant “third world” vassal was ill-received by Washington. Backlash was swift; global propaganda organs initiated Bukele smear campaigns raising suspicions of corruption, gangster collusion, human rights violations, and the suspension of due process.

The allegations fell on deaf ears—especially so coming from an arrogant militarily-intrusive empire led by a geriatric elite, burdened with its own staggering national debt, exploding urban crime rate, two-tiered justice system, and a torrentially-growing mountain of evidence suggesting influence peddling and foreign bribery at the highest levels. El Salvador, having too long played Washington’s game, has remained generationally-impoverished, subjected to a long U.S.-facilitated civil war, terrorized by gangs, and betrayed by its own quislings. This tragic generational suffering, however, wasn’t for naught; it served to hone their discernment.

They observed how unrestricted, ex nihilo creation of the unilaterally-imposed world reserve currency mothered an imperial war machine that grew ever stronger, expansionistic, and indifferent to the sovereignty of less powerful nations. They witnessed their own leaders endlessly fornicating with Washington, selling out their own people into American vassalage. As such, their suffering prepared them for the bitcoin opportunity Bukele offered.

As he emphasized repeatedly in his address to the United Nations General Assembly in September, El Salvador’s turning point was resolving to finally exercise their own sovereignty and decline following American protocols for vassal states.7 Ignoring unsolicited warnings, counterfactual criticism and the self-righteous angst of those who would rule the world, they dared to break the repeating cycle of financial oppression and entrenched gang violence. As a result, and in record time, Bukele demonstrated how quickly a failing state could be resuscitated when legitimately elected leaders actually served their people.

Bukele and bitcoin have given El Salvador a rare opportunity for improving their national paradigm but the future is tenuous. To succeed, four internal and three external potential threats must be considered:

Internal Threats

(1) Bitcoin Volatility.

Upon adopting bitcoin the conversion rate was one bitcoin to $46.8 thousand. At the time of writing it has dropped 57% to $28 thousand. To the bitcoin initiated volatility is expected and of little concern. However, to the neophyte—which arguably includes most Salvadoreños—the volatility of bear markets could breed distrust and rejection creating dissatisfied space for a political contender to exploit and ultimately scuttle the bitcoin project.

(2) Political Parasites-in-Waiting.

It is naïve to think that political aspirants aren’t lurking in the wings, ready to accept Washington patronage and do its bidding. How will El Salvador protect itself from a future U.S.-empowered puppet of weak moral fiber (usually emerging from the military fold, if history is precedent) willing to regress the nation back into approved vassalage?

(3) The Salvadoran Swamp.

Equally naïve is the assumption that Bukele’s reforms might have neutralized all former corrupt power networks from politicians to business leaders to gang facilitators—some of whom likely desire return to a previous, more profitable arrangement.

(4) Gangster Catch and Release.

Will the majority of confirmed gangsters remain incarcerated commensurate with crimes committed, or will large numbers come to find amnesty, pardon, and public release? Further, if economic conditions fail to quickly improve, thus eliminating the key conditions that birthed the rise of gangs in the first place, El Salvador could regress into chaos as quickly as it ascended out of it. Further still, it will be instructive to track the disposition of Salvadoran gangsters imprisoned in the U.S. as surreptitious release and repatriation by a jilted superpower could undermine Bukele’s security gains.

One or more of the above potentialities could hasten a deterioration of security resulting in widespread panic, political exploitation, and a throttling of foreign investment in the cradle.

El Salvador must also be prepared for the emergence of external threats to its national project:

External Threats

(1) U.S. Interference.

Small nation states like El Salvador who ditch Washington’s script and forge their own sovereign path, in this case going all in for bitcoin in an effort to eventually liberate from IMF and World Bank bondage have cause to be wary of superpower response. To the degree that bitcoin states prosper and demonstrate the superiority of hard money, legacy fiat-addicts will be shamed. Their system’s instability will be exposed, and they will want to remove the thorn from their side lest others begin following suit, like the Central African Republic last year. El Salvador’s bitcoin journey has potential to provide a compelling countermodel to the globalist fiat narrative.

As such, bitcoin states need to be geopolitically-saavy in contemplating comprehensive physical security from superpowers with histories of foreign meddling including the instigation of coups, proxy wars, and regional conflicts. Salvadoreños remember the 1954 U.S. backed coup in Guatemala which deposed elected president Jacobo Arbenz and installed a military dictator. They remember Chile’s President Allende’s ouster in 1973. They vividly recall U.S. involvement in their own civil war from 1979 to 1992. They remember U.S. interference in their 2004 presidential election which saw the installment of Tony Saca (currently imprisoned for corruption), who was one of the few Latin American leaders to participate in Operation Iraqi Freedom (OIF), sending 10 rotations of soldiers to Iraq.

Most recently, they watched as Peruvian president Pedro Castillo was sacked in a coup and imprisoned without trial a day after ex-CIA agent turned U.S. ambassador to Peru Lisa Kenna8 met with the Peruvian defense minister in December of last year. Curiously, the defense minister, Gustavo Rosas, a retired brigadier general, had been appointed to his post only a day prior to his meeting with Kenna. Interestingly, in light of U.S. allegations that Bukele had suspended due process for gangsters, the U.S. appears unconcerned that Castillo’s pre-trial detention was recently doubled from 18 to 36 months.9 Indeed, Salvadoreños can point to several U.S.-unaligned Central and South Americans leaders who have met abnormally-shortened terms of office.

(2) Military Ties with the U.S.

In this regard, one should note that El Salvador has periodically participated in military officer exchanges with the U.S. Last April, the Chief of Joint Staff of the Salvadoran Armed Forces, LTG Carlos Alberto Tejada Murcia, was inducted in absentia into the International Hall of Fame (IHOF) at the Command and General Staff College (CGSC), Fort Leavenworth.10 Since 1894, over 8,000 foreign officers have graduated from the military college. The purpose of these martial partnerships is to forge personal ties with future potential international leaders. A nation defying Washington by exercising its own sovereignty might be wise to abstain from such partnerships and be wary of previous participants within its ranks (both active and retired).

(3) Banking.

Of the twelve commercial banks in El Salvador, two are state and 10 are private.11 As I mentioned in a previous article,12 a viable threat to the bitcoin ecosystem would be an attempt to cut reentry rails back into the fiat system. Until such time as an economy is bitcoin independent, there will be many instances where bitcoin holders will need to convert portions of their stack to transact in the local currency. If the rails that permit such conversions to occur are blocked, bitcoin becomes cyber-isolated. In this regard, who owns the banks in El Salvador and could they be externally influenced and weaponized against bitcoin activity? More pointedly, if a fiat superpower disgruntled at a small nation’s bitcoin adoption either unilaterally or in conjunction with its global allies had influence over a number of El Salvadoran banks, they could potentially hinder fiat reentry rails, stranding Salvadoran bitcoin wealth in cyberspace.

Anticipating one or more of these potential threats, a number of preemptive tactics emerge:

Solutions and Opportunities

(1) Education.

First and foremost, education of the citizenry is essential. People need to understand the critical issues in order to make informed national decisions. They need to understand their history to include root causes of their recurring poverty, foreign suppression, and gang emergence. Second, they need to a sound foundation in monetary basics. Finally, upon understanding what money is, they will then be prepared to more fully understand the promise of bitcoin. Encouragingly, El Salvador’s Ministry of Education has recognized this need and has already begun incorporating bitcoin into the public school curriculum.13 In addition to educating the younger generation, a complementary and equally vital initiative would be a proliferation of workshops, classes, and free online courseware nationwide to all segments of Salvadoran society.

(2) Information Operations.

Global propaganda has already started casting aspersions on president Bukele and his policies. In the information domain, one can’t be passive: El Salvador needs to not only counterpunch, but to inundate the infosphere with its own uncensored programming to ensure its own citizenry can compare and contrast fiat misinformation with alternative, sound ideas. Such an initiative would be wide-ranging, including nationwide internet assurance, the protection of free speech and content creation, and public service bitcoin news and educational programming.

(3) Constitutionalizing Bitcoin.

In order to institutionalize bitcoin into the fabric of Salvadoran governance and economy, ensuring it transcends presidential administrations, certain changes to El Salvador’s constitution might be considered. As voting corruption has become a preferred weapon of mass disenfranchisement for corrupt regimes, enabling them to gain and retain power, then El Salvador must consider effective safeguards against this threat. To protect against fraudulent elections, the nation might consider blockchain-verified voting as the law of the land. Further, in the realm of federal monetary activity, much as the launch of nuclear weapons requires multiple trusted parties following strict procedures, so too, foolproof multi-party protocols must be established to ensure that national bitcoin holdings cannot be stolen.

(4) Bitcoin-Friendly Economy.

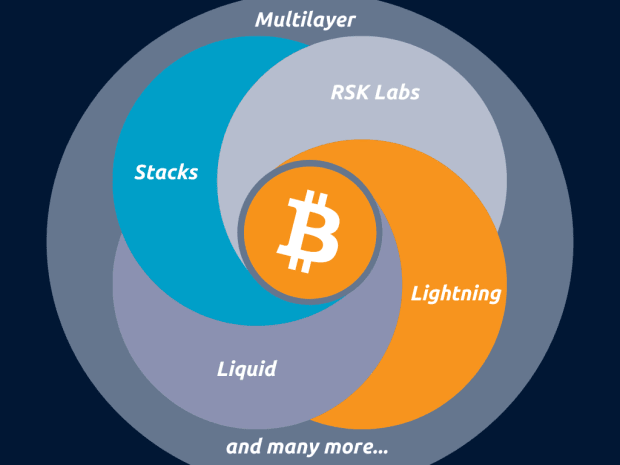

As the U.S. and much of the world seems to be consolidating power among hyper-affluent, ruling elites while simultaneously diminishing citizen freedom, wealth, and self-determination, El Salvador has unprecedented global potential to become a sanctuary and hub for bitcoin innovation. While the aforementioned jurisdictions throttle bitcoin innovation and threaten to hold technological entrepreneurs liable for perceived malpractice, El Salvador could provide a welcoming home for persecuted technologists innovators, and entrepreneurs. Establishing an hospitable environment in the freedom technology space free of state persecution could unleash a powerful catalyst for the nation’s economy. It could be a win-win, providing El Salvador with a sustainable, internally-resourced bitcoin ecosystem into which new bitcoin-emergent nations and actors could plug.

One could imagine forward-thinking innovation entities like Space-X, chip design and manufacturing firms, AI, blockchain technologists and miners flocking to the land of volcanos as their international sanctuary of choice, contributing their skills and gifts to further enrich, empower, and safeguard a nation that is actually protecting and honoring citizen sovereignty.

(5) International City Partnerships.

Despite the antagonistic stance the U.S. federal government is taking towards bitcoin and El Salvador, yet there exist a multiplicity of smaller bitcoin-friendly jurisdictions. Salvadoran cities could bypass the federal colossus and instead seek partnerships with like-minded, pro-bitcoin U.S. cities and beyond, forming strong bonds of cultural exchange, trade, educational partnerships, and wide-ranging symbiotic collaboration. The strength of such partnerships could serve as a powerful counterweight and insurance policy against aggressive U.S. federal action directed at El Salvador.

(6) Internally-Professionalized Security Forces.

Finally, to guard against the possibility of internal treason and foreign-instigated juntas, El Salvador should consider terminating military officer partnerships with U.S. and European militaries recognizing that the purpose of those programs is for more powerful states to nurture influential ties with potential future leaders of weaker countries. They hope to develop relationships with future power brokers who might be leveraged during future exigencies. El Salvador’s security requirements are self-defensive. America, with its propensity for, and losing track record of, global expeditionary campaigns financed by an inconceivably-large fiat budget, has little in common with, and little to offer a nation solely concerned with defending against unprovoked external aggression. As such, it would be wise to preemptively inhibit the potential grooming of future Salvadoreño officers into U.S. affinities. An El Salvador that has become a global leader in technological innovation resourced by bitcoin wealth could achieve effective defensive capability without having to send its officers abroad for training.

Could El Salvador represent the vanguard of an alternative international system: a Bitcoin World Order that respects the sovereignty and self-determination of individual nations and their constituent citizens? One could imagine a growing federation of such bitcoin states united in trade and mutual defense.

Conclusion

The orange experiment in El Salvador is far from over; it is premature to declare victory. Bitcoin’s freedom technology has offered Salvadoreños an opportunity to break the cycle of traitorous leadership, institutionalized corruption, generational poverty, endemic violence, and western fiat vassalship. Will they make good on this opportunity? By addressing the threats logically and lucidly, they will fortify their odds of success.

1 Lyn Alden, Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better, pp 143-150.

This is a guest post by William E. Stebbins Jr. LTC(ret). Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.