Best Bitcoin ETFs in 2024: Fees, Alternatives, and How to Buy

In 2024, the United States Securities and Exchange (SEC) made the historic decision to approve the trading of spot Bitcoin exchange-traded funds (ETFs).

This opened a new chapter in the cryptocurrency industry, further legitimizing BTC as an investment option that regulators deem worthy of regular investors’ access.

However, there are multiple intricacies associated with buying and selling spot BTC ETFs, so we’ve prepared the ultimate guide to which ones are the best, their associated fees, custodians, and everything you need to know about this new product.

Let’s take a closer look.

Table of Contents

- What Are Bitcoin Exchange-Traded Funds (ETFs)?

- Futures or Spot Bitcoin ETFs?

- The Best Spot Bitcoin ETFs

- BlackRock iShares Bitcoin Trust (IBIT)

- Grayscale Bitcoin Trust (GBTC)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Bitwise BITB

- Valkyrie Bitcoin Fund (BRRR)

- Ark 21Shares Bitcoin ETF (ARKB)

- Franklin Bitcoin ETF (EZBC)

- Invesco Galaxy Bitcoin ETF (BTCO)

- VanEck Bitcoin Trust (HODL)

- WisdomTree Bitcoin Fund (BTCW)

- Hashdex Bitcoin ETF (DEFI)

- In-Kind and In-Cash Redemption Models for Spot Bitcoin ETFs

- In-Kind Redemption Model

- In-Cash Redemption Model

- How to Choose and Invest in Spot Bitcoin ETFs

- Benefits of Spot Bitcoin ETFs

- Alternatives to Spot Bitcoin ETFs

- Best Bitcoin ETFs: Conclusion

What Are Bitcoin Exchange-Traded Funds (ETFs)?

Explained simply, a spot Bitcoin ETF provides investors with direct exposure to Bitcoin, unlike futures-based Bitcoin ETFs, which allow them to speculate on BTC’s future price, hence the name.

Either way, both allow users to open positions in the market without being obliged to hold the cryptocurrency. On a surface level, Spot Bitcoin ETFs work this way:

- The Spot Bitcoin ETF issuer, like BlackRock, buys Bitcoin and holds the funds with a secure custodian. That custodian (spoiler alert, it’s mostly Coinbase) typically uses cold storage solutions, which are hardware wallets stored somewhere safe and offline.

- Custodians not only safeguard the assets on behalf of issuers. In fact, the custodian is in charge of surveillance-sharing agreements with the ETFs’ listing exchanges.

- Note that the ETF might invest in Bitcoin directly through a broker or buy derivatives linked to the price of BTC.

- As an investor, you can simply buy the shares of the ETF on stock exchanges like the NYSE or NASDAQ or, more simply, brokers that have listed the ETF’s shares. So, when you do that, you’re essentially buying the ETF’s shares, which consequently means you’re buying a portion of the current market value of the fund’s Bitcoin holdings.

In other words, you don’t need to buy Bitcoin from a cryptocurrency exchange or deal with the complexities of managing the coin yourself, setting up a trustworthy BTC wallet, setting up security measures, etc., because you’re buying the shares in the fund that holds the BTC.

This is especially convenient if you’re a newcomer in the crypto space and don’t want to deal with the inherent burdens of buying BTC. Or any crypto asset, for that matter.

In addition, spot Bitcoin ETF issuers are regulated financial companies that adhere to the most stringent regulations of the United States Securities and Exchange Commission. It’s also worth noting that spot Bitcoin ETFs have officially been approved by the SEC in January 2024.

To learn more about Bitcoin you can read our beginners guide.

Futures or Spot Bitcoin ETFs?

Bitcoin futures ETFs allow users to invest in Bitcoin’s future price movements without holding the actual asset. That means they can use a futures contract to gain indirect exposure to BTC’s price.

Typically, investors use futures contracts to lock in prices and take offsetting positions against unpredictable market movements. But they can be expensive; futures ETFs come with higher costs related to managing futures contracts. Their market dynamics add complexity and risk, as the price of futures contracts can diverge significantly from Bitcoin’s spot price.

We’ll review the Bitcoin futures ETF in another section at the end of this article.

The Best Spot Bitcoin ETFs

Now that you understand how these financial vehicles work, and other important information is clear, let’s look at the best Spot Bitcoin ETFs.

BlackRock iShares Bitcoin Trust (IBIT)

BlackRock’s Spot Bitcoin ETF, known as iShares Bitcoin Trust (IBIT), is designed to provide investors with a cost-effective way to gain exposure to Bitcoin’s price performance without directly owning the cryptocurrency.

The ETF tracks the price of Bitcoin, allowing investors to benefit from its price movements through a traditional brokerage account. This ETF simplifies the investment process by handling the storage and security of Bitcoin, alleviating the need for individual investors to manage these aspects themselves.

Fund Facts

Overview and fund facts:

- Fund inception: Jan 05, 2024

- Sponsor fee: 0.25% (established after reaching over $5 billion in holdings)

- Exchange: NASDAQ

- Custodian: Coinbase Custody Trust Company, LLC

- Assets Under Management (as of June 2024): 295,457 BTC ($20,8B)

Grayscale Bitcoin Trust (GBTC)

The Grayscale Bitcoin Trust (GBTC) ETF is one of the largest Spot Bitcoin ETFs, having dozens of billions in assets under management (UAM).

GBTC was created in 2013 and functioned through private placements. In other words, it was only available to accredited investors. The company had famously promised that the fund would be converted into an ETF.

Due to regulatory hurdles back then, the fund suffered lower liquidity as it traded on the OTC (over-the-counter) market, had limited accessibility for most retail investors, and potential tracking discrepancies due to the lack of creation/redemption mechanisms. This didn’t stop it from becoming one of the largest Bitcoin funds in the market, however.

The premium in the Grayscale Bitcoin Trust (GBTC) refers to the difference between the market price of GBTC shares and the net asset value (NAV) of the underlying Bitcoin that the trust holds. This premium (or discount) indicates how much investors are willing to pay above (or below) the actual value of the Bitcoin held by the trust.

You should note that the fee structure is notably higher than other Bitcoin ETFs available today.

Fund Facts

Overview and fund facts:

- Fund inception: 2013, uplisted as a Spot Bitcoin ETF on January 10, 2024.

- Sponsor Fee/Expense Ratio: 1.5% management fee.

- Exchange: NYSE Arca

- Custodian: Coinbase Custody Trust Company, LLC.

- Total AUM and notional value (as of June 2024): 285,458 BTC ($20,3B).

Fidelity Wise Origin Bitcoin Trust (FBTC)

The Fidelity Wise Origin Bitcoin Trust (FBTC) is one of the industry’s first spot Bitcoin exchange-traded products (ETPs). Launched by Fidelity Investments, FBTC aims to track Bitcoin’s performance, providing investors with direct exposure to this digital asset.

The fund is available to financial advisors, institutional investors, and retailers through Fidelity’s online platforms.

Unlike other ETFs, FBTC’s Bitcoin is secured by Fidelity Digital Assets Services, which has been regulated by the New York Department of Financial Services (NYDFS) since 2019.

If you’re confused as to why FBTC is an ETP rather than ETF, then there’s some context you need to know. First, all ETFs fall under a broader category called exchange-traded products (ETPs), which are listed on exchanges and can be traded like stocks during market hours.

In other words, ETFs are the most common type of ETP and are regulated by the Investment Company Act of 1940. They are pooled investments that typically include baskets of stocks, bonds, and other assets according to the fund’s objectives.

FBTC, while similar to an ETF as it trades on an exchange, is an ETP that holds 100% Bitcoin and does not invest in securities. That means it’s not subject to the regulations of the Investment Company Act of 1940. If you search for Fidelity’s Spot Bitcoin ETF on Google, you’ll see it’s marketed and signaled as an ETF, and in a technical sense, it is.

Fund Facts

Overview and fund facts:

- Fund inception: January 10, 2024

- Sponsor Fee/Expense Ratio: 0.25% (Waived until July 31, 2024.)

- Exchange: NYSE

- Custodian: Fidelity Digital Asset Services, LLC

- Total AUM (as of June 2024): Approximately $9.17B

Bitwise BITB

Bitwise’s BITB fund is a well-known spot Bitcoin ETFt. It exposes investors to Bitcoin’s price by tracking its performance (minus the Trust’s operating expenses and other liabilities).

BITB has an expense ratio of 0.95%. While it’s higher than most ETFs, it covers management fees, custody charges, and the fund administrator’s and auditor’s customary fees.

Fund Facts

Overview and fund facts:

- Fund inception: January 10, 2024

- Sponsor Fee/Expense Ratio: 0.95%

- Exchange: NYSE Arca

- Custodian: State Street Digital Assets

- Total AUM (as of June 2024): Approximately $2.4B

Valkyrie Bitcoin Fund (BRRR)

The Valkyrie Bitcoin Fund (BRRR) tracks the price performance of BTC by purchasing and holding Bitcoin directly.

Designed by Valkyrie Funds LLC, the ETF began trading on the Nasdaq exchange on January 10. It also uses Coinbase Custody to protect its Bitcoin holdings. The company has also provided investors with other types of investment vehicles for cryptocurrencies, including a Bitcoin and Ether Strategy futures ETF.

Fund Facts

Overview and fund facts as of June 2024:

- Fund inception: January 10, 2024

- Sponsor Fee/Expense Ratio: 0.25%

- Exchange: Nasdaq

- Custodian: Coinbase Custody Trust Company, LLC

- Total AUM (as of June 2024): Approximately $607M

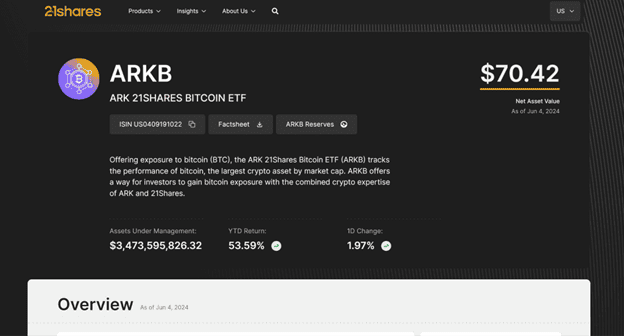

Ark 21Shares Bitcoin ETF (ARKB)

Ark 21Shares Bitcoin ETF (ARKB), co-launched by Ark Invest and 21Shares, provides investors with a regulated way to gain exposure to Bitcoin.

It tracks its performance via the CME CF Bitcoin Reference Rate (New York Variant) and adjusts for expenses and liabilities. It trades on the Cboe BZX Exchange and has an expense ratio of 0.21% as of June 6, 2024.

As mentioned, the fund was co-launched by two well-known companies in the crypto and FinTech space.

Ark Invest is a renowned FinTech firm founded by Cathie Wood in 2014. It offers ETFs targeting themes like fintech innovation and is known for its bullish outlook on blockchain and disruptive technologies.

Meanwhile, 21Shares is a Swiss fintech company that specializes in cryptocurrency investment products. It offers various exchange-traded products (ETPs) that give investors regulated exposure to digital assets through traditional brokerage accounts.

Fund Facts

Overview and fund facts as of June 2024:

- Fund inception: January 11, 2024.

- Sponsor Fee/Expense Ratio: 0.21%

- Exchange: Cboe BZX Exchange

- Custodian: Coinbase Custody Trust Company, LLC.

- Total AUM (as of June 2024): $3,47B

Franklin Bitcoin ETF (EZBC)

The Franklin Bitcoin ETF (EZBC) was launched by Franklin Templeton on January 11, 2024. It invests 100% in Bitcoin and uses Coinbase Custody as its custodian.

Franklin Templeton is a global investment management firm under Franklin Resources, Inc., an American multinational holding company founded in 1947 by Rupert H. Johnson Sr. in New York City.

Similar to Fidelity’s FBTC, EZBC is not governed by the Investment Company Act of 1940, so it’s not subject to the same regulatory requirements because it does not invest in securities, it offers exposure solely to Bitcoin.

Fund Facts

Overview and fund facts:

- Fund inception: January 11, 2024

- Sponsor Fee/Expense Ratio: 0.19% (waived until August 2, 2024, or first $10 billion in assets)

- Exchange: CBOE BZX Exchange, Inc.

- Custodian: Coinbase Custody Trust Company, LLC.

- Total AUM (as of June 2024): $312.2M

Invesco Galaxy Bitcoin ETF (BTCO)

Invesco Galaxy Bitcoin ETF (BTCO) is a Spot Bitcoin ETF that provides secure and convenient exposure to Bitcoin by directly investing in physical Bitcoin.

The ETF trades on the Cboe BZX and matches Bitcoin’s spot price performance through the Lukka Prime Bitcoin Reference Rate.

As such, the ETF is a joint venture between Invesco and Galaxy Digital. Both companies are renowned in the cryptocurrency space and have launched many crypto-related ETPs in the past due to the soaring demand for crypto assets.

Fund Facts

Overview and fund facts:

- Fund inception: January 11, 2024.

- Sponsor Fee/Expense Ratio: 0.25% (waived until July 2024)

- Exchange: Cboe BZX Exchange

- Custodian: Coinbase Custody Trust Company, LLC.

- Total UAM (as of June 2024): $384.4M

VanEck Bitcoin Trust (HODL)

VanEck Bitcoin Trust (HODL) is a trust designed to give investors exposure to the price of Bitcoin by holding Bitcoin directly.

According to VanEck, HODL is designed as a passive investment vehicle and only aims to track Bitcoin’s price without seeking additional returns or avoiding losses from price changes. It was Launched on January 4, 2024, sponsored by VanEck Digital Assets, LLC, and trades on the Cboe BZX Exchange under the ticker symbol HODL.

HODL shares are valued daily based on the MarketVector Bitcoin Benchmark Rate, which is calculated using prices from what the Sponsor considers the top five Bitcoin exchanges.

Bitcoin Benchmark Rate, which is calculated using prices from what the Sponsor considers the top five Bitcoin exchanges.

Fund Facts

Overview of HODL and fund facts:

- Fund inception: January 4, 2024

- Sponsor Fee/Expense Ratio: 0.20%

- Exchange: Cboe BZX Exchange

- Custodian: Gemini Custody

- Total AUM (as of June 2024): $705.46M

WisdomTree Bitcoin Fund (BTCW)

The WisdomTree Bitcoin Fund (BTCW) is an exchange-traded fund (ETF) designed to provide exposure to Bitcoin’s price.

As per the official website, the fund values its shares daily based on an independently calculated value from aggregated trade flows on major Bitcoin spot exchanges.

Finally, BTCW does not directly manage Bitcoin but uses a passive approach to reflect its market price through a benchmark rate. It’s listed on the Cboe BZX Exchange and safeguards its assets through Coinbase Custody.

Fund Facts

Overview of BTCW and fund facts:

- Fund inception: January 11, 2024

- Sponsor Fee/Expense Ratio: Expense Ratio: 0.25%

- Exchange: BATS Exchange (Bats Global Markets).

- Custodian: Coinbase Custody Trust Company, LLC

- Total AUM (as of June 2024): $79.7M

Hashdex Bitcoin ETF (DEFI)

Hashdex Bitcoin ETF (DEFI) distinguishes itself from other Bitcoin ETFs by having a small element of Futures ETFs in it due to a conversion in early March 2024.

Note that DEFI is a spot ETF after being converted in March 2024 to primarily hold actual Bitcoin and track the spot price. However, according to the fund description, DEFI can allocate up to 5% of its assets to Bitcoin futures contracts.

This minor allocation of futures is meant to help the ETF track the price of Bitcoin more closely and offer a smoother creation/redemption process. So, yes, DEFI is classified as a spot ETF but with a small futures component.

Moving on, DEFI’s expense ratio is 0.94%, which is higher than most ETFs. The expense ratio covers the costs of operating the ETF, including management fees, administrative expenses, and custody fees.

Fund Facts

Overview and fund facts:

- Fund inception: September 15, 2022, updated on March 2024

- Sponsor Fee/Expense Ratio: 0.94%

- Exchange: NYSE Arca

- Custodian: BitGo

- Total AUM (as of June 2024): $12.4 million

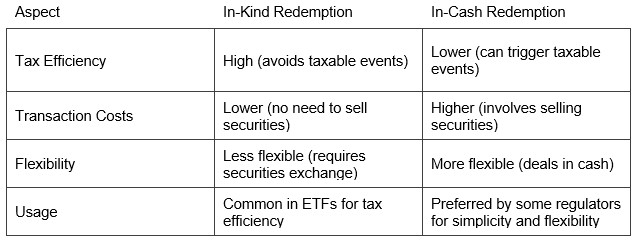

In-Kind and In-Cash Redemption Models for Spot Bitcoin ETFs

One of the many pain points for approving the Spot Bitcoin ETFs was that applicants and the SEC needed to agree on what buying and selling procedures would be used for this type of asset, given its unique nature.

This is where the in-kind and in-cash redemption models kick in.

In-Kind Redemption Model

In-kind redemptions help ETFs maintain tax efficiency by avoiding the sale of appreciated securities to meet redemptions. In this model, authorized participants (APs) exchange ETF shares for a basket of underlying securities and have been fundamental to ETF operations since their inception.

In a nutshell:

- In-kind redemptions involve exchanging ETF shares for a basket of the underlying securities held by the ETF rather than cash.

- Only the APs, typically institutional investors, can directly redeem the shares from the ETF for a proportional basket of the underlying securities.

It’s simple. However, the main reason institutions do this is for tax efficiency. This process does not trigger a taxable event for the ETF because no securities are sold to generate cash. This helps defer capital gains taxes for non-redeeming shareholders. Therefore, institutions limit trading and transaction costs (making them more tax-efficient compared to mutual funds).

In-Cash Redemption Model

In-cash redemptions, where authorized participants receive cash instead of securities when redeeming ETF shares, have also been common, especially for ETFs holding less liquid assets or for actively managed ETFs that want to keep their strategies confidential.

Here’s the skinny:

- In-cash redemptions involve the exchange of ETF shares for cash equivalent to the net asset value (NAV) of the shares being redeemed.

- The AP deposits cash into the ETF and uses it to purchase the underlying assets. That, or the ETF sells the underlying assets to generate the cash needed for redemption.

In-cash redemption provides more flexibility for fund participants because it simplifies the redemption process by dealing in cash rather than securities.

But they’re not as tax-efficient as in-kind models because selling securities to generate cash can trigger taxable events, leading to capital gains distributions that affect all shareholders. Further, the process involves higher transaction costs due to bid/ask spreads and broker commissions when selling the underlying assets.

Below is a table that can help you compare both types of redemption models:

For spot Bitcoin ETFs, the SEC has mandated that redemptions must be in cash rather than in-kind.

This might sound like a disadvantage for Bitcoin investors, but this likely stems from Bitcoin’s unique nature and concerns about potential market disruption if large amounts of BTC were sold for in-kind redemptions.

This also means that the issuers are responsible for trading BTC when shares are added or redeemed, leaving investors to bear the trading costs, such as transaction fees, cost crossing the bid-ask spread, and market-impact costs.

How to Choose and Invest in Spot Bitcoin ETFs

Not all brokerages offer shares of spot Bitcoin ETFs. Therefore, that’s the first thing to check. Also, it’s important to see what investment accounts the broker supports and if they work for you.

For example, Fidelity supports different types of accounts, starting with IRAs and brokerage accounts.

Once your account is open, you must fund it with cash to be ready to invest in spot Bitcoin ETFs.

The steps are simple:

Step 1: Open an investment account.

Step 2: Fund the account with cash.

Step 3: Select the ETF you wish to purchase.

Step 4: Execute the trade to buy the ETF’s shares.

Whichever you choose, note that spot BTC ETFs have a simple goal: exposure to Bitcoin. It’s how they do it, how much liquidity they have, their reputation, and how much they charge that matters.

However, it’s not as simple as picking up an ETF and buying the shares because you might want to buy and hold or actively trade the shares. In that case:

- Fees are the primary consideration for long-term, buy-and-hold investors as their impact compounds over time. Choosing a low-cost ETF is crucial to maximizing returns.

- Several ETFs, including ARK, Fidelity, VanEck, and iShares, have expense ratios of around 0.25% after fee waivers expire. The Bitwise Bitcoin ETF (BITB) has the lowest expense ratio at 0.20%.

- Consult each ETF’s official website and be up-to-date with fee waivers; they can expire on a specified date or when the ETF reaches a certain NAV number.

- For active traders, liquidity and tight bid-ask spreads are more important for those frequently trading in and out of their positions because higher liquidity allows for easier entry/exit and lower trading costs.

- Larger, more established issuers like BlackRock’s IBIT and Fidelity’s FBTC may offer the highest liquidity initially.

Benefits of Spot Bitcoin ETFs

Spot Bitcoin ETFs provide various advantages for investors, making them a compelling choice for those seeking БТЦ exposure without directly holding the cryptocurrency. Here are the main benefits:

- Legitimacy: Approval of spot Bitcoin ETFs by regulatory bodies such as the SEC lends credibility to Bitcoin as an asset class. This approval makes Bitcoin more acceptable to a wider range of investors, including those with retirement accounts like IRAs and 401(k)s.

- Accessibility: Spot Bitcoin ETFs offer a simple way for investors to gain Bitcoin exposure without needing to manage digital wallets and private keys or navigate cryptocurrency exchanges.

- Market Liquidity: By buying and selling large blocks of Bitcoin based on demand, spot Bitcoin ETFs can enhance Bitcoin’s overall liquidity, potentially stabilizing its price over time.

- Accurate Price Tracking: Spot Bitcoin ETFs are designed to closely follow Bitcoin’s current price, providing investors with a transparent and straightforward way to track its market value.

- Daily Creation and Redemption: Shares of spot Bitcoin ETFs can be created or redeemed daily, helping keep the ETF’s price aligned with the underlying Bitcoin holdings’ net asset value (NAV).

- Regulation: Spot Bitcoin ETFs operate within a regulated framework, offering an added layer of security and oversight compared to unregulated cryptocurrency exchanges.

- Portfolio Diversification: Spot Bitcoin ETFs provide investors with an easy way to diversify their portfolios by adding Bitcoin exposure without the complexities of direct ownership. This can be particularly beneficial for retirement accounts and other long-term investment strategies.

- No Futures Roll Costs: Unlike Bitcoin futures ETFs, spot Bitcoin ETFs do not incur additional costs associated with rolling futures contracts, which can erode returns over time.

Alternatives to Spot Bitcoin ETFs

If you can’t access a spot Bitcoin ETF for any reason, there are several alternatives to gain exposure to Bitcoin’s price. Note that neither of these provide direct exposure and the value of the listed products and alternatives is not 100% correlated to the price of BTC.

Bitcoin Futures ETFs

Bitcoin Futures ETFs track the price of Bitcoin futures contracts rather than BTC’s spot price.

What’s the difference between spot and futures? Investors иn futures contracts buy or sell an asset at a determined price at a specified time. In other words, they are not buying at current market prices. This is also beneficial as it allows investors to hedge against current market prices going in opposite directions.

However, futures contracts are subject to issues like contango, in which the price of an asset in a futures contract trades above the spot price, and backwardation, in which the contract prices an asset lower than the spot price. In other words, expect price performance discrepancies.

Some notable examples include ProShares Bitcoin Strategy ETF (BITO) and VanEck Bitcoin Strategy ETF (XBTF).

Bitcoin Trusts

Investment vehicles like the Grayscale Bitcoin Trust (GBTC) hold Bitcoin and aim to reflect its price. These trusts can trade at a premium or discount to the underlying asset’s value, which might impact their performance relative to Bitcoin.

Direct Purchase on Crypto Exchanges

You can buy Bitcoin directly from exchanges such as Coinbase, Binance, Kraken, or Bitfinex. This method involves directly owning Bitcoin and managing its storage and security. For more information see our bitcoin ETF vs buying directly comparison.

Bitcoin Mining Stocks

Investing in companies involved in Bitcoin mining, such as Riot Blockchain (RIOT) or Marathon Digital Holdings (MARA), provides indirect exposure to Bitcoin. Their stock prices are often correlated with Bitcoin’s price movements.

Stocks Holding Bitcoin: Some publicly traded companies hold Bitcoin on their balance sheets, offering indirect exposure. Examples include Tesla (TSLA) and MicroStrategy (MSTR). MicroStrategy, in particular, has significant Bitcoin holdings and considers itself a “Bitcoin development company.”

However, it’s important to note that these do not provide direct exposure to the BTC price and their value is not 100% correlated to it.

Blockchain ETFs

These ETFs invest in companies involved in blockchain technology rather than holding Bitcoin directly. Examples include Amplify Transformational Data Sharing ETF (BLOK) and Siren Nasdaq NexGen Economy ETF (BLCN).

Each method has its own risk profile and regulatory considerations, so it’s essential to research and choose the option that aligns with your investment strategy and risk tolerance.

Best Bitcoin ETFs: Conclusion

Spot Bitcoin ETFs began a new era for Bitcoin and the cryptocurrency market by introducing it to investors and the mainstream media in a regulated, secure environment. However, that doesn’t mean we shouldn’t understand the basics of Bitcoin, crypto, and how investment vehicles such as spot or futures ETFs work.

When you grasp how Spot Bitcoin ETFs work, you understand the lengthy regulatory discussions between legislators and applicants before approval. It’s worth noting that spot Bitcoin ETFs were designed (to a certain extent) for individuals unfamiliar with the crypto space. They provide a straightforward way to invest in Bitcoin without:

1) understanding traditional finance complexities and

2) the hurdles and complexities of buying, managing, and securing crypto directly.

In a certain sense, Bitcoin ETFs take away a large chunk of those intricacies and confusion from newcomers because they can invest through a large institution that handles the buying, managing, dealing with custodians, security, etc.

Further, these ETFs offer a regulated, accessible entry point for investing in Bitcoin, simplifying the process for a broader range of investors.

The post Best Bitcoin ETFs in 2024: Fees, Alternatives, and How to Buy appeared first on CryptoPotato.