Bears Rekt: $1 Billion Shorts Liquidated in a Day, Most Since October 2020

Bitcoin is ripping. After weeks of prolonged consolidation and rangebound trading where the price seemed stuck around $19K, the cryptocurrency added over $1.5k in the past 24 hours alone.

At the time of this writing, BTC is found at $20,600, up 6.8% on the day. The rest of the market is also soaring, pushing the total capitalization toward $1 trillion.

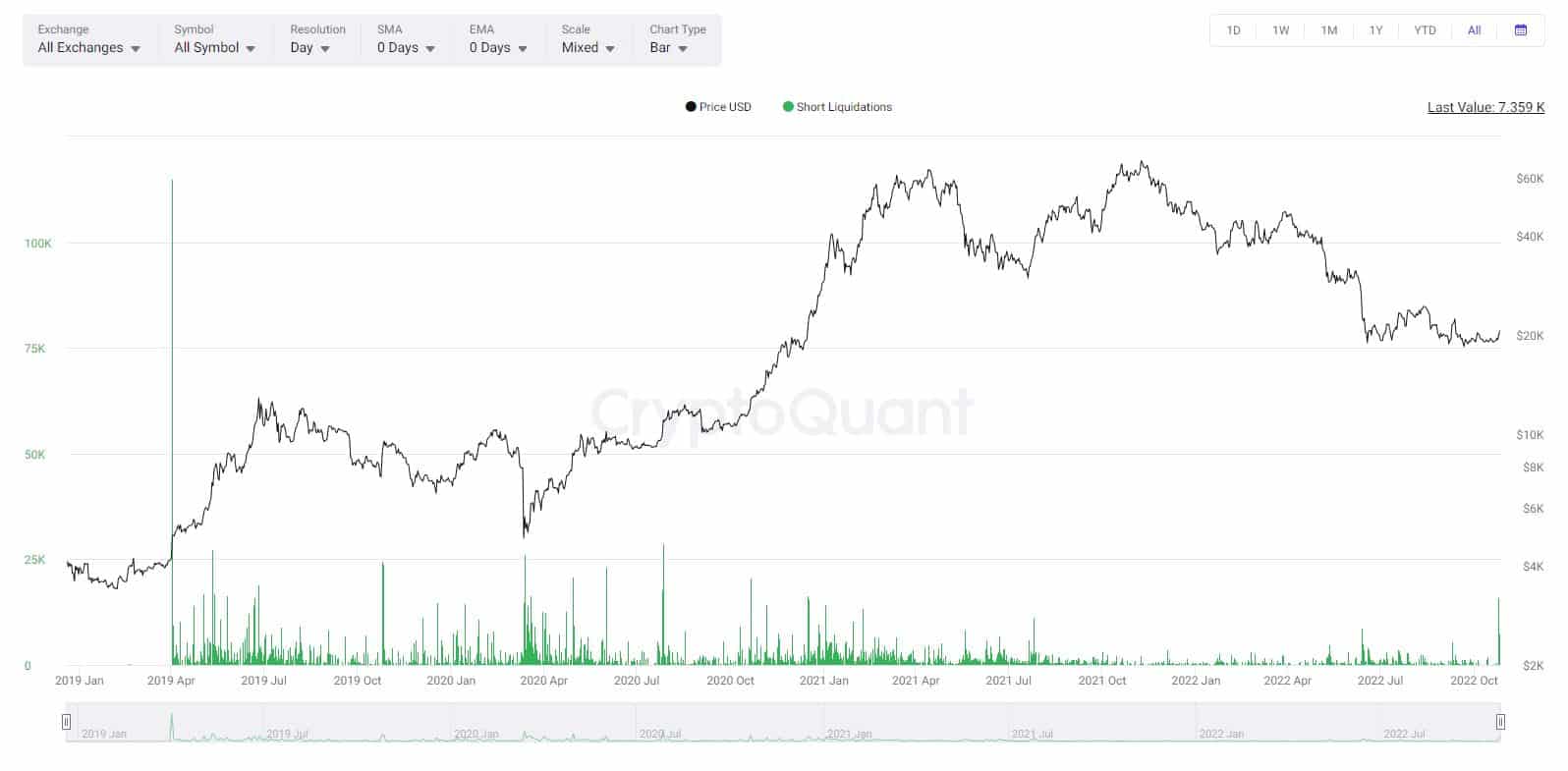

- The events of late have also left around $1 billion worth of short positions being liquidated.

- Data from the popular cryptocurrency analytics resource, CryptoQuant, reveals that this is the highest number of short positions being liquidated since October 2020.

- At the time of this writing, the total liquidations stand around $1.12 billion, where almost $1 billion of this comes from short positions.

- It also appears that this recent move has significantly improved the broader market sentiment, which is now in a state of fear, whereas yesterday it was in a state of extreme fear.

The post Bears Rekt: $1 Billion Shorts Liquidated in a Day, Most Since October 2020 appeared first on CryptoPotato.