Bearish Weekend Watch: Bitcoin Dumps Below $40K, Ethereum Beneath $3K

The adverse price developments continued in the past 24 hours, and bitcoin dropped below $40,000 for the second time this week. The alternative coins are also well in the red, at least most of them, but ApeCoin has defied the market sentiment and soared by double-digits.

Bitcoin Lost $40K

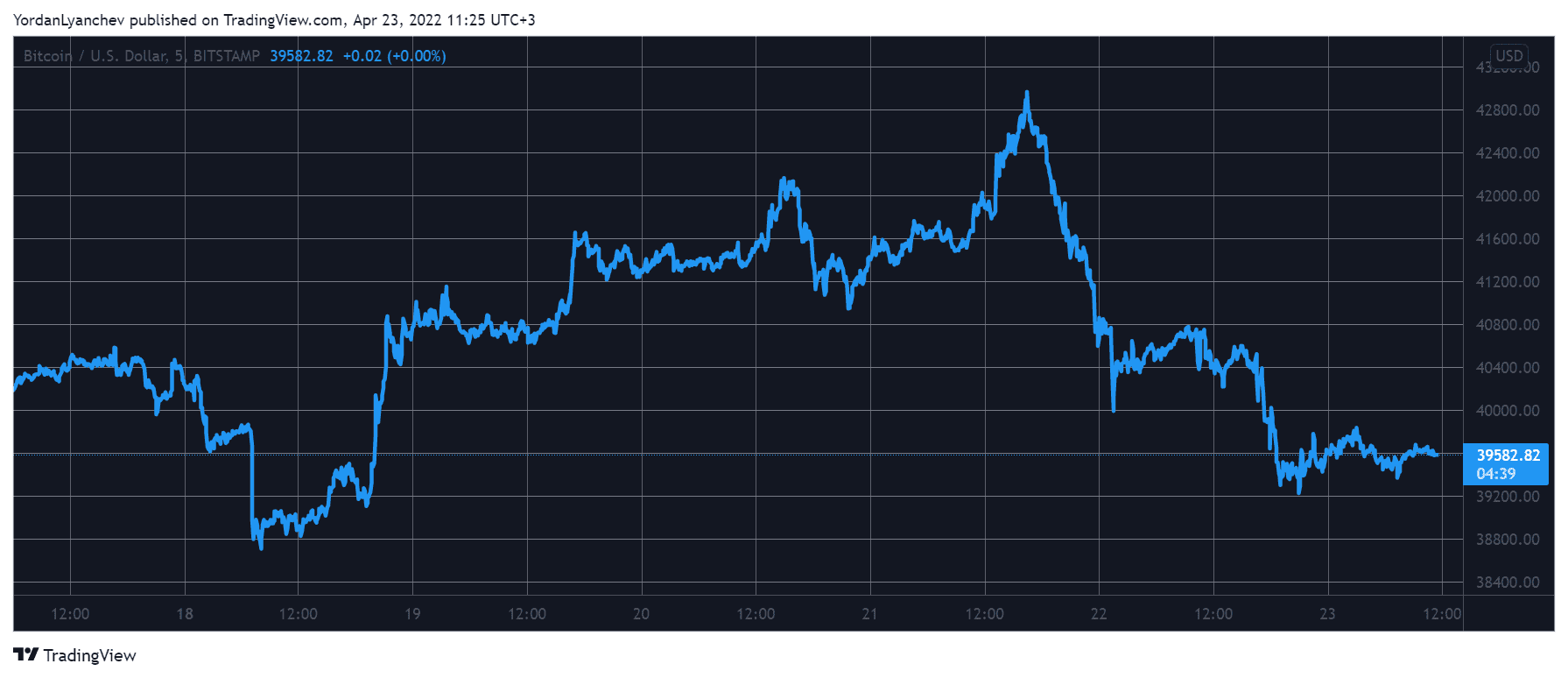

It was just a few days ago when the primary cryptocurrency spiked to almost $43,000, which became its highest price level in over ten days. This was a particularly impressive price tag because earlier this week, the asset had fallen to a monthly low beneath $39,000.

However, BTC was violently rejected at its local peak and reversed its trajectory almost immediately. In a matter of hours, the asset found itself dropping to $40,000, where it stood for most of the day.

The landscape worsened in the following hours, and bitcoin slumped below the coveted level and dumped to around $39,000. As of now, it has recovered a few hundred dollars, but it’s still beneath $40,000.

Consequently, bitcoin’s market capitalization has taken another hit and is down to $750 billion after briefly exceeding $800 billion earlier this week.

ETH Below $3K, ApeCoin Soars

The altcoins’ recent performance has resembled BTC’s to a large extent, meaning that most are covered in red on a daily scale.

Ethereum marked a multi-day high of its own at $3,200 on Wednesday/Thursday but failed to continue upwards. Yesterday, it dropped to $3,000 and now has dived below that level.

Binance Coin has managed to remain above $400 even though BNB is about 1.5% down on the day.

Ripple, Solana, Terra, Cardano, Avalanche, Dogecoin, and Shiba Inu are also in the red from the larger-cap alts. Even more losses are evident from Decred (-13%), Theta Network (-11%), Covex Finance (-10%), THORChain (-8%), Polygon (-6%), and Secret (-6%).

ApeCoin is among the few massive gainers. BAYC’s native token has surged by 17% on a daily scale and is close to its ATH.

Nevertheless, the cumulative market cap of all crypto assets is down by about $50 billion again.