Basic Attention Token (BAT) Price Analysis: Path To Recover Following Bounce At $0.20?

Looks like that Basic Attention Token (BAT) has started the rebound higher after bouncing at the $0.20 support level earlier in the month to rise to where it currently trades at around $0.2382. The cryptocurrency had started to ascend during February and April this year until it reached a peak of $0.46 and got rejected.

BAT has since struggled after reversing and has recently broken beneath a long term symmetrical triangle. However, there are some bullish signs against BTC for a possible reversal.

The cryptocurrency is ranked in the 35th position amongst the top crypto projects as it holds a $303 million market cap value.

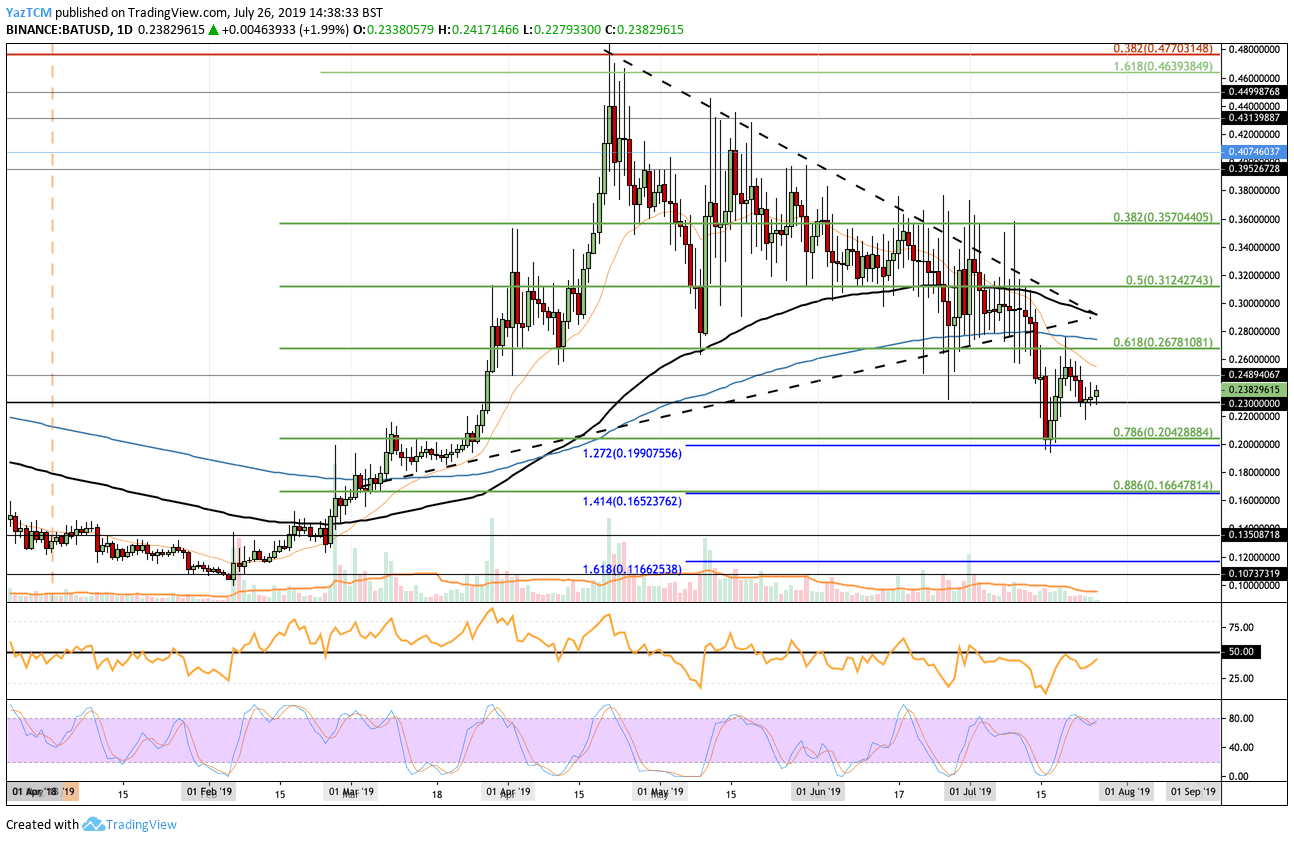

Looking at the BAT/USD 1-Day Chart:

- Against the US Dollar, we can see BAT breaking beneath the long term symmetrical triangle, as of this month, and consequently dropping beneath the 200-days EMA as well. BAT plunged through the triangle and continue to drop until finding support at the $0.204 level provided by the short term 0.786 Fibonacci Retracement. We can see that BATUSD rebounded higher at this support as it makes its way back toward $0.25.

- From above: The nearest level of resistance lies at $0.25. Above this, higher resistance lies at $0.2678, $0.30, $0.3125, and $0.35.

- From below: The nearest level of support lies at the $0.21 level. Beneath this, the next levels of support are located at $0.2050, $0.20, and $0.19. Further support can be found at $0.166, provided by the 0.886 Fibonacci Retracement level.

- The trading volume has decreased since the bull-run of April and remains at an average level.

- The RSI is currently involved with a battle at the 50 level as the bulls attempt to gain control over the market momentum. However, the Stochastic RSI is close to overbought conditions with a crossover below suggesting a potential short term drop.

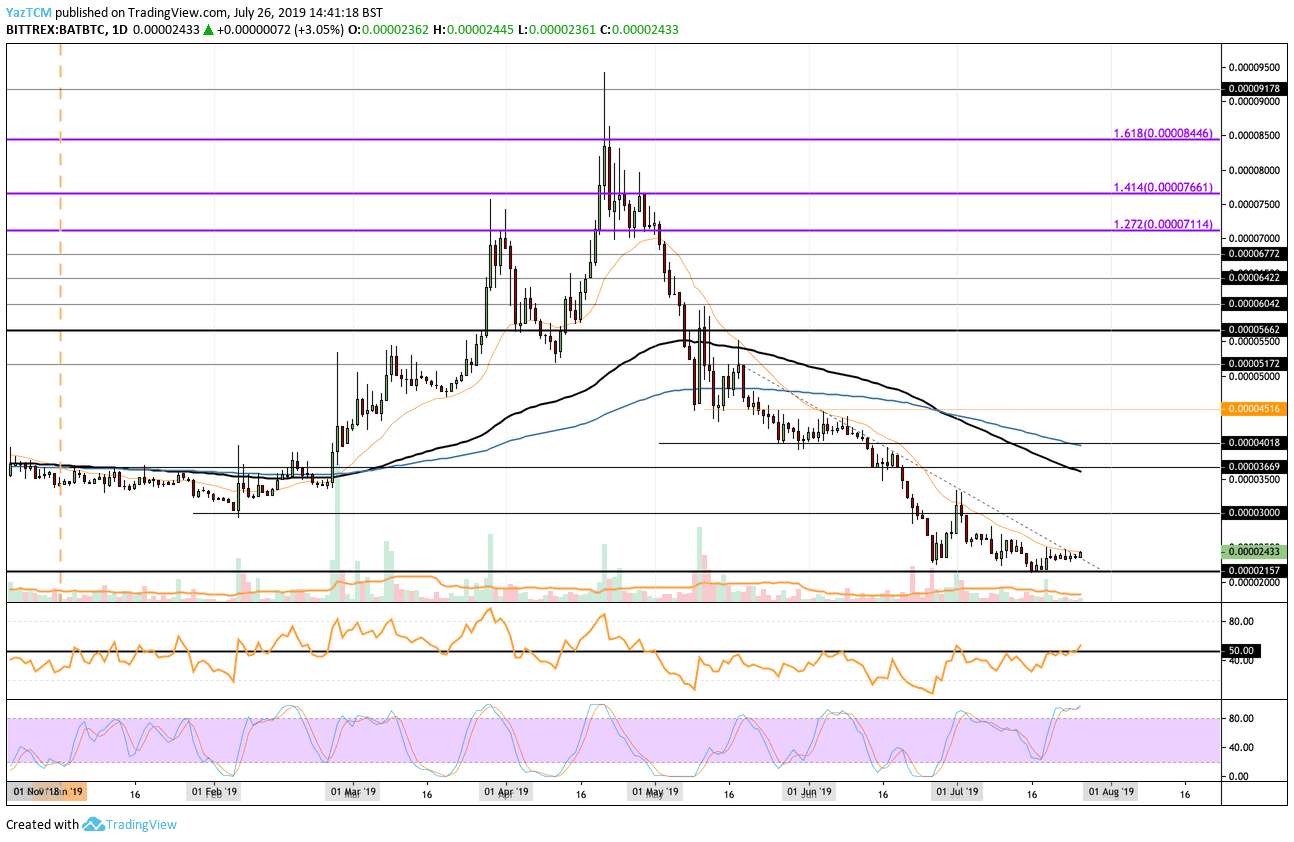

Looking at the BAT/BTC 1-Day Chart:

- Against Bitcoin, we can see that BAT has been tumbling since peaking at around 8500 SAT in April 2019. We can see that the market continued to drop much further lower until meeting the support level around 2150 SAT where a bounce was experienced. BAT/BTC is trading around 2433 SAT (as of now) and has recently attempted to break above a 3-month-old descending trend line.

- From above: The nearest level of strong resistance above 2500 SAT lies at 3000 SAT. Higher resistance is then found at 3500 SAT (which contains the 100 days EMA) and 4000 SAT (contains 200 days EMA). IF the bills continue above 4000 SAT, higher resistance lies at 4500 SAT and 5000 SAT.

- From below: The nearest level of support lies at 2400 SAT. Beneath this, lower support is expected at 2150 SAT and 2000 SAT. If the market does drop below 2000 SAT, more support is found at 1830 SAT, 1560 SAT and 1200 SAT.

- The trading volume remains lackluster at the average level.

- The RSI has recently been successful in breaking above the 50 level, which shows that the bulls have started to take control of the market momentum. If it can continue to rise higher, we can expect BATBTC to climb back toward 4000 SAT.

The post Basic Attention Token (BAT) Price Analysis: Path To Recover Following Bounce At $0.20? appeared first on CryptoPotato.