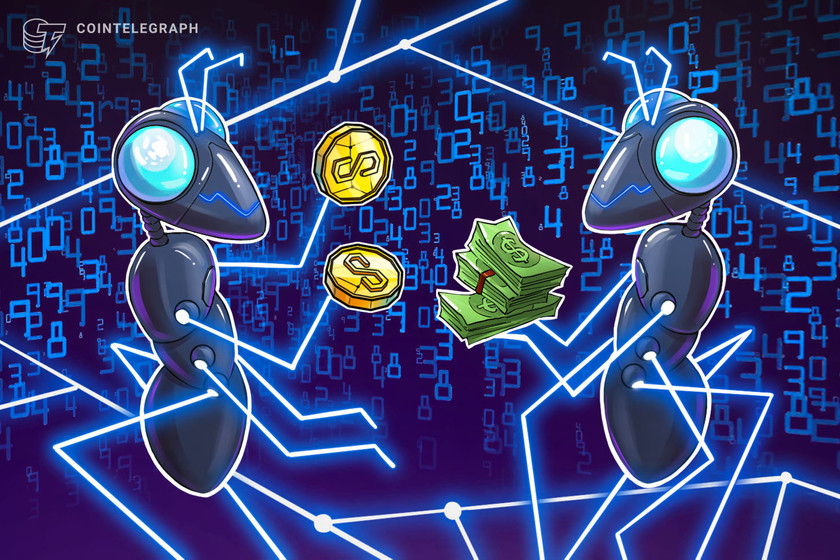

Bank of Spain selects partners for CBDC testing

Cecabank, Abanca and Adhara Blockchain have been chosen from the 24 applications received over the past year.

5484 Total views

17 Total shares

Spain’s central bank, Banco de España, has chosen its collaborators a year after publishing an open call for partners to participate in central bank digital currency (CBDC) tests.

On Jan. 3, the central bank published a resolution announcing its partnership with Cecabank, Abanca, and Adhara Blockchain.

The pilot of the wholesale CBDC will take place in the next six months and will feature the simulation of the processing and settlement of interbank payments with a single tokenized wholesale CBDC and by exchanging several wholesale CBDCs issued by different central banks.

In another part of the experiment conducted with the help of the Cecabank-Abanca consortium, the wholesale CBDC will be used to settle a simulated tokenized bond.

Related: Nigeria’s central bank greenlights cNGN stablecoin to launch in February

Three companies were chosen from the 24 applications the central bank has received over the past year. While both Cecabank and Abanca are Spanish, the headquarters of Adhara Blockchain is in the United Kingdom.

The Spanish CBDC program is unique, as it was publicly stated to be independent of the digital euro project that would cover all economies in the eurozone if implemented. Meanwhile, the Spanish Ministry of Economic Affairs and Digital Transformation announced it would implement the European Union’s Markets in Crypto-Assets Regulation six months before the deadline.

In October, the Bank of Spain published a text explaining the nature and uses of the digital euro.

Spaniards themselves haven’t expressed a significant interest in using the digital euro. In a survey in October, 65% of respondents said that they would not use the pan-European CBDC to complement their regular payment methods.

Magazine: Which gaming guild positioned itself best for the bull market?