Baby Steps or Handcuffs? Crypto Pros Assess PayPal’s Bitcoin Play

Baby Steps or Handcuffs? Crypto Pros Assess PayPal’s Bitcoin Play

Call it Crypto Lite – for now.

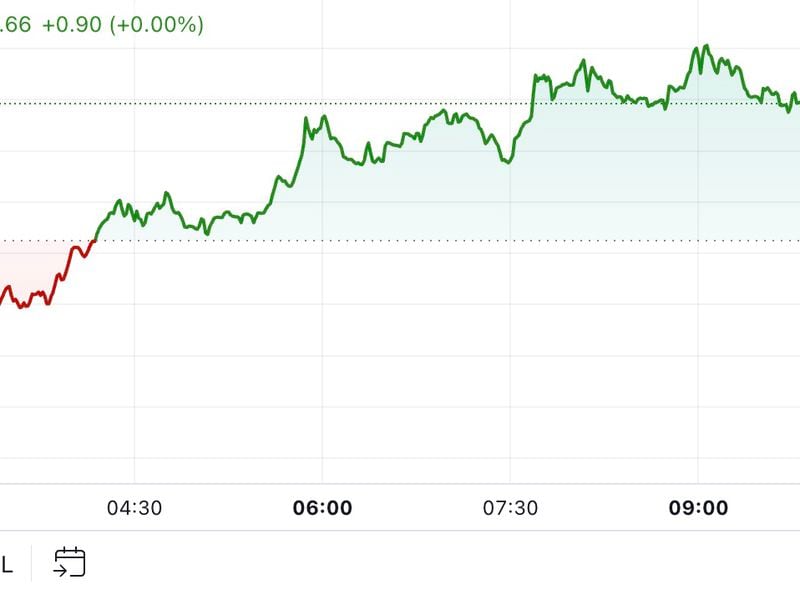

Fintech giant PayPal confirmed its long-awaited move into digital assets Wednesday, offering its 346 million users the chance to buy, hold and sell bitcoin, bitcoin cash, ether and litecoin, with the blessing of New York state regulators.

While the cryptosphere acknowledges the bullishness of a firm the size of PayPal making a move into the space, there was also concern that the new service does not allow bitcoin or other cryptocurrencies to be withdrawn or deposited. Once you buy the coins, they stay in your account until you sell.

“Currently, you can only hold the cryptocurrencies that you buy on PayPal in your account. Additionally, the crypto in your account cannot be transferred to other accounts on or off Paypal,” states the PayPal FAQ page published with Wednesday’s announcement.

Self-custody and moving your coins around is what crypto is all about though, right?

The view from some informed takes is that while PayPal did not need to impose such restrictions, it’s probably a case of taking things by degree; a “crawl before you can walk” approach.

As such, the current setup is being compared to Robinhood – which also offers crypto but in a confined space – but hopefully moving in the direction of Square – which started the same, but now allows limited withdrawals to non-custodial wallets.

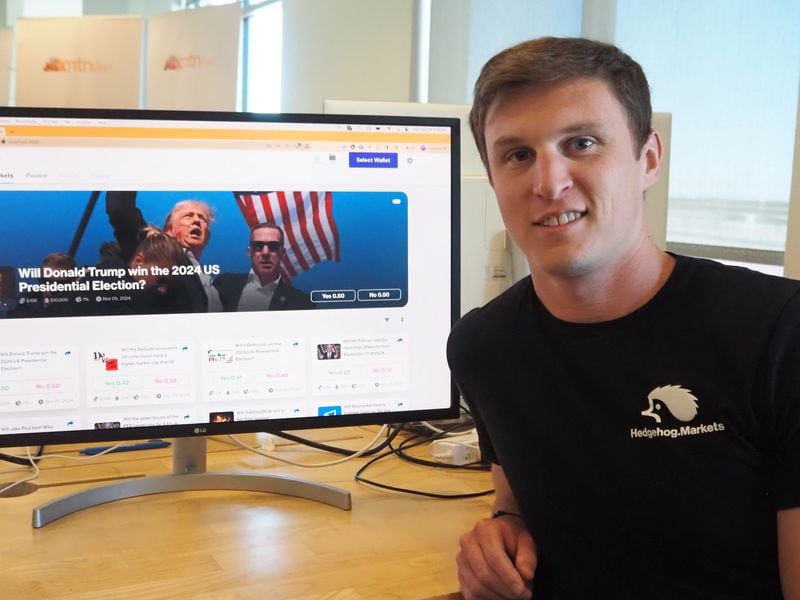

The lack of withdrawals to self-custody and inability to transfer between accounts constituted “the highlight of the PayPal news” for Jake Chervinsky, general counsel of DeFi platform Compound, who added that such restrictions aren’t required for regulatory compliance. (Chervinsky did not immediately respond to a request for further comment.)

However, it may well be the case that PayPal is simply setting out to cater to what it perceives to be the needs of the average user, pointed out Jerry Brito, executive director of Coin Center, a Washington, D.C.-based think tank.

“Simply allowing people the ability to buy and hold and sell back crypto I imagine is something they studied,” Brito said in an interview. “It may simply be that’s what most people want to do with cryptocurrency at the moment, and the demand to move it around and transact is not as high. And if that’s the case, it’s much easier from a regulatory perspective and from a user support perspective, to simply allow that option without having the ability to transact.”

Providing the most obvious route for people to have exposure to the asset class without necessarily getting into the more complex issues of running private keys and understanding cryptography and digital signatures is possibly what PayPal is thinking, said Charles Hayter, CEO and co-founder of data site CryptoCompare.

“Yes, if you’re a pure libertarian, it’s not ideal. But being pragmatic about bitcoin’s trajectory and global adoption penetration rate, this certainly brings more options,” Hayter told CoinDesk.

PayPal plays it safe

Brito of Coin Center agreed that to be compliant with regulations, PayPal did not perhaps need to wall its garden in, but pointed to gray areas like the Financial Action Task Force’s Travel Rule and other areas of anti-money laundering (AML) enforcement, which come into play when transferring crypto in a regulated environment.

“It’s certainly the case that it’s a much bigger hurdle to allow for sending [crypto] than not,” Brito said. “So, sort of top of the list would be the Travel Rule. People are finally developing solutions to comply with that but they are not there yet. This will be a relatively small part of PayPal’s business so the easiest thing to do is not engage in transfer and take on that compliance risk.”

Stephen Palley, a partner at the Anderson Kill law firm, said the functionality of the PayPal crypto announcement is not important compared to what it says about crypto, the asset class.

“They’re going to be cautious, and they’re going to roll it out slowly,” Palley told CoinDesk, adding:

“My takeaway is that the importance is not the functionality. The importance is from the normalization of the asset class. If PayPal is saying you can somehow use this via our platform, however it works, that takes it one step away from the notion that this is just for criminals.”

PayPal did not return requests for comment.