Australia tries again to combat ‘future sectors’ crypto scams

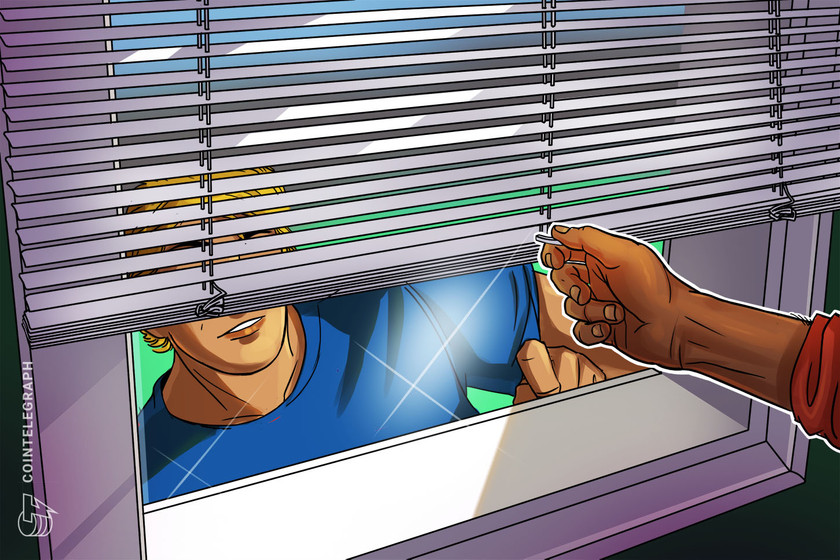

The “Proposed Scams Code Framework” consultation paper aims to delegate clear roles and responsibilities to government and private entities when combatting scams.

153 Total views

9 Total shares

A consultation paper on a new framework for addressing consumer and business scams proposed by Australia’s Department of the Treasury considers applying sector-specific codes and standards to banking and cryptocurrency scams, among others.

Adding to the efforts of the Australian Competition and Consumer Commission (ACCC), a regulator within the Treasury, to combat scams via the yearly Scams Awareness Week initiative, the Treasury issued a consultation paper. The paper revealed Australia’s plan to assign mandatory industry codes to each different type of scams.

The “Proposed Scams Code Framework” consultation paper — announced on Nov. 30 by Assistant Treasurer, Stephen Jones, and the Minister for Communications, Michelle Rowland — aims to delegate clear roles and responsibilities to government and private entities when combatting scams. “This includes ensuring that key sectors in the scams ecosystem have measures in place to prevent, detect, disrupt, and respond to scams, including sharing scam intelligence across and between sectors,” the Treasury clarified.

The framework proposes three broad categories for assigning codes and standards, covering what they see as the areas most targeted by scammers — banks, telecommunications providers and digital communications platforms. It also mentions a ‘future sectors’ category, which would tackle cryptocurrencies, nonfungible tokens (NFT) and related trading platforms and marketplaces.

Related: Australian Treasury proposes to regulate crypto exchanges, not tokens

The Treasury highlighted that Australian consumers and businesses lost at least $3.1 billion to scams in 2022, an 80% increase from 2021. While the Australian government recently introduced several initiatives to address scams, the existing disparate attempts have proved ineffective in preventing scams.

The new mandatory industry codes will outline the responsibilities of the private sector concerning scam activity. Currently, the National Anti-Scam Centre (NASC) led by the ACCC, the Australian Securities and Investments Commission (ASIC), the Australian Communications and Media Authority (ACMA), and specialist support services are working together to combat scams in Australia.

The Treasury will collect comments on the consultation until Jan. 29, 2024.

Magazine: Outrage that ChatGPT won’t say slurs, Q* ‘breaks encryption’, 99% fake web: AI Eye