Asset DNA: Explaining Bitcoin’s Speculative Attack On The Dollar

Performance Of Various Asset Types Over Time

Not all assets are created equal. Some appreciate in value, some lose value over time. This is obvious with things we consume, like the groceries we eat or the clothes we wear. But the same is true of assets that don’t visibly deplete but nevertheless lose value over time through wear and tear, like a car accumulating miles or a building without active maintenance.

Less obvious is how assets that are not depleted by consumption or depreciated through use also vary in their performance over time. Traditionally scarce assets like gold or land do a good job of maintaining their value and growing in relatively fixed proportions to the global economy. Ownership shares in successful companies typically generate additional yield by putting scarce capital to work.

Ultimately, it’s about the DNA of the asset: its inherent properties dictate how the value of the asset will trend over time. If we put all of these different asset types into one image that characterizes their respective natures, it would look something like this:

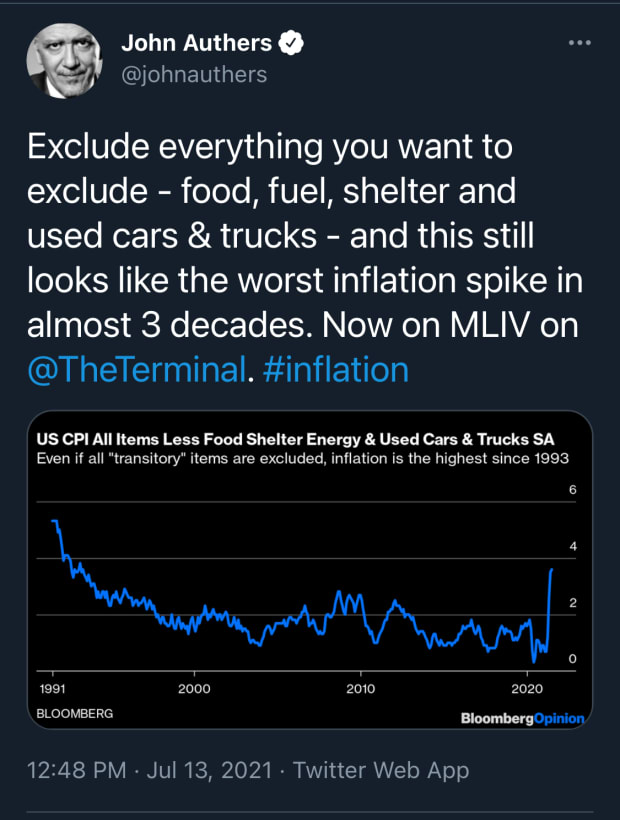

Fiat Currency: Decay By Design

This high-level image is missing something: modern currencies. Gold was currency until not too long ago, only losing its link to paper currencies in 1971. Since 1971, we have been in a truly anomalous era of human history — a 50-year departure from the 75,000 years of documented use of hard money. For the first time ever, we are engaged in a monetary experiment where money is fiat currency, currency by decree alone — no asset-backing whatsoever.

Of greatest relevance to our focus, however, is the guiding principle at the heart of fiat currency: decay by design. Central bankers and governments believe it is best for the economy that you spend or invest your money, rather than store your earnings as savings, and they have designed the currency to lose 2 percent of its value per year in order to impose that assumption.

As Paul Tudor Jones phrased it, “If you own cash in the world today, you know your central bank has an avowed goal of depreciating its value 2 percent per year.” Quite simply, this math means that the dollar’s value is designed to exponentially decay over time as a result of monetary inflation:

If we take this exponential decay trend and fit it into our logarithmic view of the various asset classes, we get something like this:

Bitcoin: The Only Thing They’re Making Less Of

The newest entrant into the set of global money competitors is bitcoin. Bitcoin’s performance over time is not linked with either global economic production or with a policy goal of losing 2 percent of value every year.

Instead, bitcoin’s performance is linked to increasing scarcity, which is to say that its design is predicated on a simple mathematical concept of decreasing issuance over time. To borrow the common simplification of what gives land its value (“it’s the only thing they’re not making any more of”), we can say about bitcoin: “It’s the only thing they’re making less and less of.”

You might think that it’s better to own something that they’re not making any more of, rather than something that they’re making less and less of. And indeed, it would not be inaccurate to say that land is a larger store-of-value asset than bitcoin today because they are making less of it than they are of bitcoin. But, what matters more to individuals than what is the largest asset today, is how the assets they hold will perform over time — to borrow Tudor Jones’ words again, an investor’s goal is to be on the fastest horse.

When a great painter dies, the value of their existing work tends to shoot upwards. Why? Because investors are guaranteed that the painter will be producing less work. There will be no more newly-added supply at all. As such, all market demand must bid for existing supply, and everyone knows it, causing willingness to pay to increase for a slice of the newly scarce body of work.

At its core, this is the concrete economic advantage of bitcoin. No other asset in history has leveraged math to deliver a credible guarantee of steadily reducing supply into the future. The simple reality of this is that bitcoin’s design gives it the scarcity of gold today, with the added rocket fuel of increasing scarcity that a famous painter’s death lends to their life’s work. Except the supply shock happens every four years, so there’s even stronger incentive for holders to keep holding through each successive Halving.

In short, increasing scarcity causes bitcoin’s value to go up exponentially over time. When we view bitcoin’s price history in linear terms, the trend is so dramatic that it’s hard to make sense of:

By viewing this same data in logarithmic terms, and tracking how price seems to jump upwards following each Bitcoin Halving event, Plan B was able to come up with his compelling stock-to-flow model. This model suggests that the Halvings themselves (and the increase in scarcity that they cause by definition) are at the heart of Bitcoin’s exponential rise to date, and ostensibly into the future:

When we reduce the red line above into a simplified version for our big picture of asset types, we get something like this:

Speculative Attack: Harnessing Currencies’ Diverging Nature

The two types of modern currencies we’ve now looked at have very different DNA. The first, fiat currency, is designed to exponentially decay in purchasing power over time. The second, bitcoin, is designed to exponentially appreciate in purchasing power over time.

This ultra-simplified representation of the nature of the U.S. dollar and bitcoin also contains the implications of a world-changing economic reality.

In 2014, Pierre Rochard penned “Speculative Attack”, in which he outlined how the diverging nature of the value of dollars and the value of bitcoin over time creates fertile ground for bold individuals to borrow dollars in order to buy bitcoin, and repay that debt in the future:

Importantly, this is not a recommendation or a guarantee that the mechanics above will play out accordingly. However, if the logic in the earlier sections of this piece is sound and the economic realities that underpin bitcoin and the dollar deterministically set them on diverging paths into the future, the option is there.

Indeed, that’s what MicroStrategy has already acted on. In December 2020, having already deployed the public company’s entire treasury into bitcoin, MicroStrategy issued $650 million in convertible debt in order to purchase more bitcoin. In an environment with dramatic dollar printing and investors desperate for any kind of yield, the terms of the deal were attractive to lenders and MicroStrategy quickly secured the debt and deployed the funds, buying 29,646 Bitcoin at an average price of $21,925 per bitcoin. One month later, MicroStrategy is up more than 50 percent on its “speculative attack.”

If the mechanics described here are accurate, more individuals and entities will leverage the opportunity contained therein — not as a gamble, but as an informed strategic move to leverage the fundamentally different designs of the two currencies.

The entire world faces a massive economic incentive to borrow dollars, buy bitcoin and settle the debt when a sufficient amount of time has passed that the value of the bitcoin holdings and borrowed dollars have meaningfully diverged. Acting on this comes with considerable risk, and requires that an individual or entity is prepared to service the debt they take on, either for the years before the purchasing power divergence manifests, or in the event of unexpected total disaster (e.g., losing keys). That said, if the representation of reality in this article is correct, the highest and best use of a dollar of debt may simply be to buy bitcoin. Any more individuals and entities will leverage this asymmetry for personal gain into the future.

The logical conclusion of this trend is that eventually, nobody will be willing to lend dollars when they can just buy bitcoin with those dollars themselves. And once the world has reached that level of understanding of bitcoin, it’s game over — fiat currencies simply cannot withstand the economic reality that bitcoin imposes upon them.

Bitcoin will continue appreciating while fiat currencies will continue decaying. It’s in their DNA.

This is a guest post by Croesus. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post Asset DNA: Explaining Bitcoin’s Speculative Attack On The Dollar appeared first on Bitcoin Magazine.