Metaplanet, a Japanese public company that started as a hotel operator, announced it purchased another ¥400 million ($2.5 million) in Bitcoin. This continues the firm’s strategy of adopting Bitcoin as a treasury reserve asset.

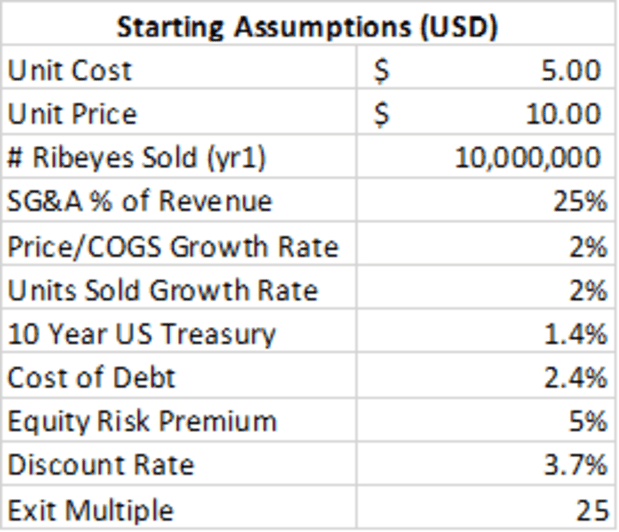

Despite the slumping Bitcoin market, Metaplanet revealed it acquired 42.466 more Bitcoin on July 8th. This brings its total holdings to around 203 Bitcoin purchased for ¥2.05 billion ($12.7 million) — an average price of ¥10 million ($62,000) per coin.

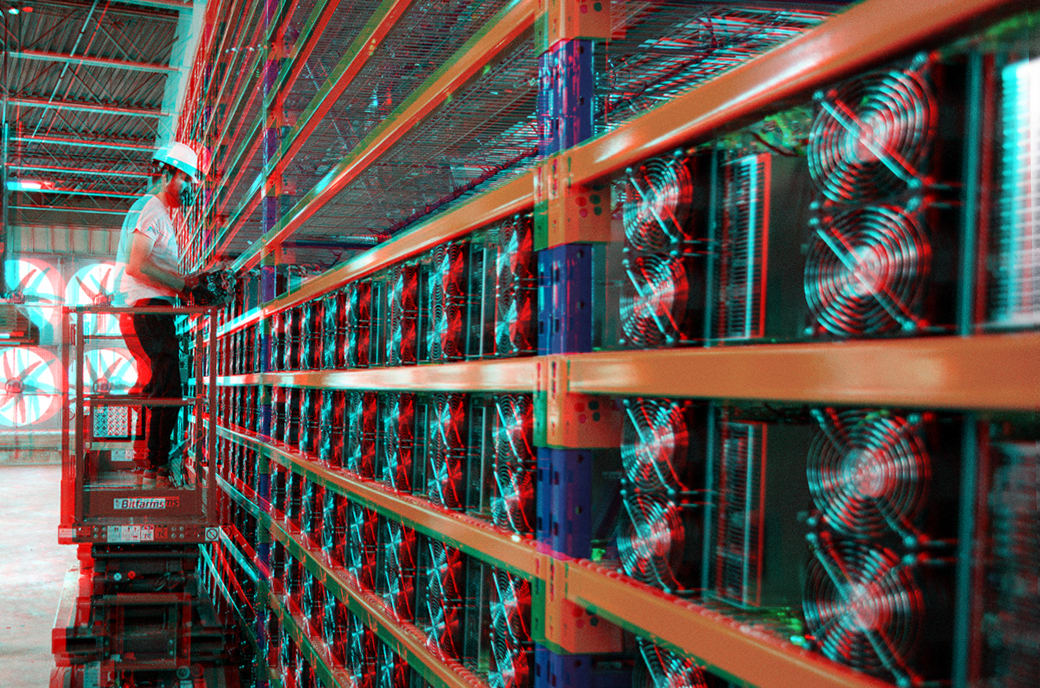

Metaplanet is mimicking MicroStrategy, the U.S. software firm’s Bitcoin accumulation strategy. Since 2020, MicroStrategy has amassed over 200,000 Bitcoin, now worth $15 billion, making it the largest corporate holder.

Its stock price has often mirrored Bitcoin’s fluctuations, with investors using it as a proxy for Bitcoin exposure.

The Japanese company said buying Bitcoin helps minimize exposure to the weakening yen amid prolonged low interest rates. This approach also provides domestic investors Bitcoin access through a public firm with preferable tax treatment.

The yen has tumbled dramatically in 2022, dropping to lows against the dollar and euro not seen in decades. The Bank of Japan has maintained a loose monetary policy in contrast to global tightening.

While amounts remain small so far, its continued purchases show commitment even amid market turmoil. As “Asia’s MicroStrategy,” Metaplanet is positioning itself to ride future waves in Bitcoin adoption.

Disclaimer: Bitcoin Magazine is wholly owned by BTC Inc., which operates UTXO Management, a regulated capital allocator focused on the digital assets industry. UTXO invests in a variety of Bitcoin businesses, and maintains significant holdings in digital assets.