Asian Markets Driving Bitcoin To $8,000 And Beyond?

Bitcoins latest run to $8,000 has been fueled by growing interest amongst institutional funds like Blackrock, and speculation about a Bitcoin ETF proposal currently being deliberated by the SEC.

Both of these indicators would seem to point to the US markets pushing Bitcoins price up to the $8,000 level. Yet recent reports show that the Asian markets are actually responsible for the bulk of Bitcoins recent trading volume.

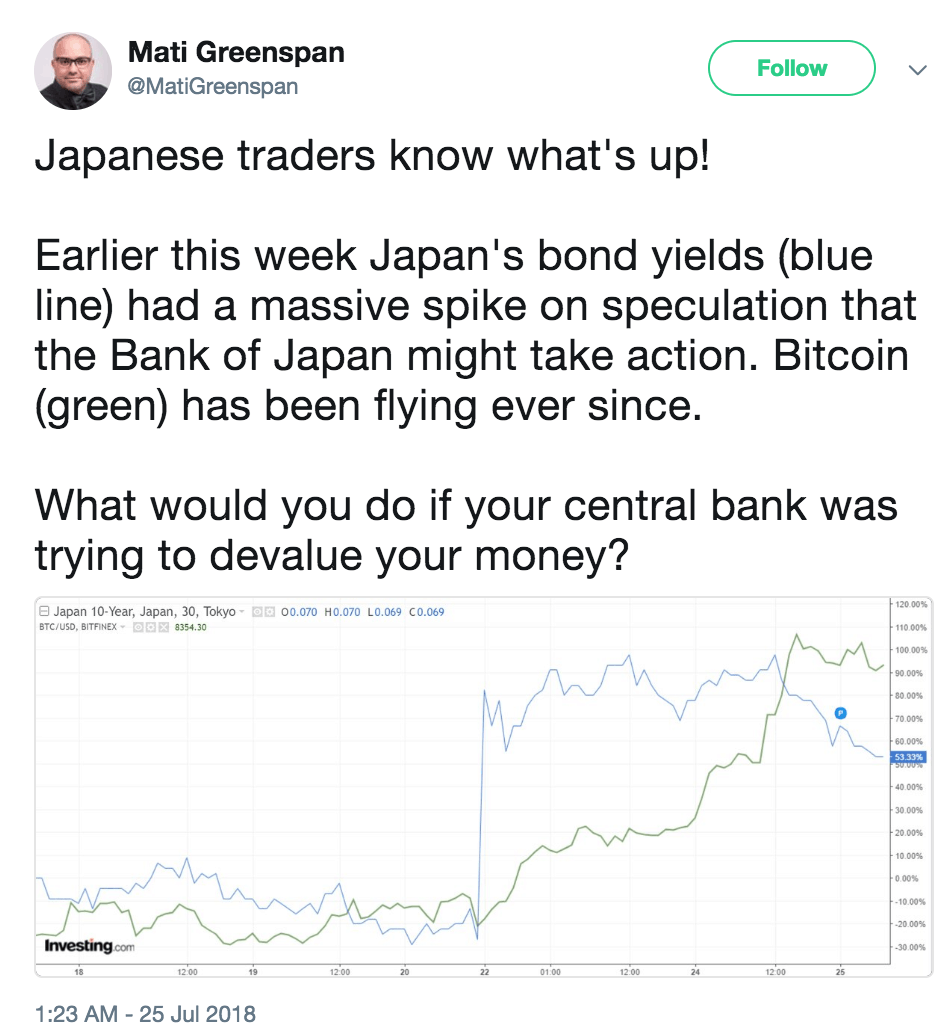

EToro senior analyst Mati Greenspan shared his thoughts on Twitter, stating that:

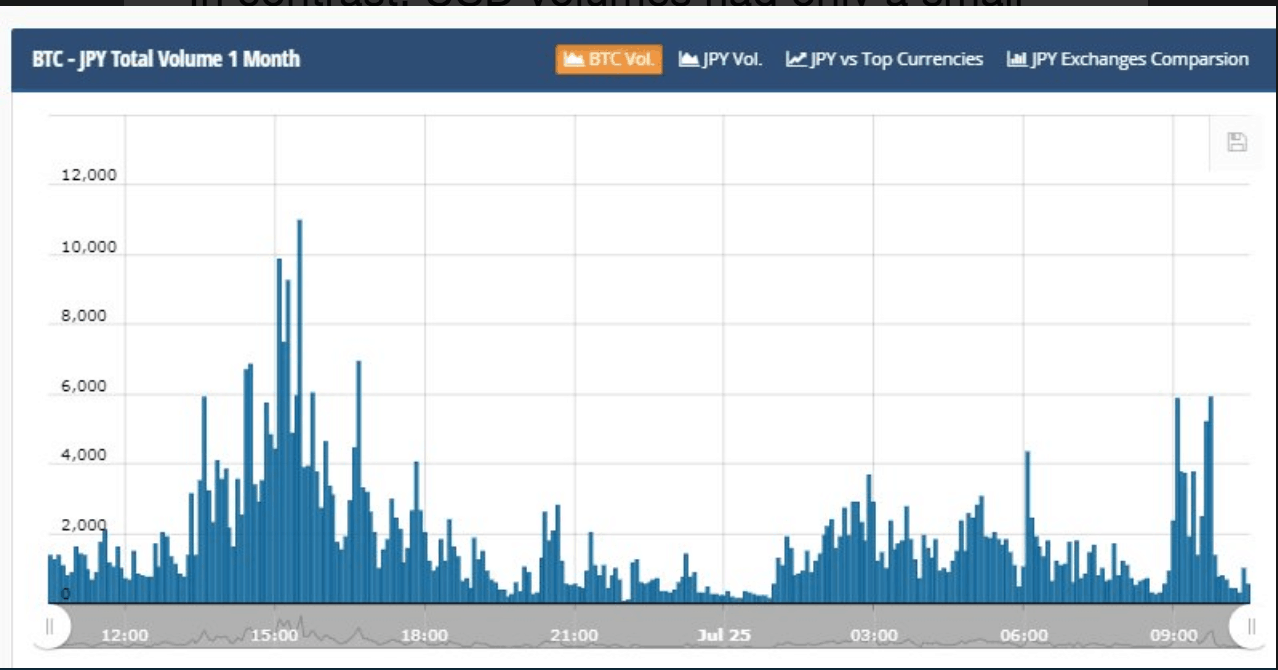

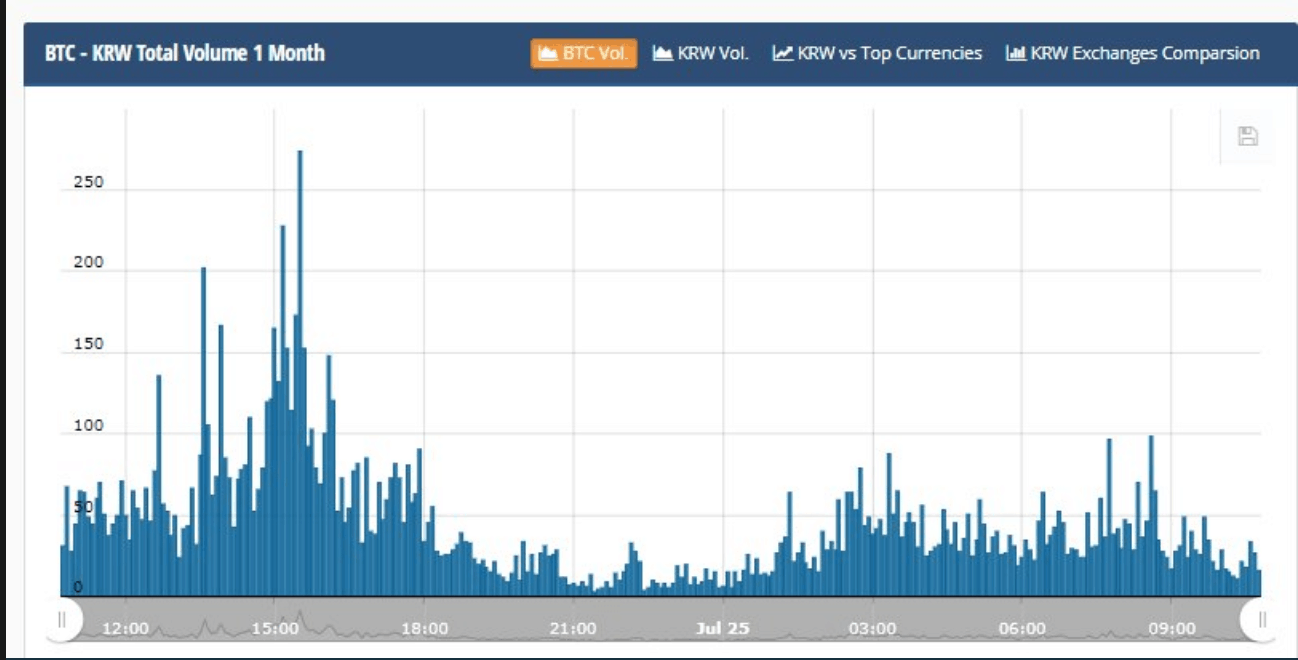

The surge above $8,000 was definitely led by East Asia. Take a look at bitcoin volumes in Japanese Yen and Korean Won at the time of the surge (13:30 – 15:00 on the chart).

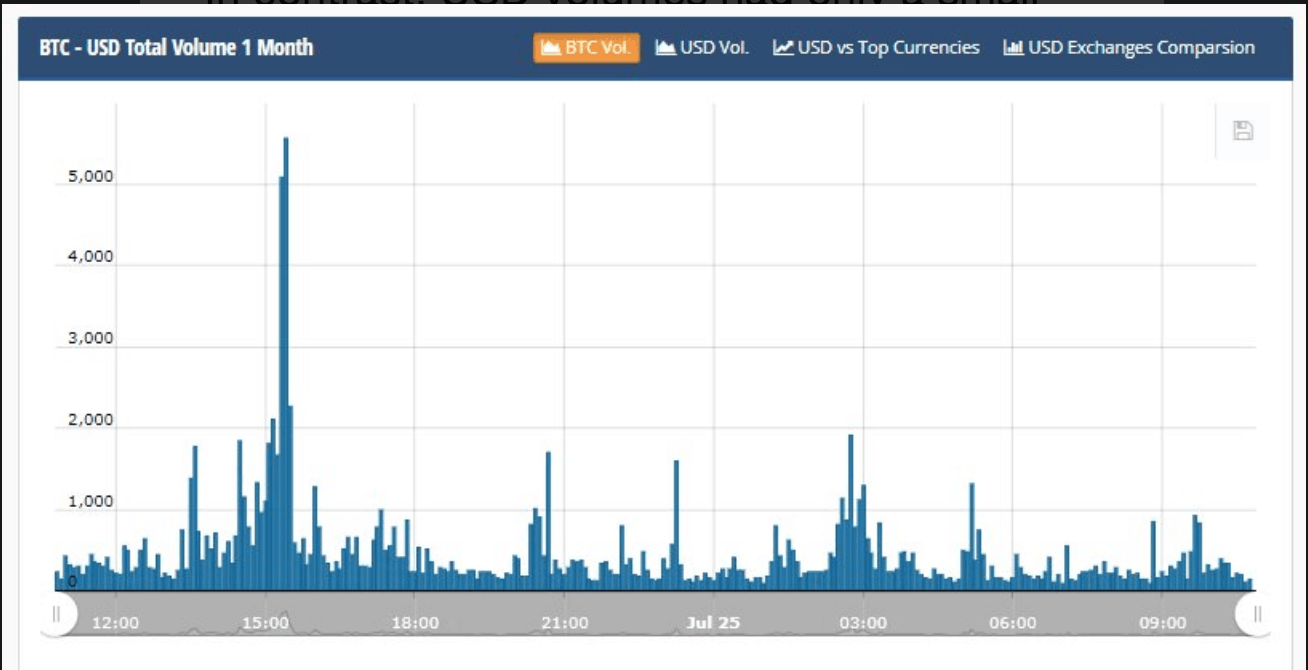

In contrast, USD volumes had only a small spike and USDT (tether) remained constant through the movement. pic.twitter.com/fHdD8gRTTL

— Mati Greenspan (@MatiGreenspan) July 25, 2018

The first graph shows the Bitcoin/JPY trading volumes are at about 11,000.

Likewise the Korean markets experienced their own spike followed by a steady wave of volume trading in early July 23rd.

The BTC/USD trading volume only experienced a small spike, followed by mediocre trading volume.

Japanese Government devalues Yen

The Japanese Governments devaluing of the Yen may be the key reasons why Japan has experienced a recent surge in Bitcoin trading volume. As seen in countries like Venezuela and China, national currency devaluation usually leads to citizens transferring their money into other assets classes like Gold, Bonds or Bitcoin in order to retain or appreciate the valuation.

Korea and Japan have long been strong adopters of Bitcoin and blockchain technology. Both countries have seen Bitcoin adopted by retailers, tech companies (like Samsung) and even airlines. The Japanese Government has arguably gone the furthest in its adoption by officially recognizing Bitcoin as a legal currency.

This recognition would have likely led citizens to view Bitcoin as the ideal currency substitute during times when the Yen was struggling.

Conclusion

It remains to be seen how much higher Bitcoins price will ascend. However, what is clear is that despite the catalyst for the recent price surge being predominantly US-based events (ETF announcement and Blackrock exploring Bitcoin) the trading volume charts seem to indicate that the Asian markets are the most eager to take us into another crypto bull run.

The post Asian Markets Driving Bitcoin To $8,000 And Beyond? appeared first on CryptoPotato.