As the Bitcoin Price Falls Back to $41k, Could BTC ETF Token Be a Higher Potential Alternative?

Bitcoin (BTC) has fallen sharply in the past few days, dropping below $42,000 as investors begin to take profits.

This pullback brings Bitcoin back to the same level it was last Monday and has left analysts questioning if further declines are ahead.

As such, some traders have shifted their focus to Bitcoin ETF Token (BTCETF), which looks positioned as a high-potential alternative to the world’s largest cryptocurrency.

Bitcoin Plunges Lower as Leverage Unwinds & Technicals Turn Bearish

Bitcoin has dropped almost 8% from Friday’s high and is now hovering around the $41,210 level.

This sharp pullback occurred after a brief tap of $44,700, which marked Bitcoin’s highest value since April 2022.

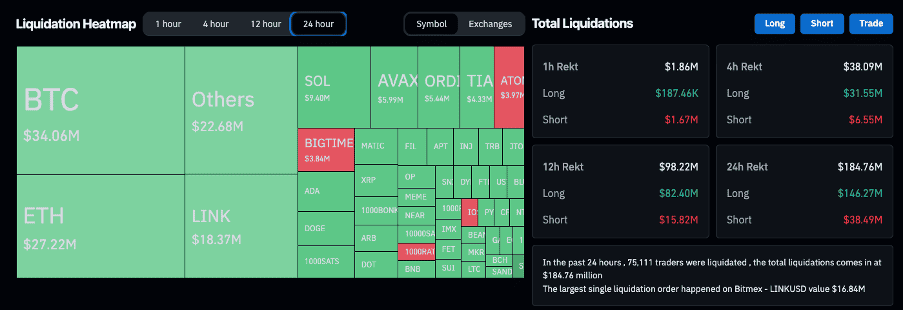

BTC’s pullback has led to a surge of long liquidations and selling pressure, with CoinGlass data showing more than $146 million in longs were liquidated over the past 24 hours.

On the technical side, BTC broke its 20-day exponential moving average (EMA) on the 4-hour time frame, hinting that the short-term trend may have flipped bearish.

Trading volumes have also dipped during the sell-off, falling 25% in the past day.

However, there is still reason to be optimistic for BTC holders, with the coin’s price forming a double-bottom pattern around $40,500 on the 4-hour chart.

This could mean Bitcoin is finding support at this level, potentially signaling an end to the downward momentum.

While the recent pullback has rattled the market, this double-bottom pattern hints that a potential rebound could be on the cards for BTC.

Increased Regulatory Oversight Weighs on Crypto Investor Sentiment

Beyond Bitcoin’s price action, the aggressive regulatory oversight of leading exchange Binance continues to worry crypto investors.

As part of Binance’s $4.3 billion settlement with US authorities, the Department of Justice unveiled extensive monitorship terms last week.

This grants authorities in-depth access to Binance’s operations and business dealings.

Naturally, this has sparked concerns that Binance’s ability to operate may be severely hampered.

Such invasive oversight of a massive player like Binance has rattled the broader crypto market, signaling that regulators are ramping up their enforcement activities.

This regulatory cloud, combined with the recent market turbulence, has created a sense of unease for many investors.

As a result, it may be contributing to traders’ willingness to sell Bitcoin on any sign of weakness – furthering the recent sell-off.

Bitcoin ETF Token Emerges as High-Potential Alternative to BTC & Raises $3.7m in Presale

As Bitcoin struggles amid technical and regulatory headwinds, some investors are looking toward alternatives that could offer higher growth potential.

One such option gaining increased enthusiasm is Bitcoin ETF Token (BTCETF), hosted on the Ethereum blockchain.

BTCETF aims to capitalize on the much-anticipated approval of a spot Bitcoin ETF, which would give mainstream investors easy exposure to BTC’s price action.

The BTCETF token incorporates deflationary elements to reward holders – every time a milestone in the approval process is reached, 5% of BTCETF’s supply is burned.

As outlined in the project’s whitepaper, 25% of the total supply of 2.1 billion will be burned through this mechanism.

Beyond just speculation on the ETF approval narrative, BTCETF also intends to offer investors real utility.

Once launched on DEXs following its presale, 10% of the total supply will be used to provide liquidity, while a 5% sell tax will be employed to burn additional tokens.

This ensures continued deflation, even outside of the ETF-related milestones.

The innovative tokenomics and the excitement around finally getting a spot BTC ETF have already helped Bitcoin ETF Token raise over $3.7 million in its presale so far.

Bitcoin ETF Token’s Twitter following has also exploded recently, surpassing 4,300 people as investors flock to learn more about the project.

Given that the SEC is expected to approve a spot BTC ETF in early 2024, Bitcoin ETF Token presents a unique opportunity to gain exposure to the buzz – with many early backers believing it represents a higher potential alternative to Bitcoin.

Visit BTC ETF Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

The project in the above article is not related to Bitcoin or to a Bitcoin ETF. It’s a completely different token.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post As the Bitcoin Price Falls Back to $41k, Could BTC ETF Token Be a Higher Potential Alternative? appeared first on CryptoPotato.