As New Week Starts, Bitcoin Price Is About To Take a Critical Decision (BTC Analysis & Overview)

The last days saw Bitcoin trading under a tight range of $300, between $7300 and $7600.

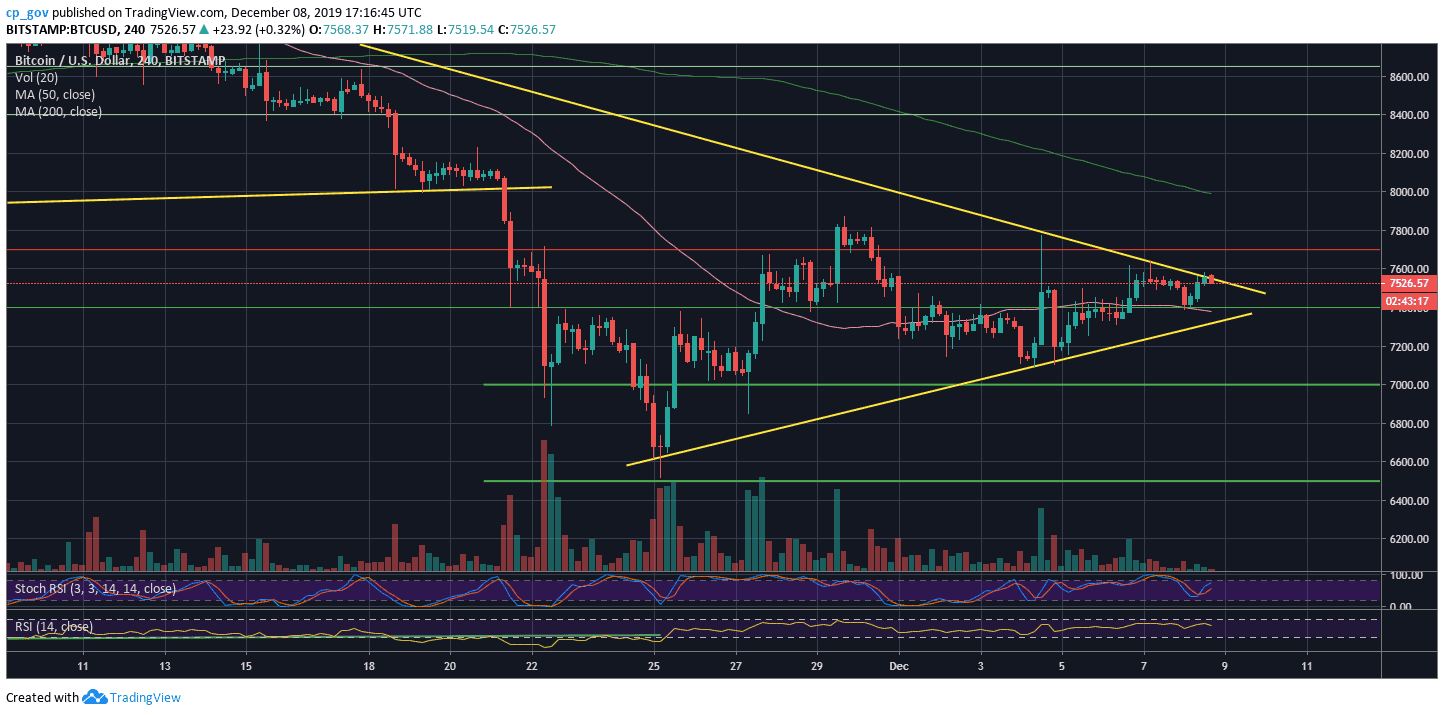

The good news is that Bitcoin is finally trading above the confluence zone of $7300 – $7400, along with the 4-hour MA-50, which was mentioned here more than once.

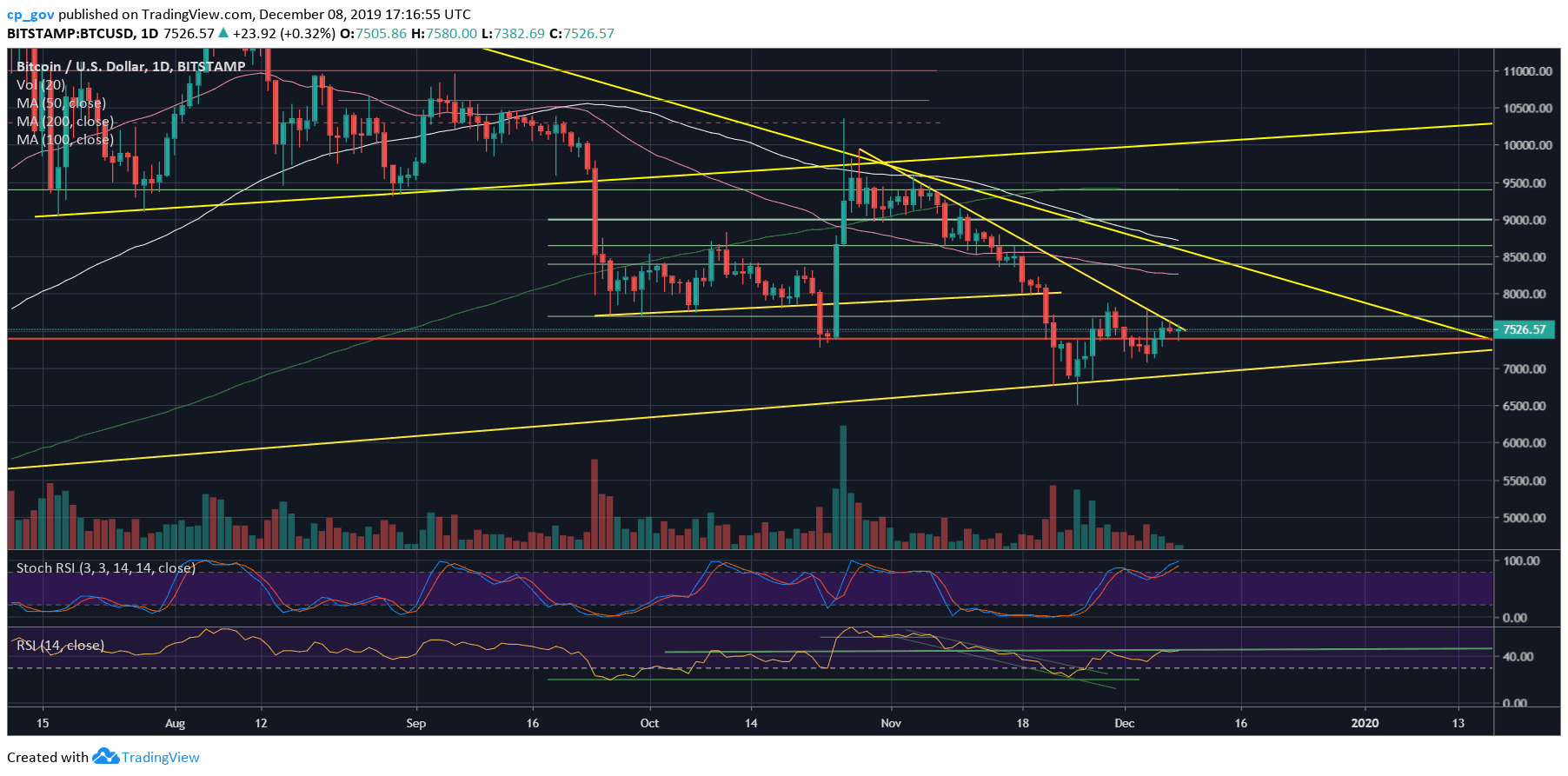

Besides, the RSI is showing strength due to the negative divergence shown on both the following charts.

However, Bitcoin is now facing a critical decision as the coin reaching a mid-term descending trend-line. This can be seen on both the following 4-hour and the 1-day charts. The decision is also reflected on the daily RSI, which is facing the critical 45-resistance resistance line.

For almost a month, Bitcoin 1-day’s RSI couldn’t breach the 45 levels. As the weekend ends, and a new week starts, we can expect a volatile Monday ahead of us.

Total Market Cap: $205 billion

Bitcoin Market Cap: $136.8 billion

BTC Dominance Index: 66.7%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: As mentioned above, Bitcoin is now facing the descending trend-line resistance. The next level is the $7700 – $7800 horizontal resistance. If Bitcoin can make it, further above lies $8000 and $8300.

From below, the first support is the 4-hour’s MA-50 line, marked by a pink line, along with horizontal support of $7300 – $7400, and an ascending trend-line on the 4-hour chart. Further below is the $7000 support, $6800, and the 6-month low around $6500.

– The RSI Indicator: As discussed above.

– Trading volume: Bitcoin had seen four consecutive days of a declining trading volume. This is another sign of a coming-up price move in the short-term.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

The post As New Week Starts, Bitcoin Price Is About To Take a Critical Decision (BTC Analysis & Overview) appeared first on CryptoPotato.