As Interest Seemingly Fades, Will Bitcoin Hold $10,000? Weekly Crypto Market Update

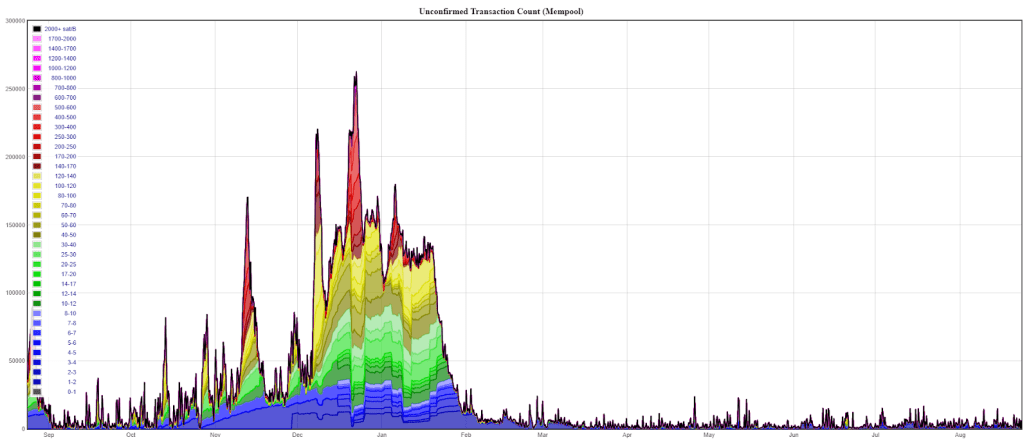

Amid the global trade war, Bitcoin’s price has remained relatively stable. However, as we’ve learned, stability in the cryptocurrency market doesn’t last long. According to Google Trends, interest in Bitcoin has been declining since 2017. Looking at data from recent months, we can even identify a trend similar to that of early 2017.

Still, the question remains – where did the money that catalyzed Bitcoin’s surge in 2019 come from? Rumors and internet conspiracies circulate, suggesting that inside information leaked from Facebook about the launch of its Libra cryptocurrency and created a trend change before the announcement and the associated hype.

When it comes to altcoins, the downtrend seems to have been halted this week as Binance announced the launch of a digital currency lending system, with its first two products being BNB and USDT. Surprisingly, users will be able to lend ETC, which explains its price increase. Wanchain also stood out this week, gaining more than 100% and occupying the 88th spot on the list of the top 100 cryptocurrencies.

Nevertheless, Bitcoin has maintained its dominance, and it’s still too early to talk about a change in the trend with respect to the altcoin markets, as Bitcoin hasn’t yet completed its move which began at the beginning of the year.

The trading volume is declining, and investors fear this trend will continue. Of course, there may also be those who are already plotting another move behind the scenes. Events such as Telegram’s coin launch, a recession, or the Bitcoin halving could certainly send Bitcoin’s price to new heights. The future won’t be boring, that’s for sure.

Meanwhile, the Kleiman v. Wright case is also seemingly coming to an end, as a judge ruled against Wright, who might have to pay 500,000 BTC to the brother of an old business partner. The sum is currently worth upwards of $5 billion, and almost half of that might need to be used to pay taxes, which could impact Bitcoin’s price in the short term.

What’s more, check out the Crypto Fear & Greed Index:

Market Data

BTC Longs (BFX): 25K BTC

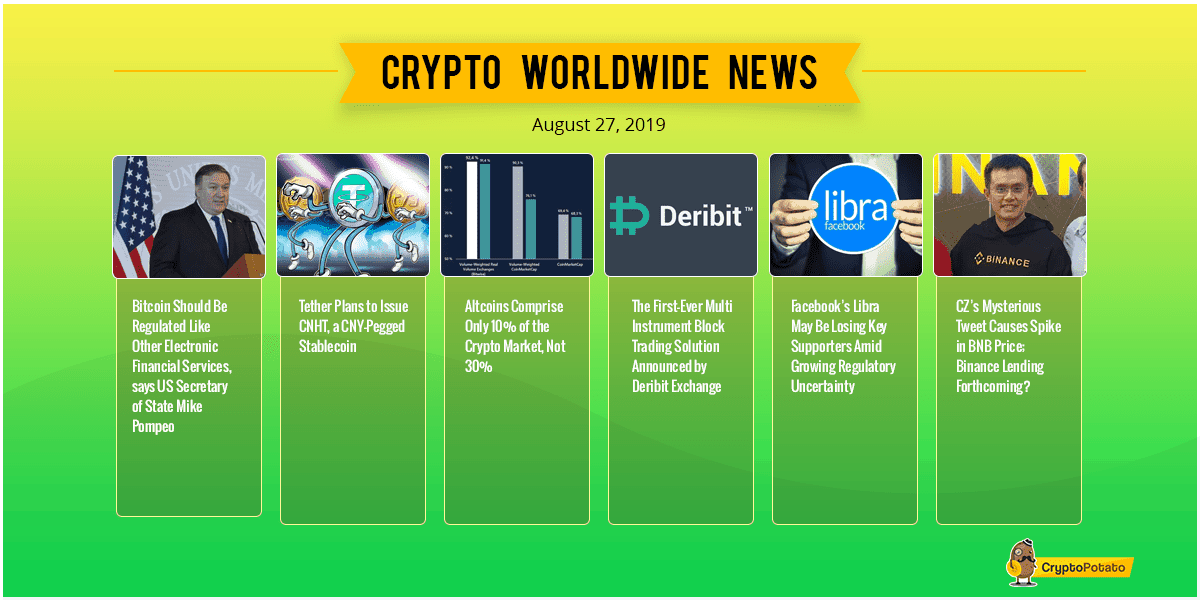

Bitcoin Should Be Regulated Like Other Electronic Financial Services: US Secretary of State Mike Pompeo. The US Secretary of State, Mike Pompeo, said that Bitcoin should be regulated like any other electronic financial service in existence today. His main concerns are related to the anonymity of transactions carried out on Bitcoin’s network.

Tether Plans to Issue CNHT, a CNY-Pegged Stablecoin. The issuer of the most popular stablecoin on the market, Tether, is reportedly working on a new stablecoin called CNHT. It will be pegged to the official fiat currency of China, the yuan. The news was confirmed by Dong Zhao, a shareholder of Bitfinex.

Altcoins Comprise Only 10% of the Crypto Market, Not 30%. According to a new study, the relative share of all altcoins in the overall cryptocurrency market isn’t 30%, but merely 10%. This suggests that Bitcoin’s dominance rate is close to 90%. The research factored in liquidity, maintaining that the latter is key in generating accurate market cap numbers.

The First-Ever Multi-Instrument Block Trading Solution Is Announced by Deribit Exchange. Cryptocurrency derivatives trading platform Deribit has entered into a partnership with Paradigm in order to provide the first-ever multi-instrument block trading solution. This automated trading solution will purportedly attract more institutional investors to the market.

Facebook’s Libra May Be Losing Key Supporters Amid Growing Regulatory Uncertainty. Facebook may be losing important partners in its effort to launch Libra. At least three of the cryptocurrency’s main backers have already met in private to discuss a potential retreat. Their concerns are mainly related to the growing regulatory uncertainty which shrouds the entire project.

CZ’s Mysterious Tweet Causes Spike in BNB Price; Binance Lending Forthcoming? The world’s leading cryptocurrency exchange, Binance, will soon allow its users to lend certain cryptocurrencies in return for attractive annualized interest rates. According to its website, the first two products available for lending will be Binance Coin and stablecoin Tether (USDT).

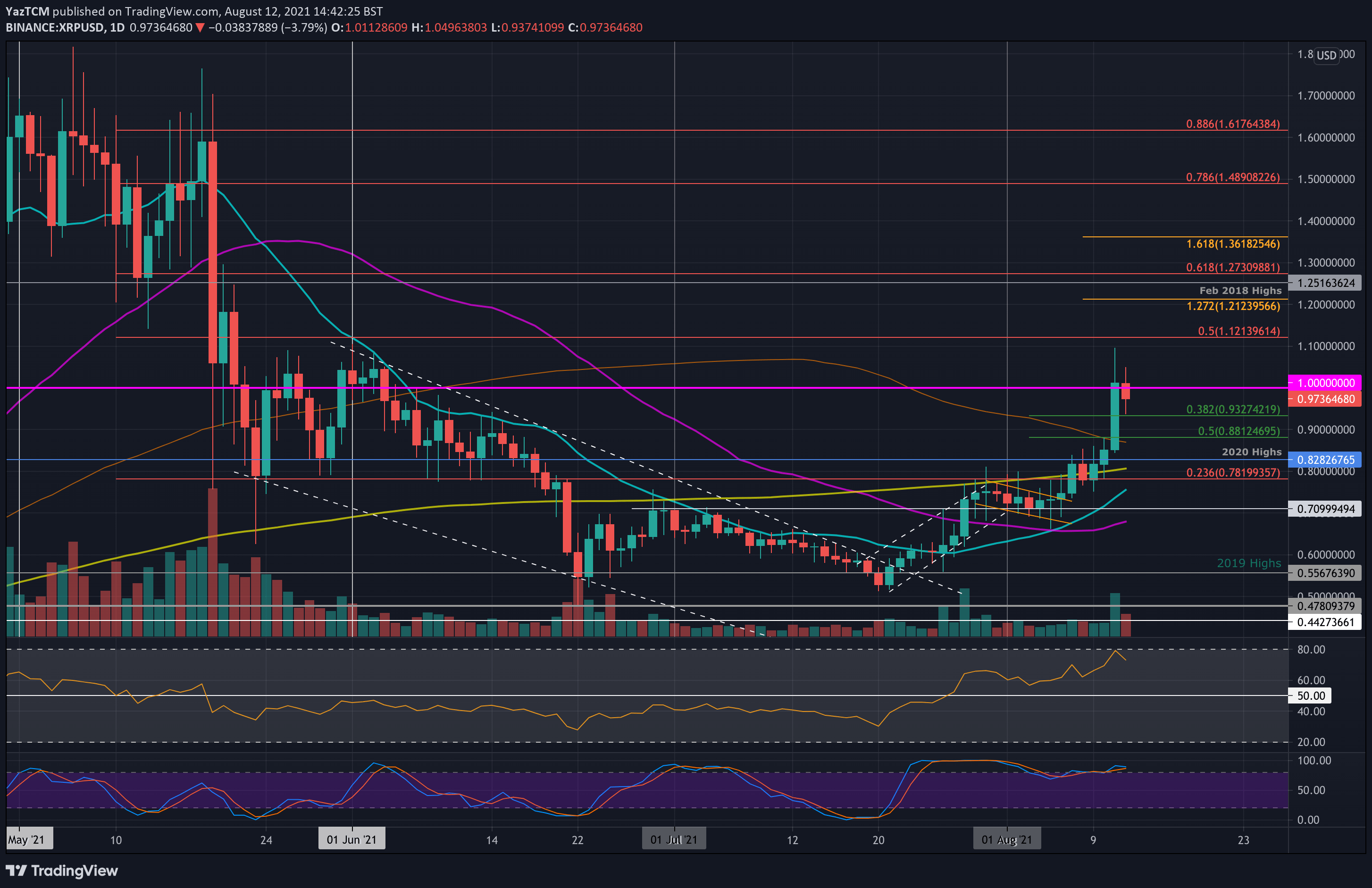

Charts

This week we’ve analyzed Bitcoin, Ethereum, XRP, Monetha, and Ethereum Classic; click here for the full price analysis.

The post As Interest Seemingly Fades, Will Bitcoin Hold $10,000? Weekly Crypto Market Update appeared first on CryptoPotato.