As Global Peace, Economy Break Down, Credit-Based Money Will Turn To Bitcoin

As nations go to war and the global economy suffers, our credit-based system will inevitably seek sound money alternatives.

“Fed Watch” is a macroeconomic podcast, true to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining current events in macroeconomics from across the globe, with an emphasis on central banks and currencies.

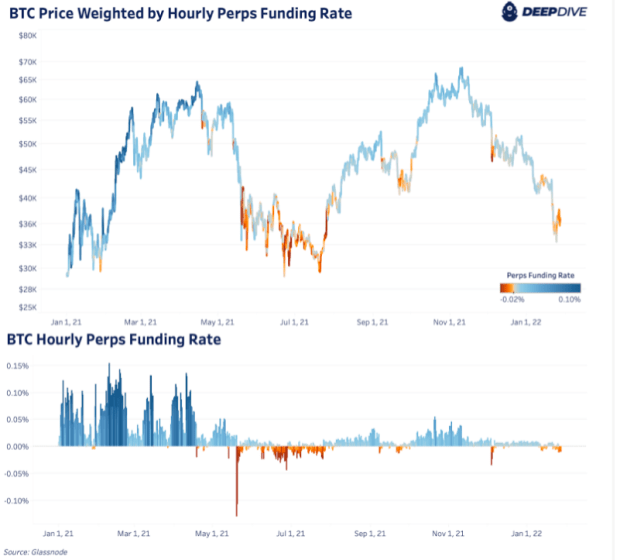

In this episode, CK and I broke down some charts, including bitcoin, the dollar, European energy and U.S. gasoline futures. Next, I read through a couple of articles and addressed the complicated financial situation in China. Lastly, we examine what the big deal is with Zoltan Pozsar’s latest dispatch about “Chussia.”

Watch This Episode On YouTube or Rumble

Listen To The Episode Here:

- Apple

- Spotify

- Libsyn

Complicated Financial Situation In China

As CK said during this episode, “we were early to the situation in China.” We were calling out the deteriorating conditions over there months before other macro podcasts. While they were still shouting about “inflation!,” we were talking about the geopolitical and geoeconomic elephant in the room, China.

In this episode, I gave a quick update for the week on what new measures are being rolled out by the Chinese Communist Party (CCP), to tackle the imploding credit crisis there. Of course, the main idea is it is trying to fight a debt trap with more debt.

I read parts of a couple of articles. First, this one from the Global TImes, which details some of the 19 new measures it is putting in place. And guess what, it’s more debt:

“Among the 19 new policy measures was the addition of more than 300 billion yuan ($43.68 billion) in quotas for policy and development financial instruments, and a green light for central power generation firms, among others, to issue 200 billion yuan of bonds.”

The second article, this one from Bloomberg, went through some of the uses for the estimated $1 trillion infrastructure spending binge:

“Beijing is making 6.8 trillion yuan (about $1 trillion) of government funds available for construction projects, according to Bloomberg calculations based on official announcements. Total spending could be even higher than that — three times that amount, by some estimates — once bank lending and corporate funds are added.”

The article is interesting because it gleefully walks through what the Chinese will likely spend the money on:

- “More renewables than Europe” (worked out great for Europe, didn’t it?)

- “The world’s longest water tunnel”

- “From concrete sprawl to greener cities”

- “More than twice the high speed rails in the world”

To show that these efforts are not as highly productive as they are claimed, I walked through a few points in depth on the podcast.

For starters, the water situation in China is horrible. They only have about one-fifth of the water available per person around the world. Its huge water projects of the last decade have failed from the reports I’ve seen. All of these hundreds of billions in spending on water projects are estimated to increase the amount of water available by 122 billion cubic meters, or 100 cubic meters per person per year. That’s a lot, but only increases its per capita water availability from approximately 400 cubic meters per person to 500.

As for the high speed rail, the amount of high speed rail already in the country is bringing on big financial troubles, because it is already highly unprofitable. This expansion is destined to be a huge waste of money, not a productive use of debt as supposed.

For example, the Bloomberg article says, “The most ambitious [new high speed rail line] is a 1,629 km line from Sichuan province in the southwest to the Tibetan capital Lhasa, climbing more than 3,000 meters through earthquake-prone terrain and glaciers.”

This sounds unprofitable and very risky of being destroyed by those earthquakes and glaciers. It just sounds silly as a productive use of money.

Zoltan Pozsar’s Latest Dispatch

The bulk of the signal in this episode, in my opinion, is from the Zoltan Pozsar breakdown. I read through several quotes from his most recent dispatch on geopolitics and explain why he gets it all wrong. He’s a brilliant financial plumbing expert, but obviously not one of geopolitics.

The problems start right up front, as he attempts to use three pillars for this analysis as if they are causative. In reality, they are caused by more fundamental items:

- Cheap immigrant labor to the U.S.

- Cheap Chinese goods to the U.S.

- Cheap Russian natural gas to Europe

The problem here, however, is in the sentence right before he lists these three things. He states, “Global supply chains work only in peacetime, but not when the world is at war, be it a hot war or an economic war.”

So, which is it? Is peacetime or cheap stuff more foundational? It is definitely the peacetime. In the podcast, I offer my three pillars of the last 50 years of increasing globalization and trade as the following:

- Peace and free trade, along with respect for international organizations

- Productive opportunities for credit, i.e., low credit saturation

- Credit-based money, highly-elastic money to expand into all the productive opportunities

It is a misnomer to think that the last 50 years have been a “low inflation” environment. Sure, the CPIs around the world were low, because productivity was expanding so quickly that prices remained stable. But credit (money) was expanding rapidly. This was literally an era of money printing.

Now, like a drug addict with shrinking doses of their drug, the system now is less inflationary with deflationary pressures dominant. We are now entering the post-credit expansion period. Literally, this is a deflationary era, CPI be damned.

In the podcast, I tied bitcoin back into these pillars. What we are viewing today is a systemic breakdown in my three pillars. Peace is breaking down as evidenced by Ukraine and other Global Spring events happening today. The global economy has become saturated with credit, leaving no economically-productive uses left (or at least relatively few). These two things will lead to the final pillar, credit-based money being pressured into a new form of money, back to commodity or sound money, bitcoin being the best modern choice.

I got into more from Pozsar after this on the show. Specifically, his point about Russia and China (“Chussia”) being a match made in heaven, with Russia as a great resource producer and China as the factory of the world. The only thing he forgets is an end consumer. You can’t simply cut yourself off from the consumer-half of the global economy, and expect things to work out.

Anyway, you’ll have to listen for that juicy stuff at the end.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.