As Bitcoin Surges, Google Searches Suggest Little FOMO Among Retail Investors

Web search data suggests popular interest in bitcoin remains at normal levels, despite a sharp price rally to near $16,000.

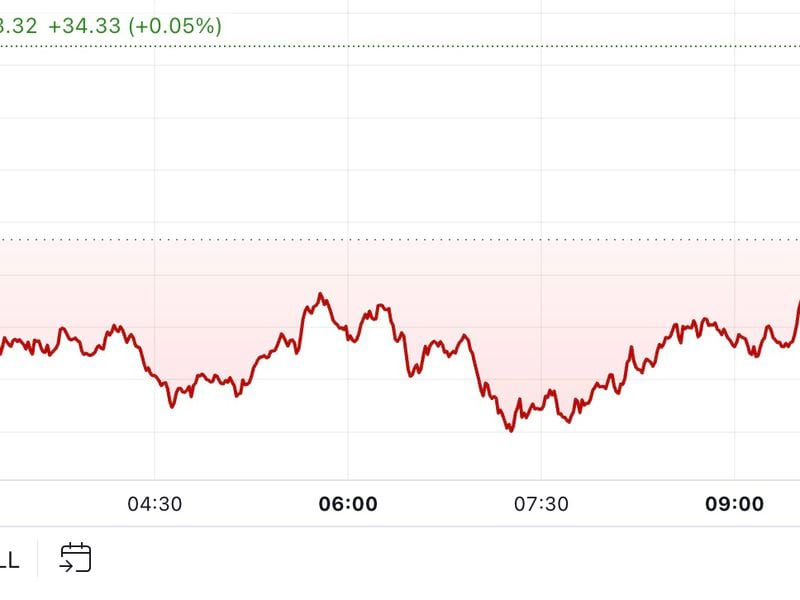

- The top cryptocurrency has chalked up a nearly 50% gain in the past four weeks to trade as high as $15,971 earlier on Friday – a level last seen during the bull market frenzy between December 2017 and January 2018.

- Some observers say the rally is now being driven higher by retail greed and fear of missing out (FOMO). However, Google data suggests otherwise.

- Google Trends, a barometer used to gauge general interest in trending topics, is currently returning a value of 10 for the worldwide search query “bitcoin price”.

- That’s significantly lower than the value of 93 observed in early December 2017 following bitcoin’s record break above $15,000.

- The current reading is also lower than the peak of 19 observed in the second week of May when bitcoin underwent its third mining reward “halving.”

- Google’s data suggests that retail investors are showing calm over bitcoin’s recent rally and the market is far from being in a state of bull frenzy.

- Google search values typically rise following a major bull run as high street investors, who missed the early rise, often scan the internet for price information before joining the market.

- Google Trends provides access to a mostly unfiltered sample of actual search requests made to Google and scales their searches on a range of 0 to 100, according to the company.

- FOMO action is widely considered a sign of an asset nearing a major top as retailers are usually the last to join the market.

- But with popular interest still relatively low, it seems safe to say that FOMO is yet to take hold of the market and the ongoing institutional-driven rally has legs.

- Bitcoin peaked at a record high of $20,000 in mid-December 2017. At the same time, the worldwide search query “Bitcoin Price” touched 100 on Google Trends.

- It’s worth noting, though, that a high search value does not necessarily translate into increased buying pressure. Often investors search for information, but remain on the fence.

- At press time, bitcoin is trading near $15,588, representing a 118% gain on a year-to-date basis. The figure of $15,971 reached early Friday was a 33-month high.