As Bitcoin Mining Hits All-Time Highs, Access To ASICs Is Key

As bitcoin propels its mining industry to new heights, the challenge of obtaining new equipment is critical.

Like many providers in the space, international bitcoin mining services company Compass Mining is on a roll. With the success of BTC and rising mining revenues — now at an all-time high of $60 million per day — this rapidly-growing startup finds itself squarely in the middle of a bull run.

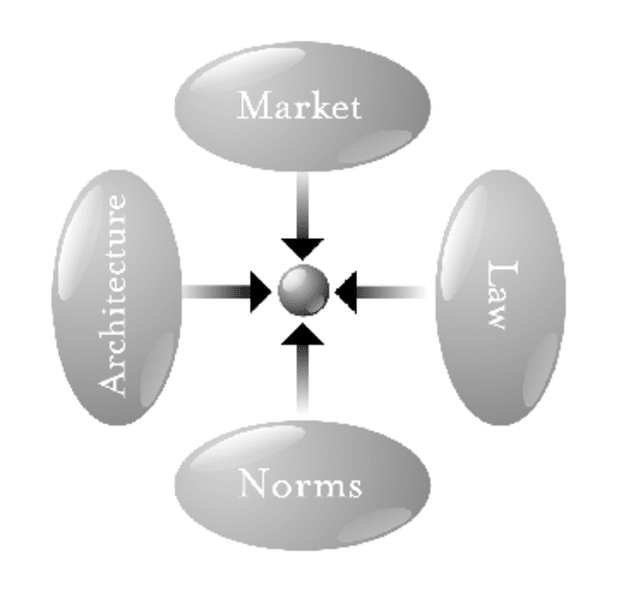

Founded in October 2020, Compass has been able to capitalize on a growing demand for mining services, particularly through access to new ASICs in a very tight mining equipment market. In a news release from early March, Compass described itself as “the first two-sided bitcoin hosting marketplace,” meaning that it works with both prospective miners helping them get established and with existing hosting facilities to find the best fit to fill their vacancies.

The release also announced that Compass had secured $1.7 million in seed funding in a round led by Galaxy Digital, with participation from other stalwarts in the space, including CoinShares and CoinGecko.

“March was the best month yet for miners @compass_mining!” Compass CEO Whit Gibbs recently tweeted. “13.964 #btc mined, up 114% from February. 112 [petahashes] contributed to Bitcoin’s network security.”

Echoing the enthusiasm and adding some detail to what is driving this growth in the bitcoin mining industry through an April 4 newsletter, Upstream Data’s Steve Barbour noted how lucrative bitcoin mining has become:

“…the bitcoin price started appreciating and it has since increased approximately 600% (since Oct 2020) and the difficulty has not even doubled. The result is a marked increase in revenue for bitcoin miners everywhere,” he wrote. “..I am a bit surprised at how slow the difficulty and hash rate has been to react to the price, but this is likely due to the significant shortage in the semiconductor industry combined with existing mining hardware failure (hardware breaking). With no relief in the semiconductor supply chain in sight, I would guess bitcoin mining will continue to be extremely profitable for quite some time to come.”

The Fight For New Mining Equipment

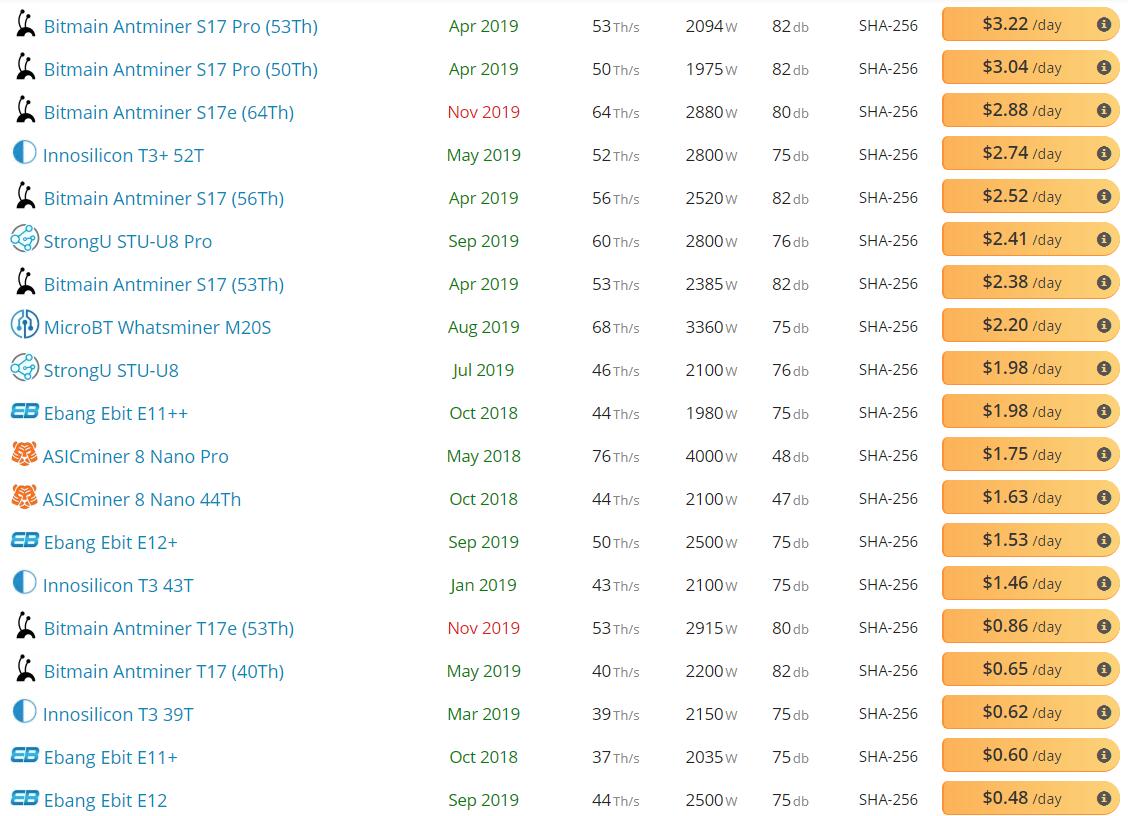

Bitcoin mining has become so competitive and profitable that it’s becoming increasingly difficult for people wanting to mine BTC to access the ASICs needed to power a profitable mining operation.

As a “two-sided marketplace,” one of Compass’s secrets to success is its ability to acquire new ASICs for clients in such a challenging market. It’s easier for a larger provider like Compass to deal with ASIC suppliers like Bitmain, Whatsminer and Canaan, which are likely to prioritize bigger customers like Compass, rather than smaller mining operations.

Compass has been able to secure new ASICs, even as the demand for silicon-based chips has become a problem affecting manufacturing enterprises around the globe. A Compass team on the ground in Southeast Asia, including COO Thomas Heller, negotiates directly with manufacturers.

In a direct message on Twitter, Gibbs told Bitcoin Magazine that its work with ASIC manufacturers is “very relationship based” and it is fortunate that Heller “has great ties to Chinese distributors from his time working in China”.

In its first two months, the company sold $11.4 million worth of mining machines to clients, per its March news release.