Arthur Hayes Says Bull Market Will Be Back When China and Hong Kong ‘Love Crypto’

China was emerging as the epicenter of the crypto industry. Within a decade, the country witnessed the spawning of giant exchanges like Binance Holdings Ltd. as well as the biggest Bitcoin mining firms. However, Beijing’s move to ban crypto trading and mining last year seemed poised to douse the entire domestic industry.

Hong Kong, on the other hand, has always been China’s window to the world. According to Arthur Hayes, BitMEX co-founder, it is this deepwater port at the mouth of the Pearl River Delta that has been where China and the West met.

Hong Kong Wants Crypto Back

In a recent blog post, Hayes said the lack of a real economy allowed Hong Kong’s financial system to be freer and more experimental when it came to establishing crypto capital companies.

But the ripple effects of the ban in Mainland China led to a disruption in Hong Kong’s strategic ambiguity with regard to the legal status of crypto, and the territory became a less friendly place driving companies to set camp elsewhere, including – Singapore, Dubai, and The Bahamas.

However, this trend appears to be changing.

“Hong Kong’s friendly reorientation towards crypto portends China reasserting itself in the crypto capital markets. When Choyna loves crypto, the bull market will come back. It will be a slow process, but the red shoots are budding.”

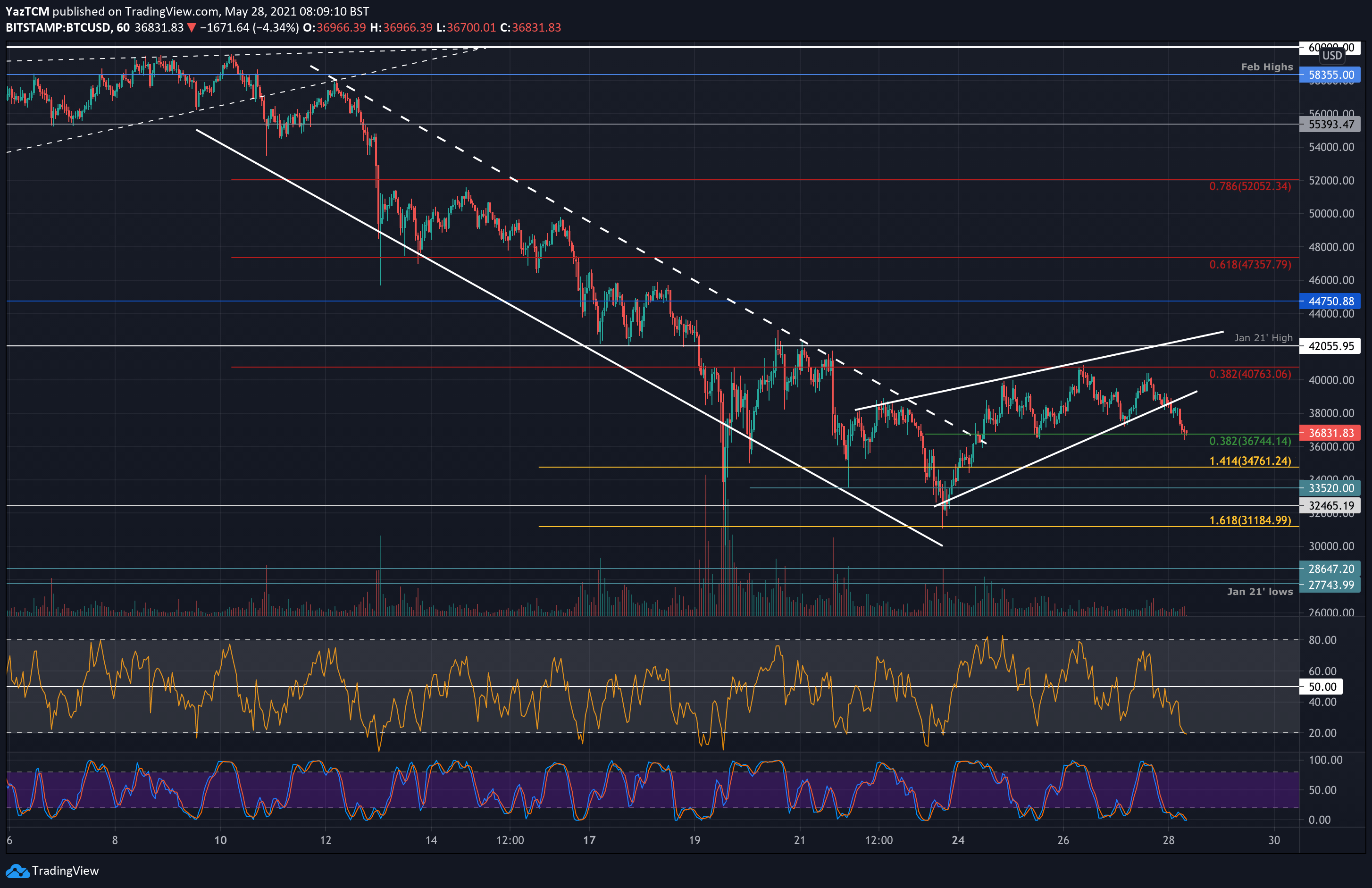

Hayes opined that a sharp and sudden yuan depreciation, similar to that in 2015, could lead to the beginning of another epic bull market. Notably, this isn’t the first time the former exec shared a similar sentiment.

He added that China has just been dormant but has not left crypto. The current global geopolitical situation will eventually force the country to do something with the dollars that it earns every month from its exports to the world minus imports. Reorientation of Hong Kong as a pro-crypto location, according to Hayes, is a prong in Beijing’s strategy to tackle China’s USD problem in a way that would not destabilize its internal financial system.

Political Drift

Despite the political turmoil that was foiled by the pandemic, there’s a high chance that Beijing may allow Hong Kong to function as a testbed territory to follow the West a bit more as well as open for business with them.

Hayes also believes the Chinese government is starting to view Singapore as a bigger threat to its dominance than the continued political drift of Hong Kong. Hence, favorable policies can reassert the city’s relevance in terms of finance and crypto.

After nearly three years of pandemic isolation, the special administrative region of China is aggressively courting foreign talent as it battles with rival finance hubs like Singapore.

Besides, Hong Kong has also moved away from adopting stringent measures for its domestic crypto ecosystem. Unlike regulators in Mainland China, the director of licensing and head of the fintech unit of Hong Kong’s Securities and Futures Commission (SFC) recently confirmed that it is considering enabling retail investors to invest directly in crypto assets.

CryptoPotato earlier reported that Hong Kong ranked as the most crypto-ready nation in 2022.

The post Arthur Hayes Says Bull Market Will Be Back When China and Hong Kong ‘Love Crypto’ appeared first on CryptoPotato.