Arkham Intelligence Traces Transactions on the Blockchain

Blockchains are transparent, as long as you know who’s behind 0xb794f5ea0ba39494ce839613fffba74279579268 or 0xCd73f4E8F50C48267E26348DF60e6d27C5DBf168.

Privacy on the blockchain is dependent on the ability to hide behind long, wonky addresses – pseudonymity is the natural state of a blockchain. Tens of billions of dollars move through Ethereum’s virtual pipes every day relatively unnoticed, just because people don’t know where the money came from or where it is going.

Oftentimes, that is very problematic. Blockchain’s mix of pseudonymity with an immutable record of transactions enables peers to trustlessly transact online, but it also empowers bad actors to cheat, steal and exploit.

If stakeholders knew where to look, they could, for example, find data that shows client and exchange funds are being co-mingled.

Or, that Sam Bankman-Fried’s hedge fund, Alameda Research, once an industry giant, had a material part of its balance sheet backed by FTT, the FTX exchange token.

Regulators are doing what they can to make sure that on-ramps into the crypto economy, like crypto exchanges, identify users as they come aboard. But know-your-customer (KYC) rules can only do so much when fresh addresses are easy to spin up and crypto mixers allow people to shield their transaction history.

Read profiles of all of the Projects to Watch 2023: Reclaiming Purpose in Crypto

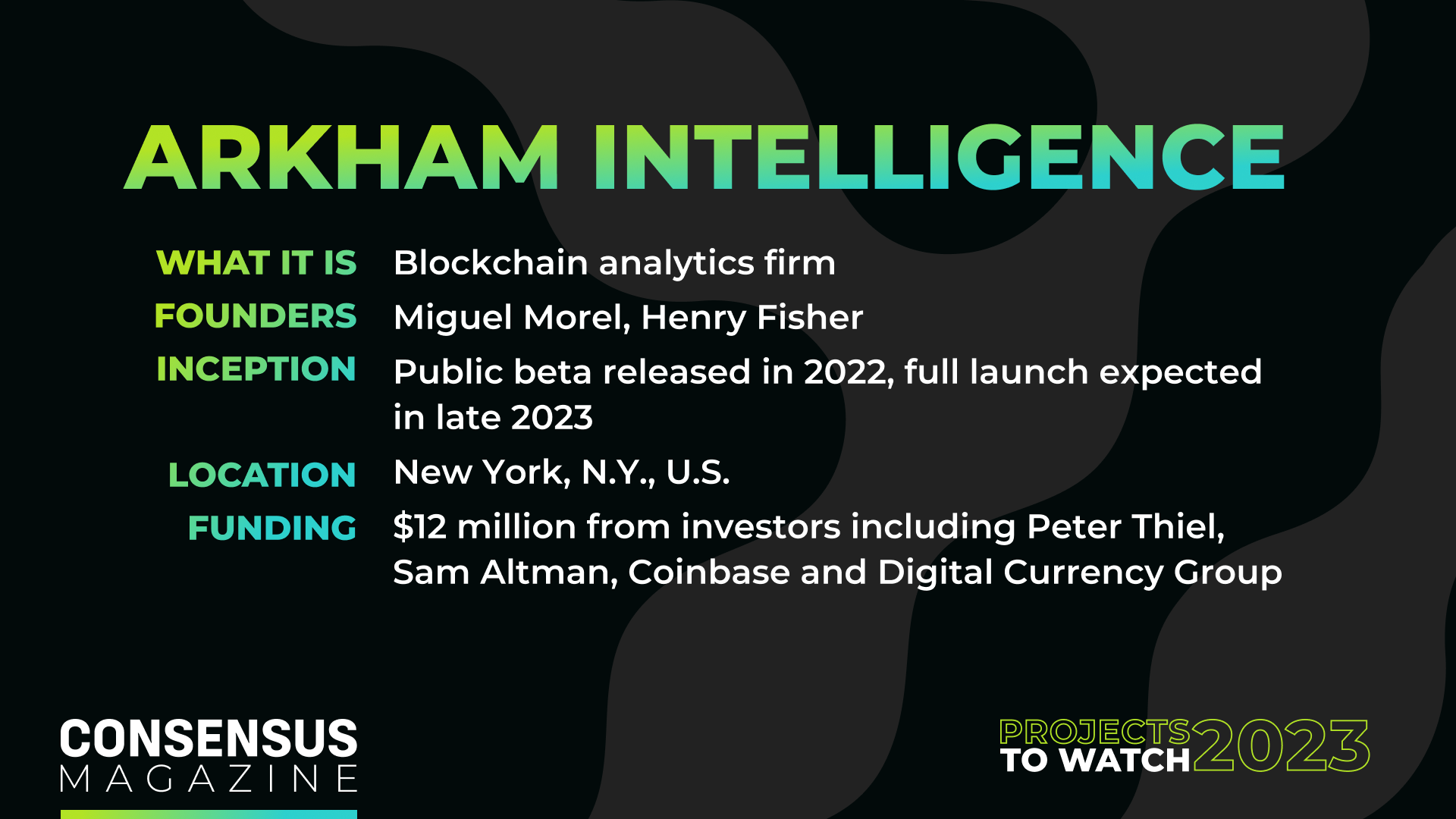

Arkham Intelligence

The idea: Arkham Intelligence

Critics of cryptocurrency often accuse the sector of being skewed toward early adopters. Having a first-mover advantage, the quicker you are to a crypto project the more likely you can amass a small fortune in tokens while the price is low. Sometimes project insiders are able to benefit the most by surreptitiously collecting tokens. Other times seemingly unconnected addresses appear to collude to sway governance decisions.

Without putting a name to an address, it’s difficult to understand what’s being sent around. While some say that privacy is a fundamental part of crypto, there’s also another school of thought that says market fairness and equality is only found in markets that are transparent. There are legitimate needs for privacy, say the founders of blockchain analytics firm Arkham Intelligence, but the market as a whole is better off if the public knows who is making the largest trades in the ecosystem.

Arkham Intelligence hosts a relatively new platform that enables users to scrutinize blockchain addresses, inspect both sides of a transaction, track fund movements and investigate counterparty connections. Its user interface sorts data by entity and tracks the flow of funds that way as opposed to sorting things by token, which is how most of its competitors organize data.

The company has closed $12 million in funding, and plans to exit beta and launch publicly by the end of 2023. With its current runway, the firm plans to expand its feature set, including support for more chains, and build more tools that will be familiar to traditional finance (TradFi) users.

“It’s very difficult to actually figure out, despite its transparency, who the people behind those transactions are, what they’re doing with their money,” said Miguel Morel, a founder of Arkham.

Arkham users can see the relationship between entities in real time and track relationships between the two.

Say, for instance, a large fund makes a move on a token, either adding to its position or liquidating it. Users will be able to see what occurs and where the funds are flowing.

“As a cryptocurrency user, you must manage your exposure at all times,” Morel says. “And you have to understand what it is that you’re investing in, what it is that you’re trading and what it is you’re speculating in.”

Arkham’s dashboards allow for granular filtering and tracking of the relationships between addresses, so users can see where coins are going.

For instance, via Arkham, it’s possible to see how the entity that exploited the Euler Finance protocol is moving around the funds, including deposits into wallets controlled by North Korea’s Lazarus Group.

Sure, it’s possible to do this with a regular block explorer that’s free, but it would be a much more difficult task.

“The good thing about blockchains is that it’s not a black box. You don’t need a subpoena. You don’t need to wait for a judge to release information,” Morel said. “You don’t need to wait for the company to release information about what’s going on internally. You can just look at the books.”

Arkham Intelligence is currently in private beta. Already it has media (including CoinDesk), crypto exchanges, hedge funds and other financial institutions as users. It gained a significant amount of buzz around the time of the FTX collapse, shortly before/after it launched, because of the company’s Twitter threads outlining and helping to explain the odd flow of funds at the defunct exchange.

Transparency versus anonymity

Morel said he was motivated to build Arkham to remove pseudonymity from blockchains.

While some believe this forced unveiling is antithetical to crypto, Morel disagrees.

Morel says that even before he started Arkham he saw that there were two narratives within the crypto industry: one that highlights the transparency and decentralization of blockchain, and another that emphasizes its privacy and pseudonymity.

“And they’re both true, or at least they were both true. Mostly because while the blockchains are completely transparent, auditable and public with their information, it’s incredibly difficult to actually use that data,” he said. “With Arkham, that’s actually what I wanted to… I wanted to marry that as an idea.”

All the necessary data to tell who’s who on-chain is public and transparent, but unless you know the entity behind an address this trove of data is useless for the average user.

“People are publicly broadcasting to everyone their activity on a minute-by-minute basis, every single time they make a transaction,” he said. “We’re basically just making software that matches that information to the relevant person and then shows that to the end user.”

After all, why should the right of a large investor’s anonymity trump that of a retail user wanting to know what they are investing in?

Morel points out that traditional finance also has a similar problem with opaqueness, but there are remedies for this, such as the 13F form the U.S. Securities and Exchange Commission (SEC) requires people or funds to file when they manage over $100 million in assets and take positions in listed companies.

“What we’re building is 10 times, 100 times, 100 times more granular than that,” Morel said.

Edited by Jeanhee Kim.