Archax, a U.K.-regulated cryptocurrency exchange and crypto custody service, plans to offer an exchange for tokenized assets such as funds and bonds before the end of the year, Chief Marketing Officer Simon Barnby told CoinDesk in an interview on Tuesday.

“We believe the future is the tokenization of all real-world-assets, and all traditional financial instruments are moving on-chain too,” Barnby said. “So we are launching a regulated digital market to handle these regulated tokenized assets.”

The target audience for the new exchange will be professional investors and institutions, he said.

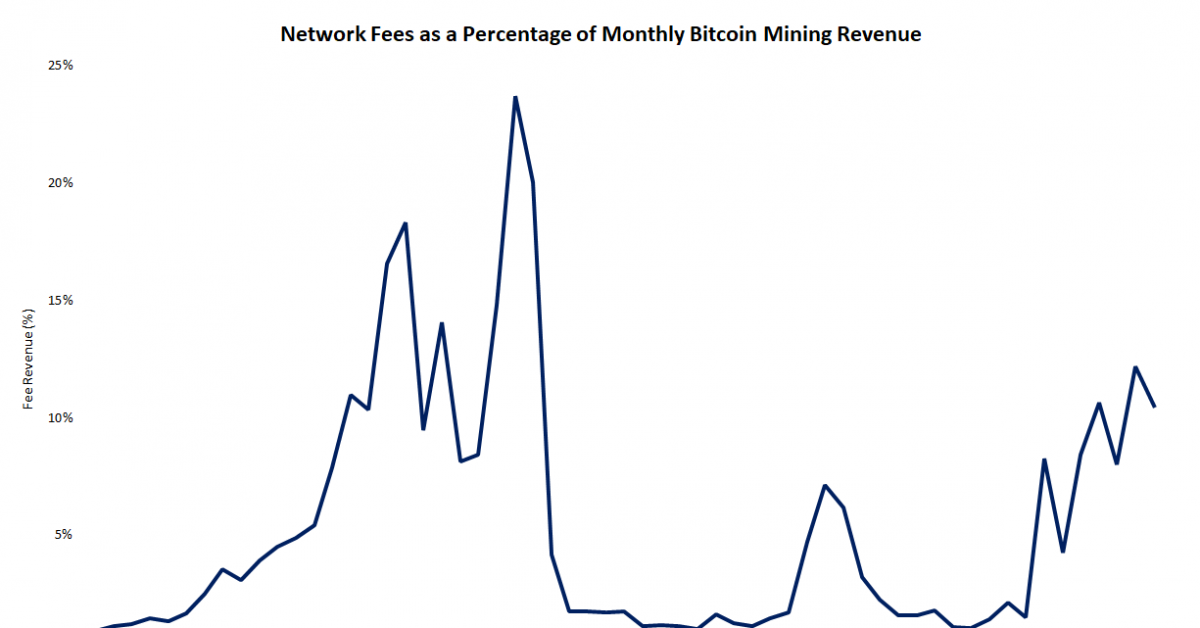

Tokenized assets are digital representations of those assets on a distributed ledger. The market for tokenized assets could reach as much as $10 trillion and $3.5 trillion even in the bear case, digital asset manager 21.co said in a report earlier this month. One example: Euroclear, one of the world’s largest securities settlement houses, said Tuesday it settled its first digital note, a World Bank issue that raised 100 million euros ($106 million) for sustainable development.

Archax received Financial Conduct Authority authorization as a regulated exchange, broker and custodian for digital and traditional assets in 2020, Barnby said.

The London-based company has also tokenized an abrdn market fund in euros, pounds and dollars and has “a pipeline of several hundred million dollars worth of funds coming in to be held in that tokenized money market fund and where people can receive a yield based on the money market fund,” which is live, he said.

Abrdn, the U.K.’s biggest asset management firm, is the exchange’s largest external shareholder after buying a stake that was announced in August last year.

Edited by Sheldon Reback.