Arbitrum, Ether Liquidity Providers Earn $500K From ARB Airdrop

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Entities providing liquidity to one of the most-anticipated token issuances in recent times made over $500,000 in profits in the first few hours, data shows.

Arbitrum’s governance tokens, ARB, went live for claiming on Thursday. The tokens can be used to vote on decisions on future changes to the Ethereum scaling protocol.

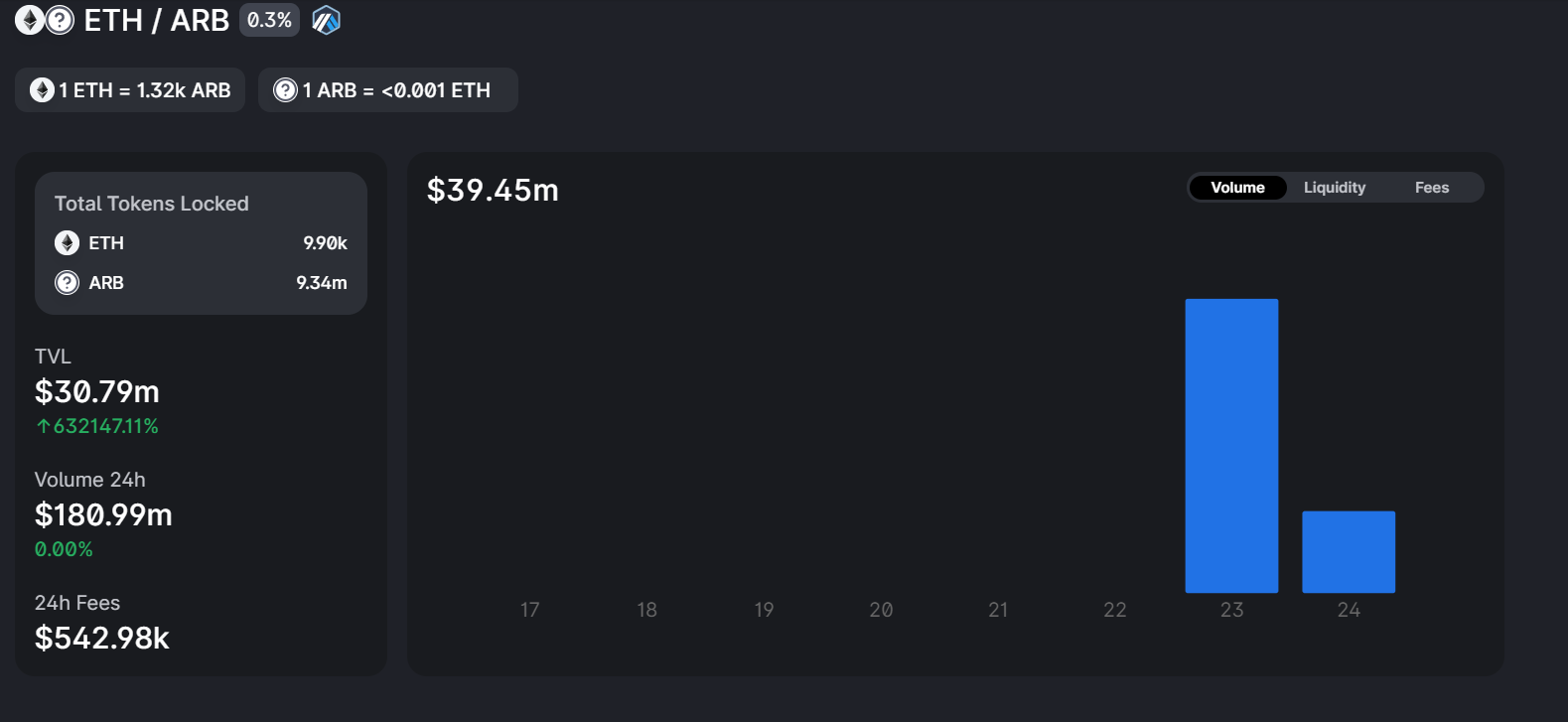

Uniswap data shows over $180 million in volume was traded on the ARB/ETH liquidity pool, netting $542,000 in fees for liquidity providers (LPs). LPs are entities that provide two different tokens to any decentralized exchange’s smart contracts – netting a cut of fees charged by that exchange on each trade.

Data shows 9,900 ether (ETH) and 9.34 million ARB are locked on the Uniswap liquidity pool at writing time on Friday. Another relatively smaller liquidity pool on Trader Joe locks up over $3 million.

Annualized yields on the Uniswap pool are between 90%-100% in Asian morning hours on Friday. The Trader Joe pool is a significantly larger 800%.

Meanwhile, Nansen data shows over 75% of all tokens were claimed as of Friday, with over 800 million ARB now held by users. ARB has a circulation supply of 1.2 billion and is trading at $1.30 with a market capitalization of $1.7 billion.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.