Arbitrum Airdrop Shows Interest in DeFi, Researcher Says

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/babbc463-ff00-4c88-bbf6-967e974c517e.jpg)

Fran is CoinDesk’s TV writer and reporter.

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

Banking jitters in traditional markets and the crackdown by regulators on centralized exchanges may be prompting users to turn to decentralized-finance apps, said Pedro Herrera, head of research at DappRadar, an online store for decentralized applications, or dapps.

“If you start to see how these use cases for DeFi start fitting and give you more autonomy to basically manage your own assets and investments, it’s the answer to why DeFi is [being] highly used,” Herrera told CoinDesk TV’s “First Mover” on Friday.

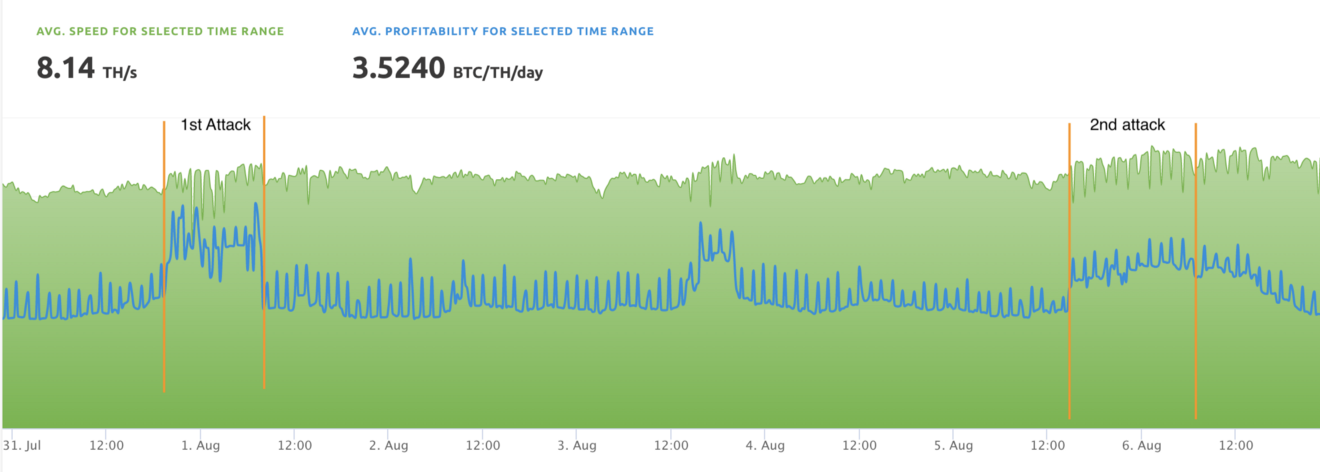

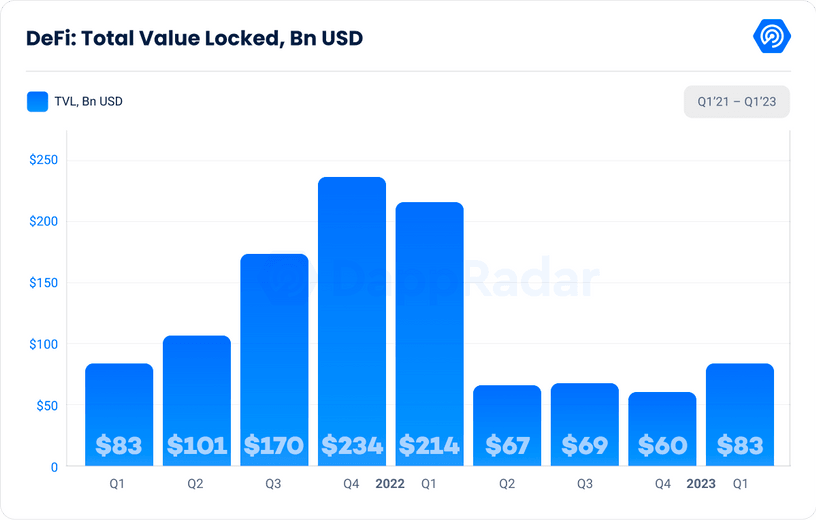

A new report by DappRadar found that the total value locked for DeFi during the first quarter rose by 37% to $83.3 billion from $60 billion in the fourth quarter of last year.

(DappRadar)

Part of the increase was due to layer 2 network Arbitrum’s airdrop of its ARB token last month. The airdrop also marked Arbitrum’s shift to a decentralized autonomous organization structure that gives token holders more input in securing a network, something that’s becoming more popular in the wake of bank failures in the U.S. and regulatory actions against centralized crypto exchanges like Coinbase and Binance.

Projects like Arbitrum “are creating a sense of loyalty and engagement within their community,” Herrera said, which can then in turn “engage developers to build better products,” and ultimately, draw more users into the project.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/babbc463-ff00-4c88-bbf6-967e974c517e.jpg)

Fran is CoinDesk’s TV writer and reporter.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/babbc463-ff00-4c88-bbf6-967e974c517e.jpg)

Fran is CoinDesk’s TV writer and reporter.