ApolloX Crypto Derivatives Exchange Guide & Review

ApolloX is a cryptocurrency derivatives exchange founded by experts with backgrounds in traditional financial institutions, technology companies, and other leading crypto exchanges.

The name of the exchange has been cleverly crafted by combining the Apollo and the letter X – the former standing for the first successful mission to land a person on the Moon, while the second stands for a crypto exchange.

The ApolloX platform aims to deliver a seamless trading experience, a secure environment while providing high-end order-book liquidity to allow its users to trade efficiently with minimal slippage.

Quick Navigation

- How to Register on ApolloX

- How to Deposit and Withdraw

- How to Trade on ApolloX

- The Liquadation Insurance

- Customer Support

- Security: Is it Safe to Trade on ApolloX?

- Trading Fees

ApolloX

Pros

- Intuitive trading interface

- Liquidation insurance fund

- Sufficient order types

Cons

- Low trading volume

- Trading pairs amount is still a bit limited

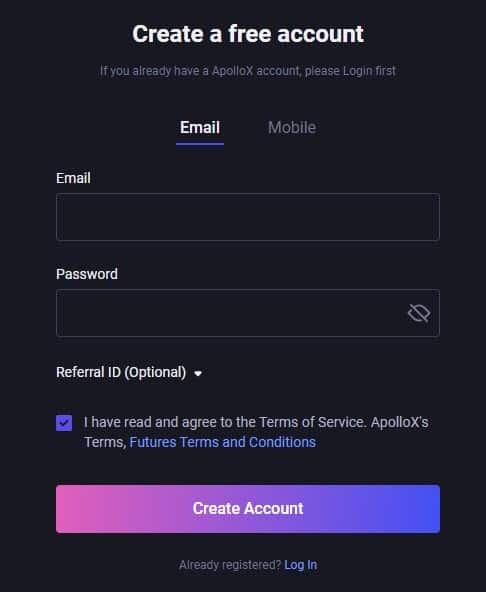

Getting Started: How to Register an Account?

First things first, to begin trading on ApolloX, you would need to register an account. The process is relatively simple and, of course, free. It’s also important to note that there are no requirements for Know-Your-Customer (KYC) verification.

Follow this link (open it in a new window if you like), welcome to the registration page. You will need to place in a valid email address and create a secure password.

You will receive a 6-digit verification code on the email that you provided, and you have to enter it to verify your account.

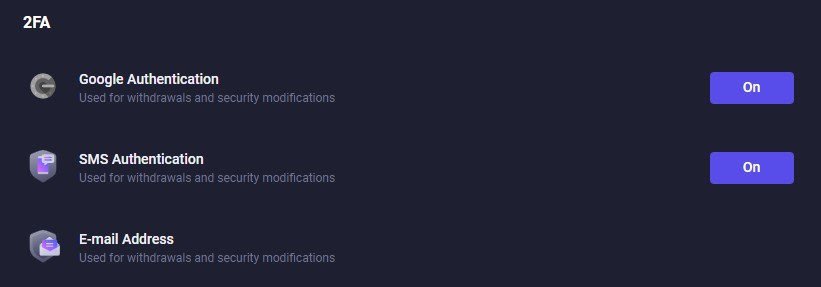

Once this is done, it’s highly recommended that you head directly for the security tab in your account profile and take the extra steps needed to make sure you’re well-protected.

It’s advisable to turn on the Two-Factor Authentication (2FA), as well as the SMS authentication:

Once you have these things carried out, you can proceed to deposit funds into your account.

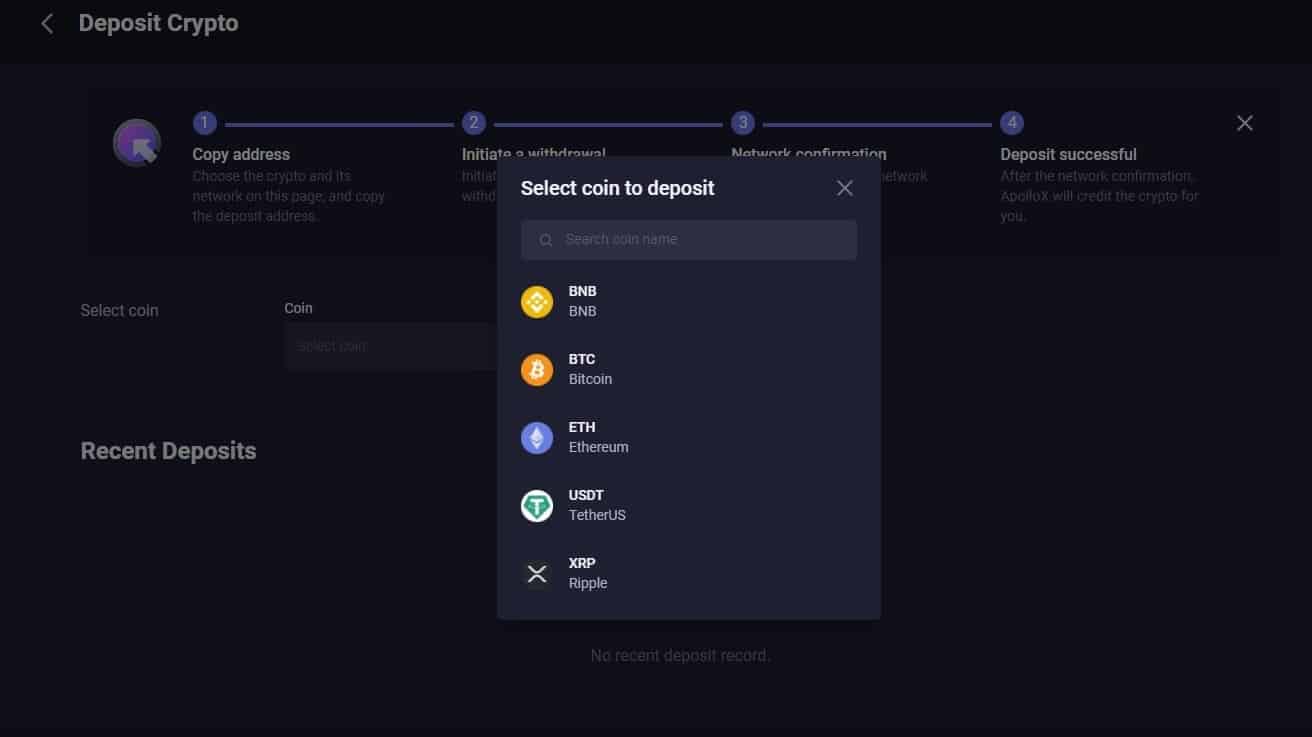

How to Deposit Funds on ApolloX?

To deposit funds on ApolloX, you need to open your wallet dashboard and click on “Deposit.”

This will bring up the following screen:

These are the currently available deposit methods. For the purpose of this guide, we will deposit some USDT into our account.

After selecting the option, you need to choose the transfer network. ApolloX currently supports both Binance Smart Chain and Ethereum-based USDT deposits – BEP20 and ERC20.

We’ve chosen the BEP20 option, and once this is done, if you deposit for the first time, you need to “retrieve” your deposit address by clicking on the blue button, after which it will be directly displayed to you.

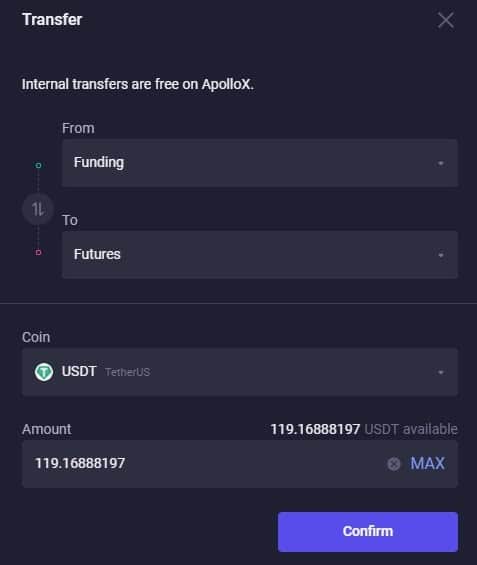

Once you’ve received your funds, you need to transfer them to your futures account so you can start trading. Doing so is very easy, as shown in the image below:

Once this is done, you are ready to start trading. Now let’s see how.

How to Trade on ApolloX

The overall trading interface is very intuitive and easy to navigate through. This is how it looks like:

At the top left corner, you’ll find a drop-down menu that allows you to select the available cryptocurrency trading pairs. At the time of this writing, the exchange supports the following:

- ETH/USDT

- ADA/USDT

- XRP/USDT

- BTC/USDT

- DOGE/USDT

- SOL/USDT

Please note that all of these are perpetual contracts – a type of derivatives futures contract that allows you to open and close positions without expiration dates. This means that you don’t trade the underlying asset itself but a contract that’s built to track its price. It’s convenient for those who want to speculate on the price of different cryptocurrencies with (or without) leverage without having to worry about taking possession of the asset itself.

The team also let us know that they expect to add more trading pairs in the next couple of weeks.

The interface also features a trading chart, order book panel, recent trades, a tab for your currently open positions, and a tab for the trading orders.

Using Leverage

Before explaining how to open and close a position, as well as other specifics of ApolloX, it’s important to know what leverage is.

Leverage allows you to open positions that are larger than your current account balance. The exchange “lends” money to the trader based on the multiplier they choose to use.

ApolloX offers up to 100x leverage on its BTC/USDT perpetual contract, which means that you can open a position 100 times larger than the funds you have on your account.

For example, if you have $100 in your account, you can open a BTC/USDT position worth $10,000. This is where you need to be careful, though. While this gives you a possibility to make more money, it’s also particularly risky because if the price moves in the opposite direction of your trade by as little as 1%, you will lose the margin you posted or potentially liquidate your entire account if you’re using cross margin. It’s not advisable to use anything higher than 5x in terms of leverage.

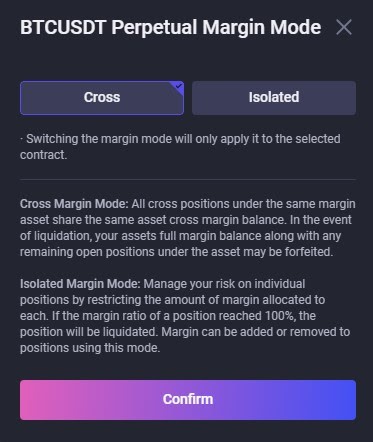

This brings us to our next point: different types of margin specifications on ApolloX. There are two:

- Isolated Margin

This allows you to manage your risk on individual positions by restricting the amount of margin allocated to each.

- Cross Margin

This means that all cross positions under the same margin asset share the same asset cross margin balance.

In the event of liquidation, if you use an isolated margin, you will only use the margin you posted for this specific position. If you use cross margin, you will lose the margin in your account and that for other cross positions you have currently open.

Now that you’re aware of what leverage is and how to use it let’s see how to open and close a position on ApolloX.

Different Order Types

ApolloX supports a few different order types that you can choose from, depending on your strategy and purpose of trading. These include:

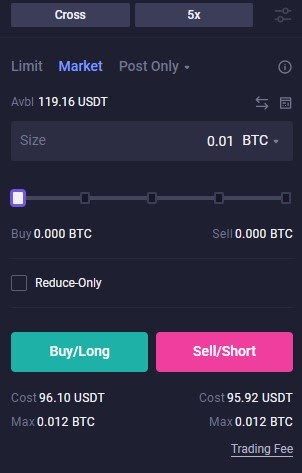

- Market Order

This is the simplest type of order, and it gets filled right away at the best price currently available on the market. Market orders typically require liquidity to be filled, and it’s executed based on the limit orders that were previously placed on the order book.

In this example, we’ve selected a basic market order worth 0.01 BTC. Since we’re using a 5x leverage, it only cost us $96.10 to open a position worth approximately $480 ($96.10 x 5). This will open your position as soon as you hit Buy or Sell.

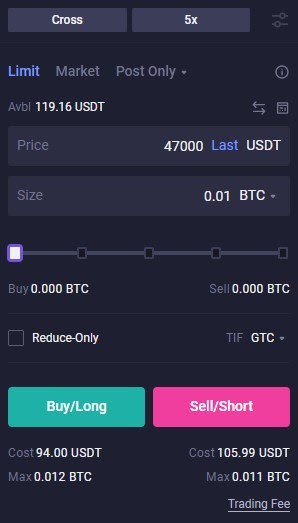

- Limit Order

This allows you to place an order at a specific price or a more favorable price. There’s no guarantee that it will be filled, though – keep this in mind.

In this example, we’ve selected a limit order, again, with a 5x leverage. This time, we want to open a 0.01 BTC position once the price retraces back to $47,000. If the price retraces to this point and there’s enough liquidity on the order book, we will have our position opened.

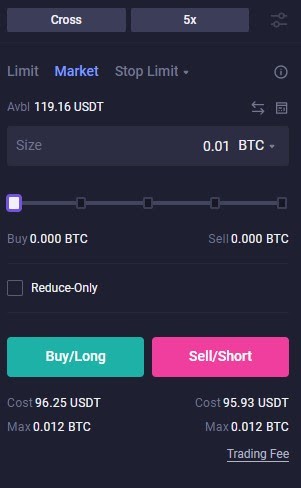

- Stop Limit Order

This is a conditional order that’s set to execute during a specific time range. It’s executed at a specified stop price once the asset reaches that price. Once the stop price is reached, the asset will be either bought or sold at the selected stop price or at a more favorable price. This is used to set the so-called Stop Loss or Take Profit.

- Stop Market Order

This is a stop order that, once it gets triggered, the system will send out a market order at the current market price. This is also used to set the Stop Loss or Take Profit.

- Trailing Stop

This allows following a strategy where traders pre-set an order to be executed when the market goes through a significant correction or a callback. Once the latest market price reaches the highest (or, alternatively – the lowest) price you set on a trailing stop order, it will be triggered and sent at the market price. This is an order for more advanced traders.

How to Open a Position?

For the sake of this guide, we will open a position using a market order on the BTC/USDT perpetual.

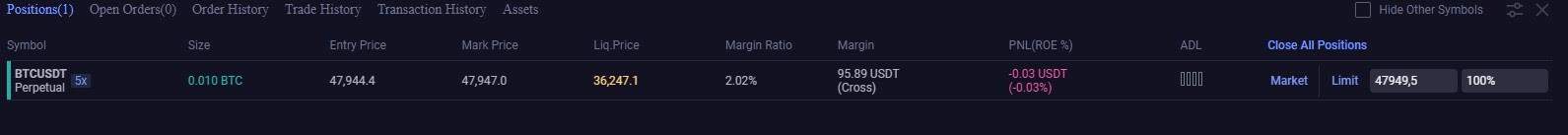

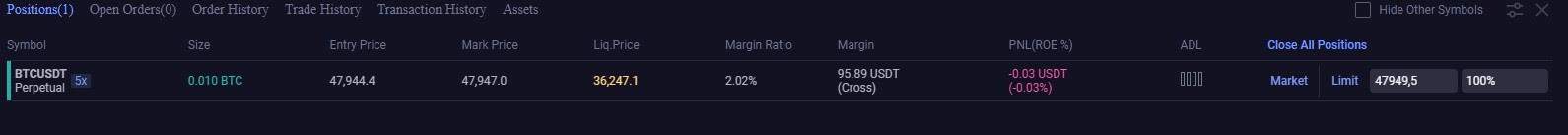

This is how the specifications look like. We use cross margin and a 5x leverage. The position size is 0.01 BTC. As soon as we hit Buy, our position will be opened and displayed right under the chart:

This is where you can track all of your positions. It reveals important information such as the position’s size, entry price, mark price, liquidation price (the price which, if reached, will see your position automatically closed and margin liquidated), margin ratio, margin posted, PNL, and so forth.

How to Close a Position

To close the position, you have a few options. You can do so through a market order, limit order, stop-limit order, or a stop market order.

For this example, we will close it using a market order, and it’s available right where you track your positions:

By clicking on the “market” button, you can directly close the selected position.

What is Hedge Mode?

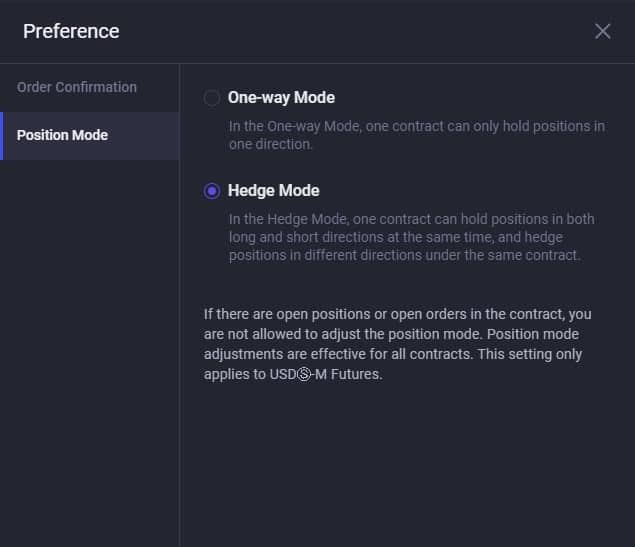

ApolloX also supports the so-called Hedge mode. By default, the settings of your account are in a “one-way mode,” which means that one contract can only hold positions in one direction. For example, you can only open BTC longs or BTC shorts, not both at the same time.

With the hedge mode, however, you can hold positions in both long and short directions at the same time and hedge positions in different directions under the same contract. This is once again for more advanced traders and can be used to protect the downside.

To activate it, you need to click on the button on the right side of your leverage preference:

![]()

From there, you need to select “Preference,” “Position Mode,” and “Hedge Mode.”

Fees on ApolloX

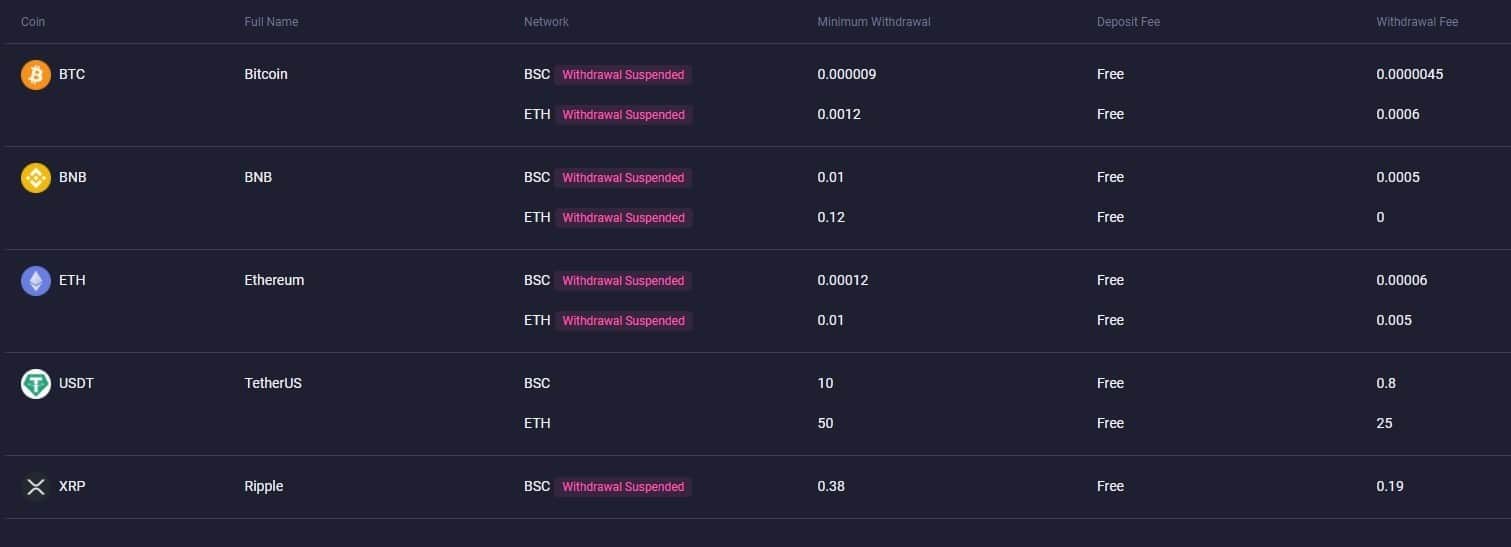

Right off the bat, it’s worth noting that all the deposits are free of charge, but there are standard network fees associated with the withdrawals.

At the time of this writing, users are also only able to withdraw USDT, for all of the other supported cryptocurrencies are suspended, according to the official website. The team said that they will roll out support for withdrawing other cryptocurrencies as soon as there’s demand for it.

An important thing to consider when trading derivatives is the funding rate. ApolloX also shows the real-time funding rate, as well as the funding rate’s history, so that traders can take it into consideration when opening positions.

Apart from that, the exchange charges a 0% maker fee and 0.08% taker fee.

The Liquidation Insurance Fund

This is another interesting feature that the exchange brings forward to offer some sort of liquidation protection for its users.

The liquidation insurance fund aims to cover losses that are incurred by traders who go bankrupt. Fees that are paid by non-bankrupt traders are injected into this fund and used for said purpose.

The main purpose of it is to reduce counterparty liquidations.

- If you get your position closed by force and you have no funds left in your account, or if the position can’t be closed through a forced liquidation, ApolloX will take control of the remaining positions on your account.

- If this happens, ApolloX will use the fund to reverse the liquidation. If there’s not enough money in the fund to take over the remaining positions of someone who is going through liquidation, a counterparty liquidation will take place.

Of course, there are additional considerations to take in mind, more information on which can be found here.

Security: Is It Safe to Trade on ApolloX?

There’s no information online showing that the exchange has gone through any kind of exploit or has had any issues, for that matter.

Of course, as it is with any other cryptocurrency exchange, you need to know that you’re not in control of your funds. There’s a popular saying in crypto – “Not your keys, not your Bitcoin.” With this in mind, it’s highly advisable to only keep an amount that you need for your trading purposes while sending the rest to a cold wallet. As mentioned, though, this is not only true for ApolloX – but for any centralized exchange out there.

The exchange has taken a lot of steps to enhance the security on the platform, including:

- Two-Factor Authentication

- SMS Authentication

- Additional security steps when a new device or new IP address attempts to log in

The team also revealed that the tokens are stored in cold wallets for increased protection.

Customer Support

Contacting customer support on ApolloX is rather easy and straightforward, and it can happen through a few different channels, depending on your own preferences.

First, it’s possible to open a ticket directly through the help center – ApolloX assures its users that they have 24/7 customer support.

In addition, there’s also a Telegram group where users can discuss their experience on the platform and receive assistance from team members and admins. However, it’s particularly important to stay vigilant when it comes to Telegram and make sure that the person you’re chatting to actually belongs to the team.

ApolloX has also prepared a comprehensive set of guides where users can familiarize themselves with various intricacies and processes on the platform. This is particularly helpful, and it’s encouraged to take a look at them and the FAQ section before contacting the support team.

Conclusion

In conclusion, the platform is very easy to use, and it delivers sufficient trading tools for a comprehensive and efficient experience regardless of whether you’re a novice or seasoned veteran.