ANZ to Kickstart Chainlink Private Transactions Protocol in RWA Boost

-

Chainlink has introduced a new protocol aimed at ensuring privacy for financial institutions, enabling them to conduct secure, confidential transactions across different blockchain networks.

-

Australia and New Zealand Banking Group (ANZ) will pilot this privacy feature for settling tokenized real-world assets, as part of Singapore’s Project Guardian, highlighting a practical application of Chainlink’s technology in the banking sector.

21:33

Is Ethereum the ‘Blackberry’ of Crypto?

01:28

Key Indicator Lends Credence to $100,000 Bitcoin

02:16

Bitcoin Eyes $70,000, Vitalik Buterin Outlines Ethereum ‘Scourge’ Upgrade

01:30

What’s Driving Bitcoin’s Recent Price Rise?

Chainlink released its CCIP Private Transactions protocol, a privacy-preserving tool, on Tuesday. The tool will allow financial institutions to maintain confidentiality and regulatory compliance when transacting across blockchain networks.

Australia and New Zealand Banking Group (ANZ) will be among the first financial institutions to pilot the capability for cross-chain settlement of tokenized real-world assets (RWAs) under the Monetary Authority of Singapore (MAS) Project Guardian initiative.

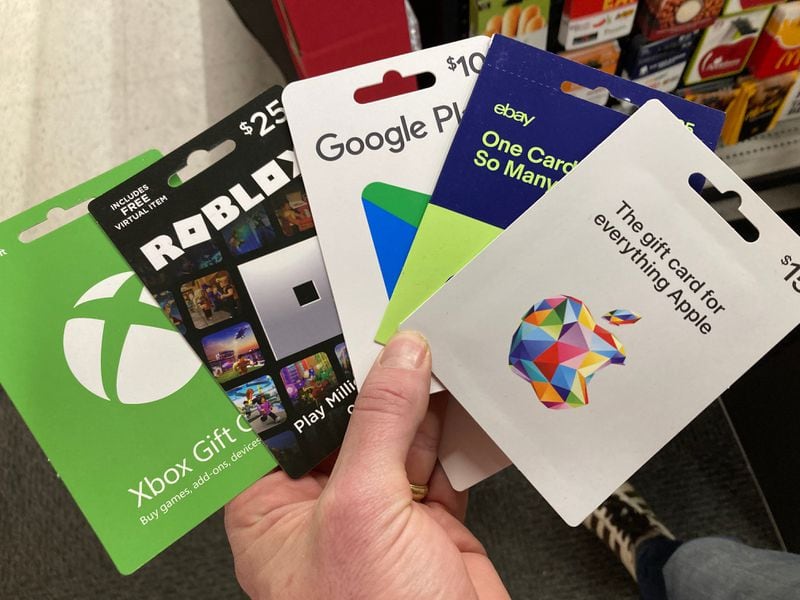

Cross-chain protocols allow token holders to transfer and interact with applications among different blockchains, which is otherwise not possible. RWAs refer to a tokenized version of a physical asset, such as artwork or real estate, that is tradeable on the open market.

Institutional requirements include the need for complete end-to-end privacy for private chain to private chain transactions and limiting data exposure for private chain to public chain transactions.

The private transactions allow institutional users to define privacy conditions in a way that keeps onchain data private from all third parties and adversaries, while enabling authorized parties in the transaction or the compliance industry to view that same data.

“Privacy is a critical requirement for most institutional transactions,” said Sergey Nazarov, Chainlink co-founder, in a prepared statement. “So far the blockchain industry has not provided the level of privacy necessary for these institutional transactions to move forward successfully, limiting the entire industry’s growth.

“Now that private transactions across chains are possible, we expect an even greater influx of institutional adoption of blockchains, CCIP, and the Chainlink standard in general,” Nazarov added.

Edited by Parikshit Mishra.