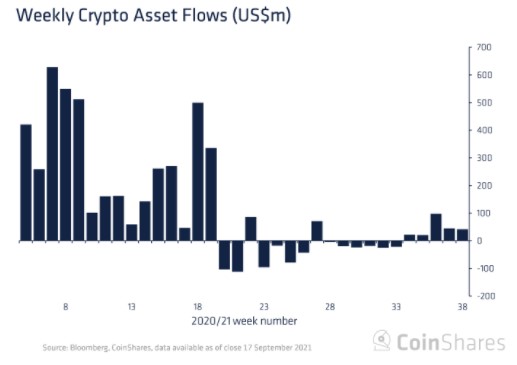

Another Week of Institutional Accumulation: CoinShares Sees $42 Million Weekly Crypto Inflows

One of the most popular digital asset managers, CoinShares, continues to see institutional inflows for a 5th week in a row now.

- In its latest Digital Asset Fund Flows Weekly Report, CoinShares revealed that it ended the previous week on a positive note in terms of inflows.

Digital asset investment products saw inflows totaling $42M last week. Inflows were seen across all digital assets and signals what we believe to be continued improving sentiment amongst investors.

- It’s also worth noting that Bitcoin saw inflows of about $15 million and has suffered from negative investor sentiment in only 3 of the last 16 weeks.

- Another thing that the report touched on is Solana. As CryptoPotato reported, the network suffered from an outage and was off for hours.

- Despite this, Solana saw inflows of some $4.8 million, which “suggests investors were happy to shrug off the attack, seeing it as teething problems rather than something more inherent with the network.”

- Nevertheless, this report accounts for the data up until September 17th. In the past couple of days, the cryptocurrency market lost billions of its capitalization in a broader collapse.

- This saw Bitcoin tank to about $40,000 earlier today, while other cryptocurrencies are also bleeding out.

- WIth this said, it’s interesting to see how institutional investors are handling the current situation.