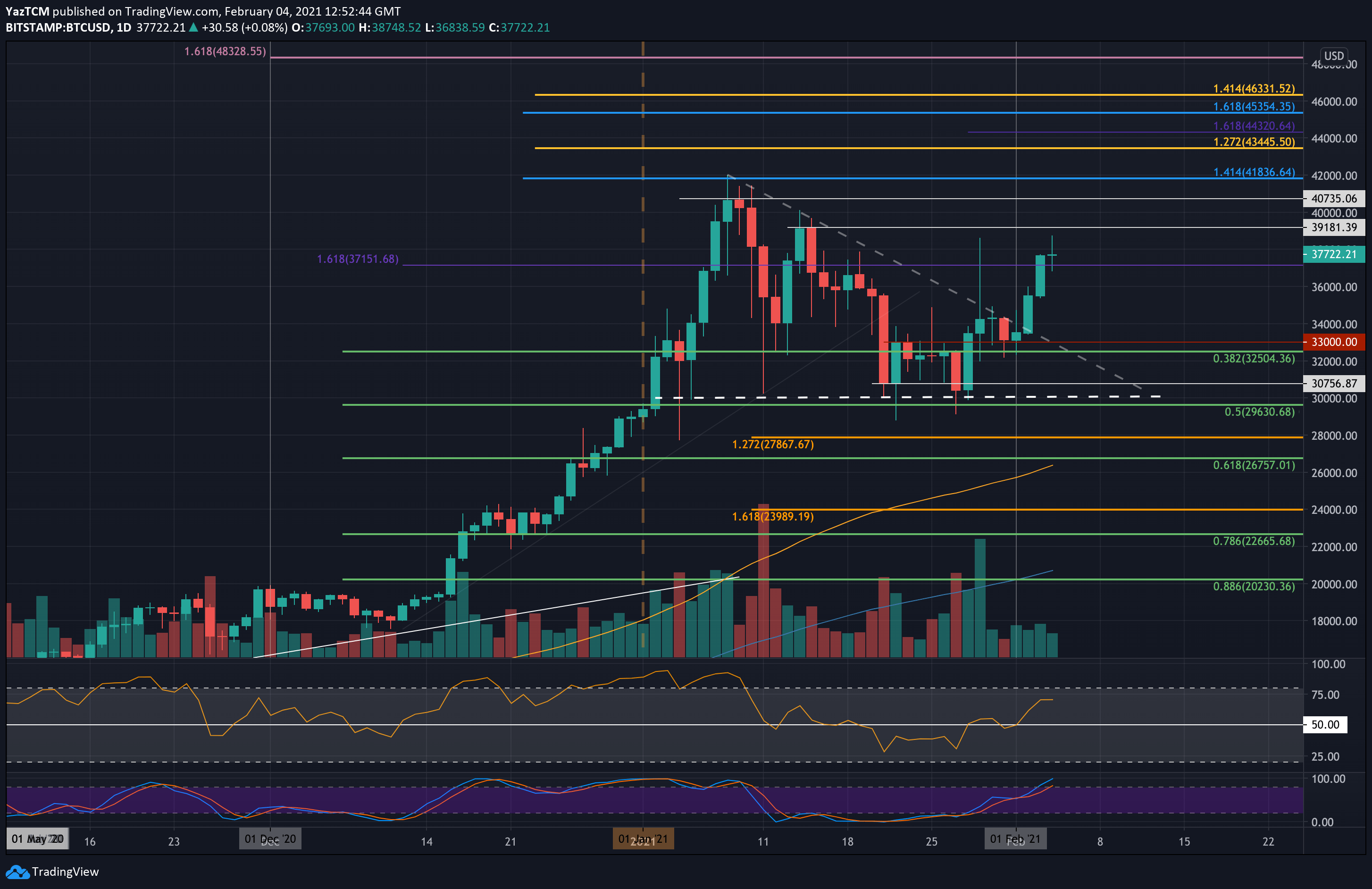

Another $439M in Liquidations As BTC Drops Below $40k

Under threat of greater rate hikes from the Federal Reserve, Bitcoin is plunging to a monthly low, alongside stocks. Hundreds of millions of dollars in liquidations have been set off across the crypto market in the process.

- Last week, Bitcoin fell back below $45k despite having a bullish late March. This came following hawkish comments from Federal Reserve Governor Lael Brainard, who said that the task of reducing inflation pressures was “paramount” the previous day.

- Stocks and bonds also fell following these comments, with which Bitcoin has held a tight correlation in recent months.

- The downtrend continued this Monday, as Bitcoin fell below $40k for the first time since March 16th. Its price is $39,773 at the time of writing after having fallen to 39,570, according to Bitstamp.

- This has not left bullish traders in good shape. According to Coinglass, over $439M has been liquidated across the crypto market within 24 hours. That includes 141,000 trades, one of which just lost $10M on his trade.

- Across cryptocurrencies, about $152 million in liquidations occurred among Bitcoin traders, versus $103 million among Ethereum traders.

- As is typical, altcoins are down heavily as well. Ethereum is barely holding $3000, while Solana is already down 12% today.

- The event mirrors the losses from last week, which also exceeded $400M.