Analyzing The Insights From River Financial’s Lightning Node Report

River Financial research analyst Sam Wouters shares about his report which details unique insights from the company’s Lightning node.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

- Apple

- Spotify

- Libsyn

In this episode of “Bitcoin, Explained,” hosts Aaron van Wirdum and Sjors Provoost speak with Sam Wouters, a research analyst at River Financial. River operates the fourth-largest node on the Lightning Network, and Wouters recently published a report which details unique insights from River’s Lightning node.

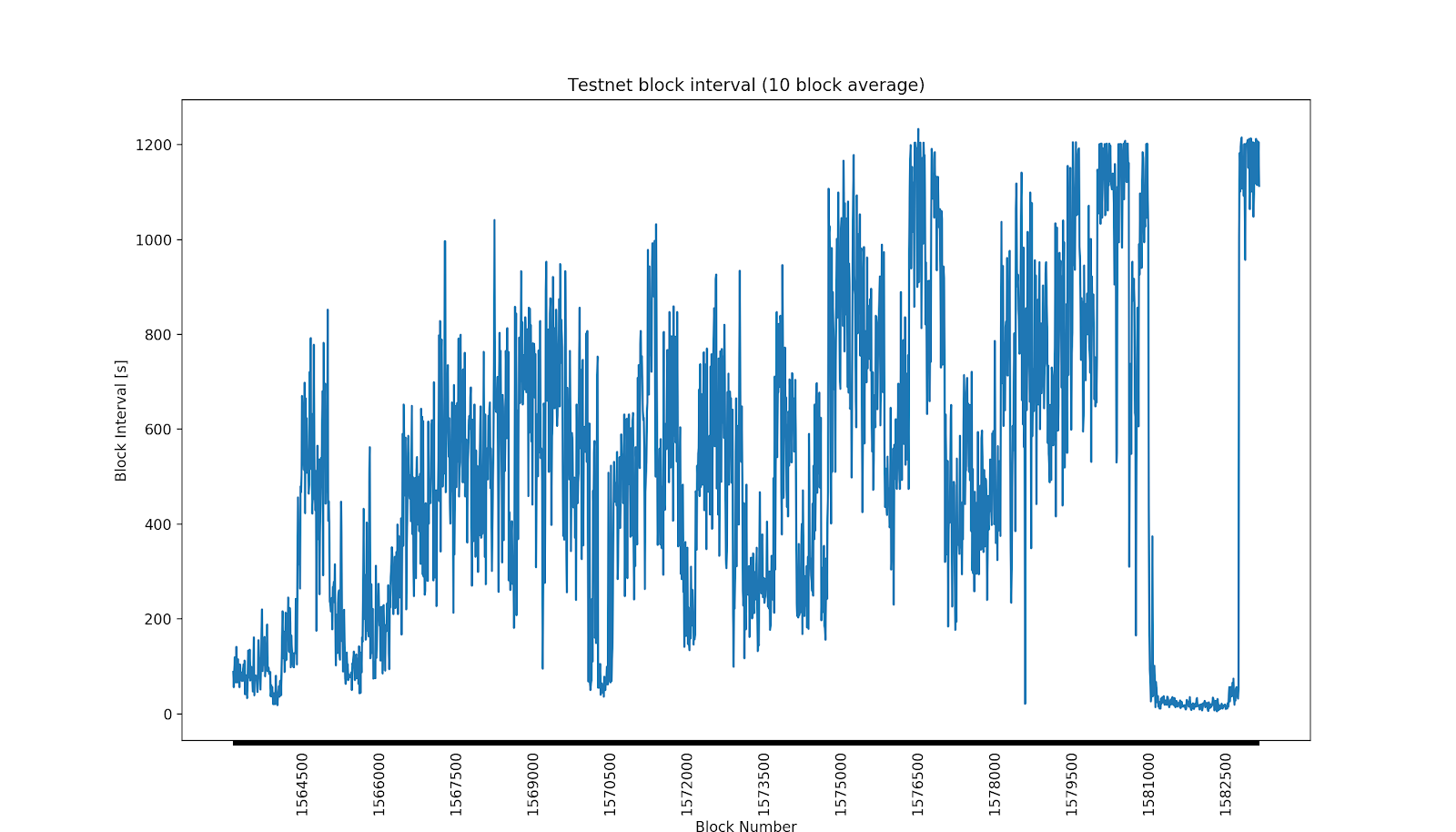

At the start of the episode, Provoost first gives a brief update on the bug that brought down LND nodes (as discussed in the last episode). He confirms that his assessment of the cause was correct, and explains that a very similar bug has brought down LND once more on November 1.

Van Wirdum and Provoost then go on to ask Wouters about the contents of his report, with a focus on three subsections of the report in particular.

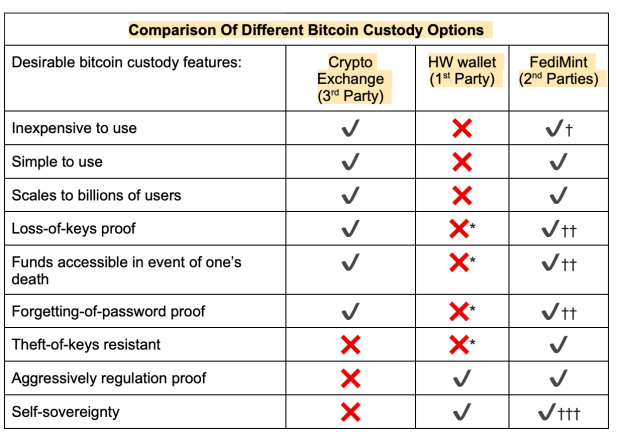

First, van Wirdum, Provoost and Wouters discuss the current status of fees and liquidity. Wouters explains that large Lightning nodes can earn a “return on investment” of several percentages per year by routing payments over the network, but that this does require active channel maintenance to manage liquidity.

Next, van Wirdum, Provoost and Wouters discuss why some Lightning payments fail. Wouters explains that the success rate of Lightning payments is very high compared to just a few years ago, but that there are two main reasons why payments sometimes do still fail: payment timeouts and a lack of available routes. The trio speculates why this might be the case.

Lastly, Wouters outlines some of the challenges and concerns related to running Lightning infrastructure for businesses.