Analysts suggest Dogecoin traders are rotating profits into large-cap altcoins

Every cryptocurrency bull market has at least one surprise catalyst that comes out of nowhere to excite traders and spark massive trading volumes that lift the total market capitalization to new highs.

The 2021 bull market is no exception to this rule, and one of the biggest catalysts for growth this year has been the explosive popularity of Dogecoin (DOGE), which has made headlines in traditional and alternative financial circles as its price surge to new all-time highs over the past few months.

With such tremendous growth happening in just a few short months, it’s only natural for traders to make moves that help lock in gains and then search for the next potential mover to invest in.

The price action for DOGE even caught the eye of Jon Bollinger, inventor of Bollinger Bands, who on May 3 tweeted “$Dogeusd put in a top, fell by 65%, and is now knocking on the door again while $dogebtc is breaking out. Simply amazing price action.”

Dogecoin was trading near $0.40 at the time of the tweet but has since skyrocketed 80% to a new all-time high at $0.69. After today’s strong rally, Bollinger to posted the following tweet as a word of advice to DOGE traders:

I think that ll you dog lovers better start thinking about a top here.

— John Bollinger (@bbands) May 5, 2021

And it appears that some traders had similar thoughts or took Bollinger’s words to heart on May 5, as the price of DOGE experienced a pullback of 25% before recovering near the $0.60 level.

Large-cap altcoins benefit from Dogecoin’s momentum

Several observant traders, including Digital Currency Group founder Barry Silbert, pointed out that a lot of DOGE’s trading activity has happened on the Robinhood trading app and that the other cryptocurrencies available on the platform could benefit from traders rolling profits over from DOGE into slower performing cryptocurrencies.

This turned out to be a prescient viewpoint, as all the major cryptocurrencies available on Robinhood have seen double-digit gains on May 5, while the price of DOGE has experienced a 25% pullback.

— Alex Krüger (@krugermacro) May 5, 2021

Ethereum Classic (ETC) has been one of the biggest beneficiaries of the shift in funds, which helped the Ethereum fork blast to a new record high of $100 on May 5. In the same period, Bitcoin Cash (BCH) and Bitcoin SV (BSV) have seen gains in the 25%–30% range.

While the percentage growth seen in the price of Litecoin (LTC) is less than that of the other tokens listed on Robinhood, LTC’s 15% rally pushed the altcoin to a new multiyear high of $351. This puts LTC price less than 7% below its previous all-time high at $375.

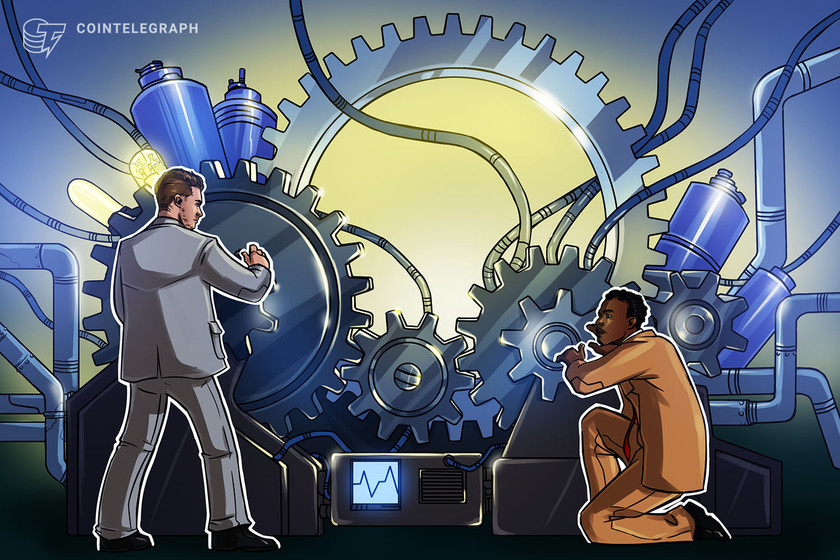

According to data from Cointelegraph Markets Pro, market conditions for LTC have been favorable for some time.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen on the chart above, the VORTECS™ Score for LTC began to pick up on April 29 and maintained an elevated level over the next four days before hitting a high of 68 on May 2, around 11 hours before the price increased 35% over the next three days.

With DOGE still trading above $0.58 at the time of writing and hype is continuing to build ahead of Elon Musk’s appearance on the comedy sketch show Saturday Night Live, the bullish price action for LTC and the other cryptocurrencies available on Robinhood could continue as retail traders new to the crypto market flock to the popular meme coin.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, and you should conduct your own research when making a decision.