Analyst Backs Bitcoin Price to $50k in February as Another Trader Highlights Bitcoin Minetrix’s Potential

It’s been a mixed start to 2024 for Bitcoin (BTC), with the coin rising to $49,000 on January 11 before falling 21% in the 12 days that followed.

However, one veteran analyst remains bullish on Bitcoin’s prospects, providing a price target of $50,000 and predicting that the coin could hit that level as early as next month.

Meanwhile, the new presale project Bitcoin Minetrix (BTCMTX) is also drawing attention from traders after hitting the $9.7 million milestone.

Bullish Trader Sees Bitcoin Surging to $50k in February

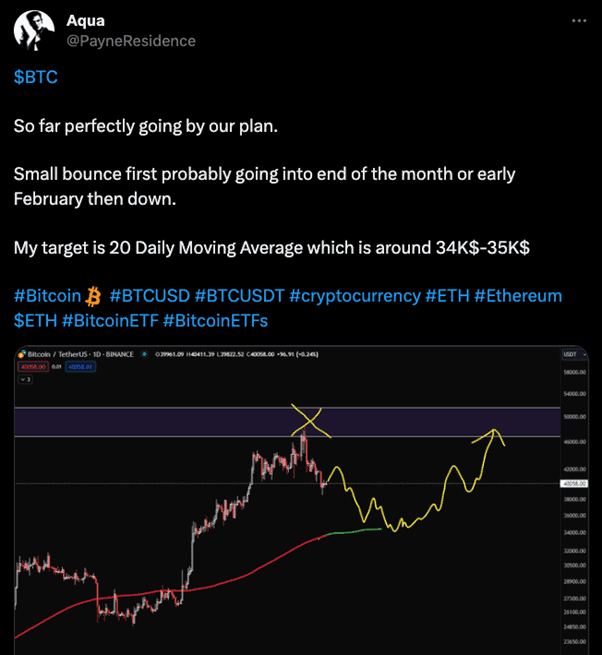

Well-known crypto trader @PayneResidence, who goes by Aqua on Twitter, has outlined a bullish scenario for Bitcoin over the next few weeks.

According to Aqua, Bitcoin’s price action so far has been going “perfectly by our plan.”

He expects a “small bounce” going into the end of the month or the start of February, then down to test support around the 20-day moving average (MA), which currently sits between $34,000 and $35,000.

However, he doesn’t expect Bitcoin to drop below this key MA – once the price bounces off, Aqua is targeting a move up to between $47,000 and $52,000.

Essentially, Aqua believes Bitcoin will see some short-term weakness but will ultimately regain bullish momentum and move back toward the psychologically important $50,000 level in February.

So, while investors may have to brace for volatility soon, Aqua remains bullish on Bitcoin over the medium term.

Spot BTC ETFs Attract Billions as BlackRock Dominates the Field

Aqua’s bullishness is backed up by the solid performance of the spot BTC ETFs launched in the US just a few weeks ago.

Leading the way is BlackRock’s iShares Bitcoin Trust ETF (IBIT), which has accumulated over $2 billion in assets under management since its debut.

BlackRock’s fund tops its nearest competitor, Fidelity’s Wise Origin Bitcoin Fund, which has attracted $1.8 billion in capital since it launched.

Unlike other ETF issuers targeting crypto-native audiences, BlackRock is leveraging its reputation as the world’s largest asset manager to market BTC to mainstream investors.

Moreover, with competitive annual fees of just 0.12%, it’s no surprise that investors are piling in.

If momentum continues, analysts estimate spot Bitcoin ETFs could accrue a whopping $10 billion in their first year.

In turn, this could be great news for Bitcoin’s price – further reinforcing the bullish forecasts made by Aqua.

Disruptive Bitcoin Minetrix Presale Receives 100x Forecast from Prominent Crypto Trader

Alongside Bitcoin, another crypto gaining attention in the market is Bitcoin Minetrix (BTCMTX).

As an ERC-20 token built on Ethereum, BTCMTX offers a Stake-to-Mine model that allows users to earn mining rewards by staking their tokens without requiring expensive computing hardware.

This works by users accruing “mining credits” over time, which can be burned to receive cloud mining power or a share of the associated mining yields.

The accessibility brought about by this Stake-to-Mine approach could be a game-changer, opening up passive Bitcoin mining income streams to everyday investors.

Bitcoin Minetrix’s features are underpinned by Ethereum-based smart contracts, which have been audited by Coinsult and found to be issue-free.

These elements have created an enormous buzz around the project’s presale phase, which has now raised over $9.7 million in funding.

Prominent crypto influencer Jacob Bury even boldly predicted in a recent video that BTCMTX could be the next 100x cryptocurrency – highlighting its disruptive potential

Only time will tell whether Bury’s prediction comes true, but the strong presale performance and impressive value proposition have helped Bitcoin Minetrix step into the limelight.

With BTCMTX tokens still on offer for just $0.0131 during the current presale stage, many community members believe now is the ideal time to get involved before the token’s exchange listing in the coming weeks.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Analyst Backs Bitcoin Price to $50k in February as Another Trader Highlights Bitcoin Minetrix’s Potential appeared first on CryptoPotato.