Analysis: BitMEX Traders Short BTC In Large Quantities – Good Buying Opportunity?

Bitcoin traders utilizing the popular derivatives exchange BitMEX still seem significantly more bearish on the asset’s future price developments, on-chain data reveals.

At the same time, a prominent analyst argued that the most violent stages of the recent market crash are over, which could suggest good entry opportunities.

BitMEX BTC Traders Still Bearish

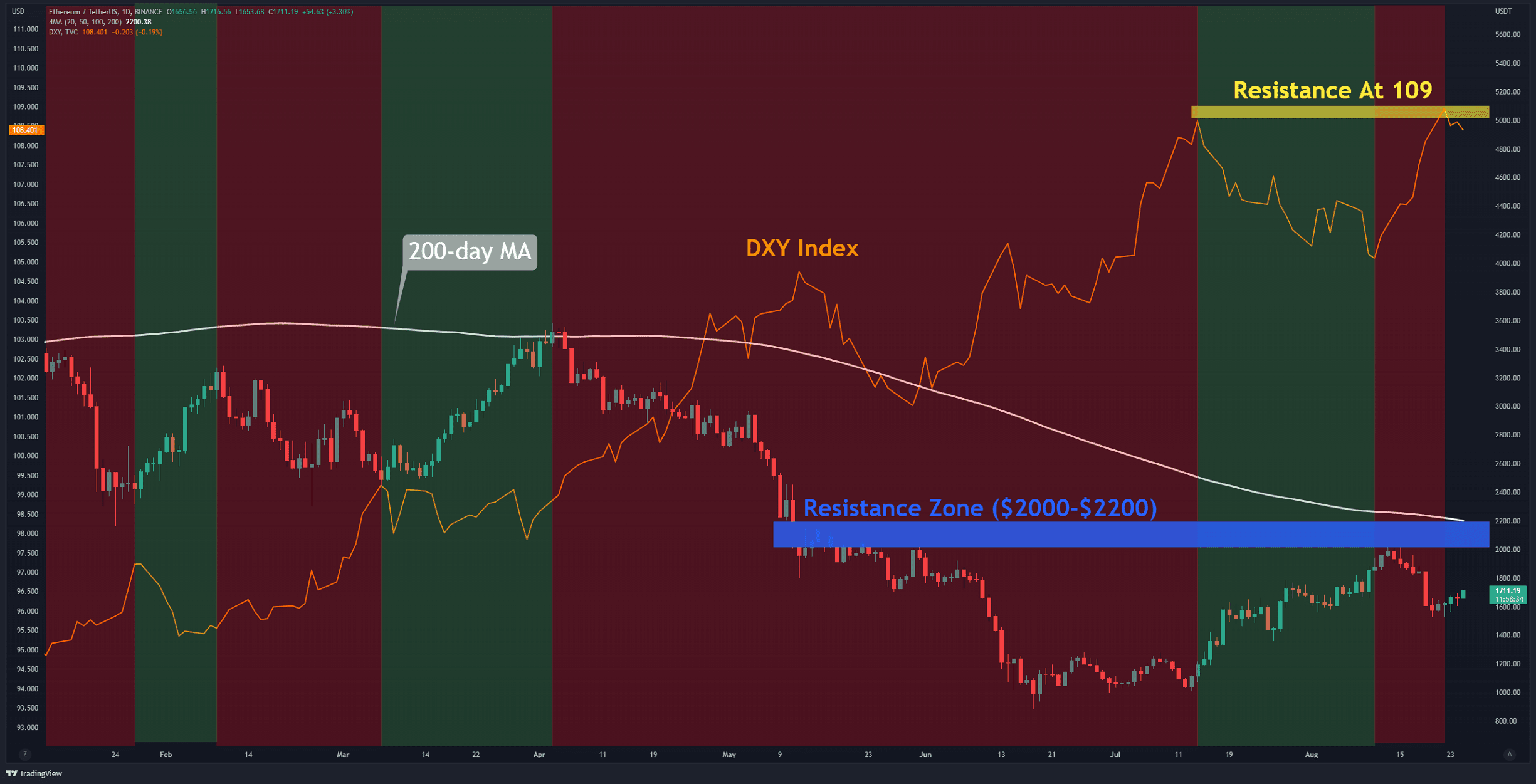

Bitcoin’s price went through a roller-coaster in the past month propelled by FUD and over-leveraged positions on derivatives exchanges. Despite recovering to some extent from the mid-May bottom at $30,000, the asset might not be out of the woods yet.

Although the leveraged positions are substantially less now as some traders may have learned a painful lesson, data from the cryptocurrency analytics tool Santiment reveals that users employing BitMEX still envision adverse price developments for BTC.

“BitMEX traders are continuing to short Bitcoin in large quantities, at the most bearish ratio since April 2020.” – reads the firm’s Twitter post.

Nevertheless, the analytics company outlined that this could also be a “great sign for those waiting for markets to turn upward again.” This is because “price tends to increase when crowd FUD begins to take hold.”

Good Opportunity For Newbies?

The narrative that this could be indeed a good opportunity for newer investors to join the market received support from the Chief Executive Officer of Pantera Capital, Dan Morehead.

In the monthly newsletter, the executive opined that bitcoin is “currently trading 36% below its 11-year exponential trend.” The asset has spent only 20.3% of its history as far under this valuation, which could be a clear sign that it’s undervalued.

For new investors, it’s best to buy when the market is well below trend. Now is one of those times.#Bitcoin has only been this “cheap” relative to its trend 20.3% of the past 11 years.

More perspectives on market timing in our June investor letter: https://t.co/AOvhFyxBJh pic.twitter.com/2bsxbw5Iay

— Dan Morehead (@dan_pantera) June 16, 2021

When BTC has been this low in previous examples, its price has skyrocketed in a matter of months to new highs. He also addressed some speculations that the impressive price appreciation in the past year has put BTC in a highly overvalued (bubble) state.

“The year-on-year return never went literally off-the-chart like in past peaks. It’s currently trading at 281% year-on-year – which seems entirely plausible given the money printing that has occurred in that period.”