Analysis: Bitcoin’s Next Leg up Will Probably Take Some Time

Bitcoin’s price corrected over the past few days after reaching an all-time high well above the $60K mark. Now, a cryptocurrency analytics provider believes that it will probably take some time for it to get back up.

Bitcoin’s Most Recent Correction

After reaching an all-time high at $61,781 (on Bitstamp), Bitcoin’s price has started to retrace as it goes through a correction.

It started a couple of days back. As CryptoPotato reported then, over $2.2 billion, long positions were liquidated in less than 24 hours as BTC slipped below $55,000. It has since attempted a recovery but has so far failed, and it continues to trade around that mark at the time of this writing.

According to JP Morgan analysts, the most recent surge above $60K wasn’t caused by institutions but rather by retail investors, which might also be part of the reasons for which it’s rather unsustainable.

In any case, the following areas of resistance, should the price starts picking up some steam, would be around $58,300, $60,000, and then the current all-time high level. On the flip side, if the price starts trending downwards, support can be expected around $54,500 and in the range between $53K and $52,340.

Recovery Might Be Slower

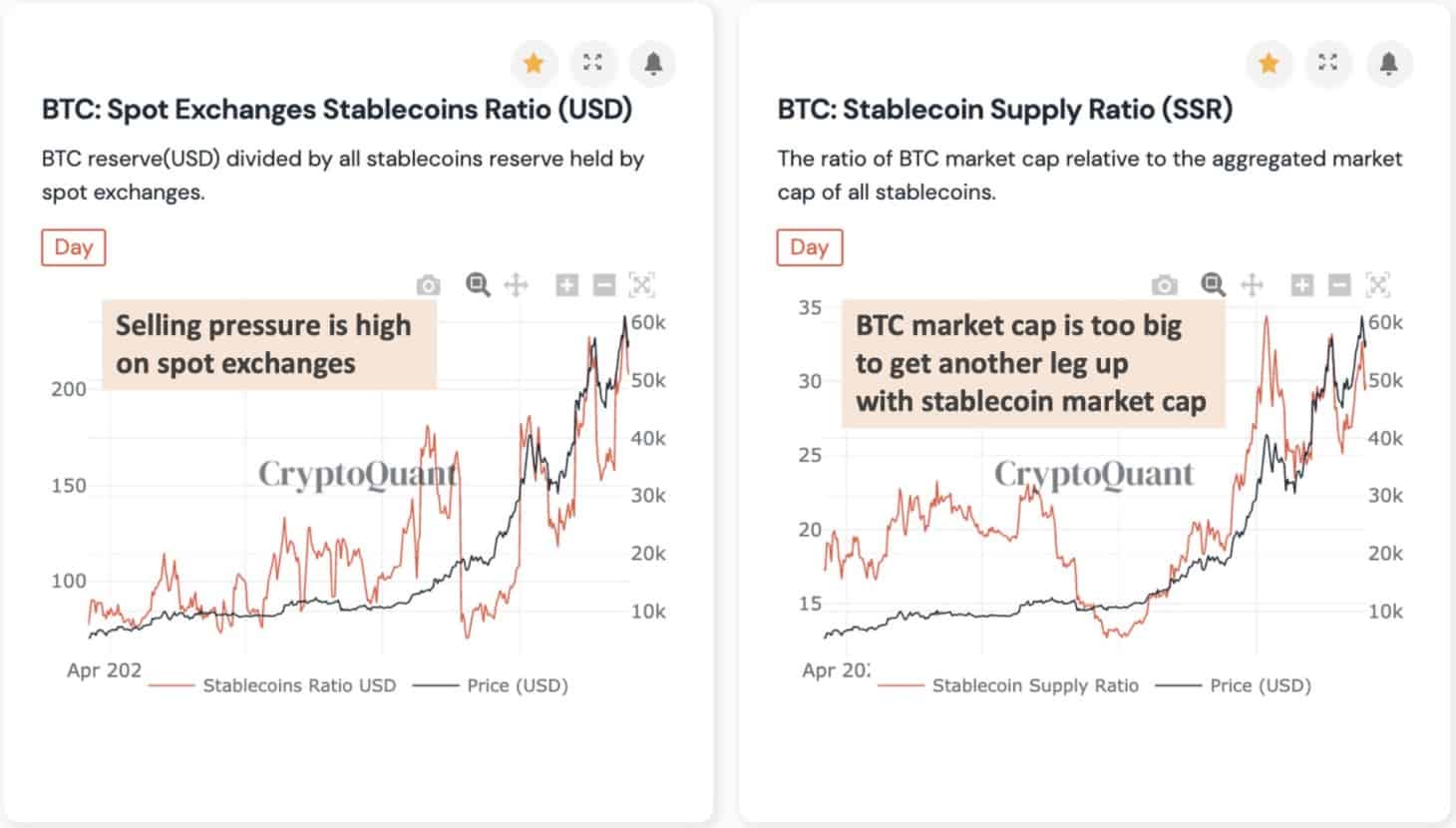

Amid all this, notable cryptocurrency analytics provider, CryptoQuant, says that it might take some time for the price to recover and go through another leg up based on a few metrics.

Right off the bat, the current BTC holdings in USD are too many compared to stablecoin holdings on spot exchanges. This means that there’s currently not enough sidelined capital sitting on exchanges waiting for an entry.

As a second reason, the analysts note that the “BTC market cap is too big to get another leg up by leveraging stablecoin market cap solely.”

The last point that Ki Young Ju, the CEO of CryptoQuant, makes is that there are no significant spot inflows of USD. The Coinbase premium is neutral, while GBTC and QBTC premiums are negative.