An Unintended Consequence of Low Interest Rates? The Big Get Bigger

(IconicBestiary/Getty Images)

An Unintended Consequence of Low Interest Rates? The Big Get Bigger

As companies have to shift their business model to contend with low interest rates, the largest find themselves in a comparatively better situation.

For more episodes and free early access before our regular 3 p.m. Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica, iHeartRadio or RSS.

This episode is sponsored by Crypto.com, Bitstamp and Nexo.io.

Today’s episode of The Breakdown is an extended edition of the Brief.

NLW discusses:

- The “COVID-19 vaccine trade” on Wall Street kicks markets higher

- The latest on TikTok vs. the U.S. and what it means for the U.S.-China relationship

- More companies move reserves from cash to bitcoin

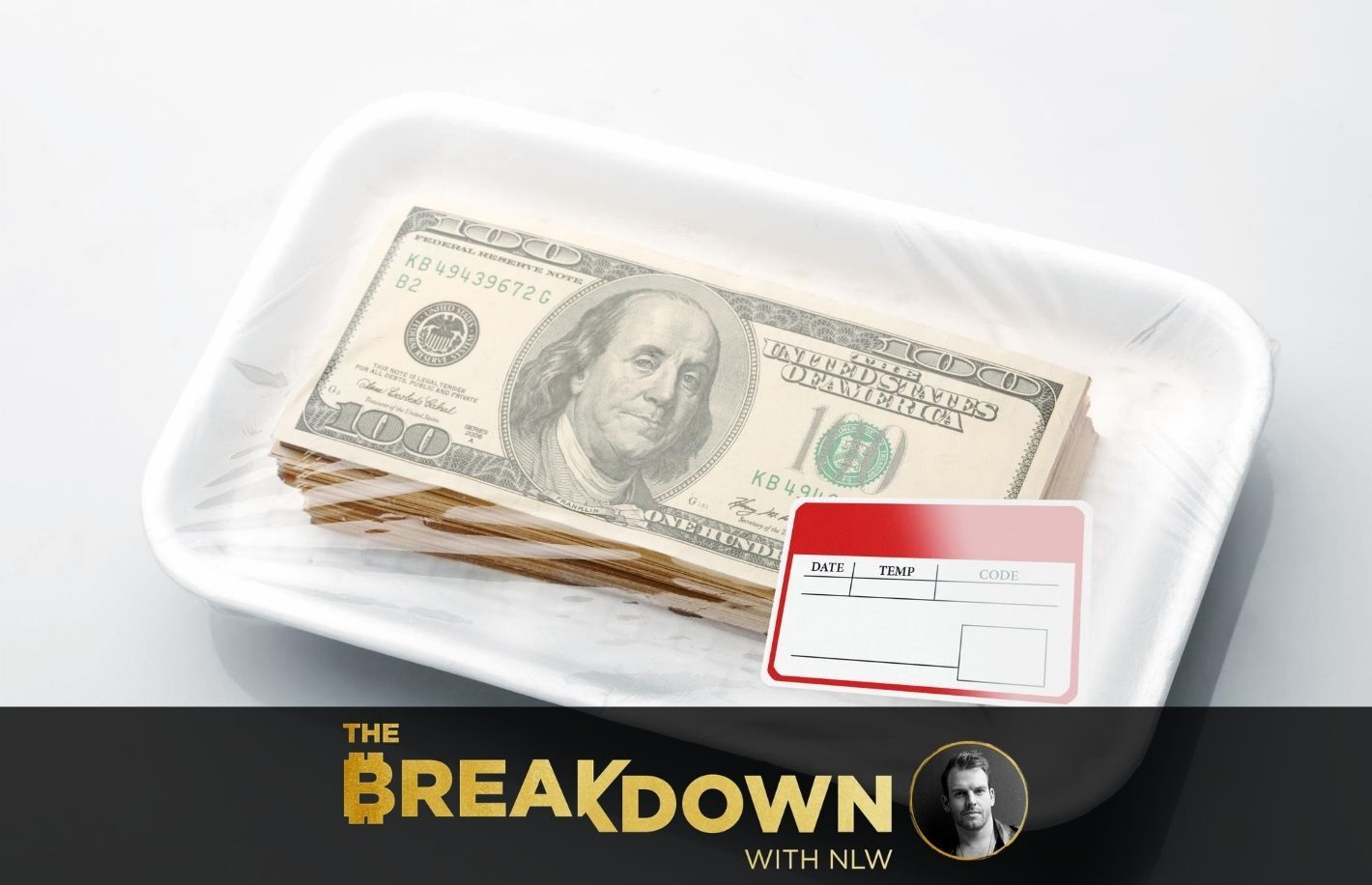

The final topic today looks at news that some large money market funds are shifting fees from users and taking the financial hit themselves. This creates a dynamic where only the largest companies can survive long term, and reflects a key unintended consequence of low interest rates.

For more episodes and free early access before our regular 3 p.m. Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica, iHeartRadio or RSS.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.