Amid the Bitcoin Fiasco: Elon Musk No Longer the World’s Second-Richest Person

Tesla’s CEO, Elon Musk, has lost his spot as the world’s second-richest person to the French billionaire investor – Bernard Arnault. Interestingly, this development came after Musk’s adverse comments on bitcoin and the continuous price drop for Tesla’s stocks.

Musk Loses Second Spot in Terms of Wealth

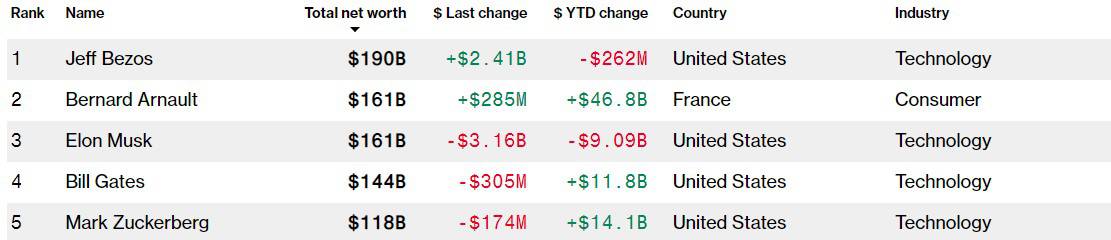

According to data from the Bloomberg Billionaires Index, Elon Musk’s net worth has dropped quite considerably year-to-date. This could be somewhat of a surprise as he actually became the world’s richest person in January 2021.

However, his wealth has been on the downfall since then and is down by over $9 billion to $161 billion. In the past few days alone, he has lost over $3 billion.

At the same time, the LVMH Chairman and Chief Executive, Bernard Arnault, has increased his wealth by $47 billion YTD and has surpassed Musk for the second position in terms of richest people.

Amazon’s Founder and CEO, Jeff Bezos, still occupies the first spot with a personal net worth of over $190 billion.

What Caused Musk’s Wealth Decline?

Musk’s decreasing wealth is a direct result of the adverse performance of Tesla’s stocks lately. The electric vehicle giant started the year with a solid pump that drove it to a high of just shy of $900 per share. Naturally, this was the time when Musk surpassed Bezos as the world’s richest person.

However, some mishappenings with Tesla electric vehicles started to turn the tables. TSLA began falling quickly and is down to $576 as of yesterday’s closing price. This means a 21% YTD drop and a 35% decrease since the yearly high in January.

Interestingly, Michael Burry, the investor who made a name by profiting from the subprime mortgage crisis, revealed that his fund – Scion Asset Management – holds 800,000 put options on Tesla. It means that SAM has betted $534 million that the Tesla stocks will keep falling. This is the fund’s largest single position.

On a more micro-scale, TSLA shares are down by roughly $100 in the past week alone. This coincides with the company’s announcement that it has stopped receiving bitcoin for its products.

Furthermore, Musk has been openly criticizing the primary cryptocurrency, which has attracted substantial attention from crypto insiders and outsiders. Some reports suggest that Tesla’s decision could have something to do with the declining stock prices.

Featured Image Courtesy of Medium