Amid Escalating Geopolitical Tension, Circle CEO Says Crypto Is ‘Double-Edged Sword’

The Russia-Ukraine crisis is far from cooling down anytime soon. In the thick of the ongoing chaos, the CEO and founder of the digital currency company Circle – Jeremy Allaire – asserted that crypto is a double-edged sword.

In the Face of Crisis

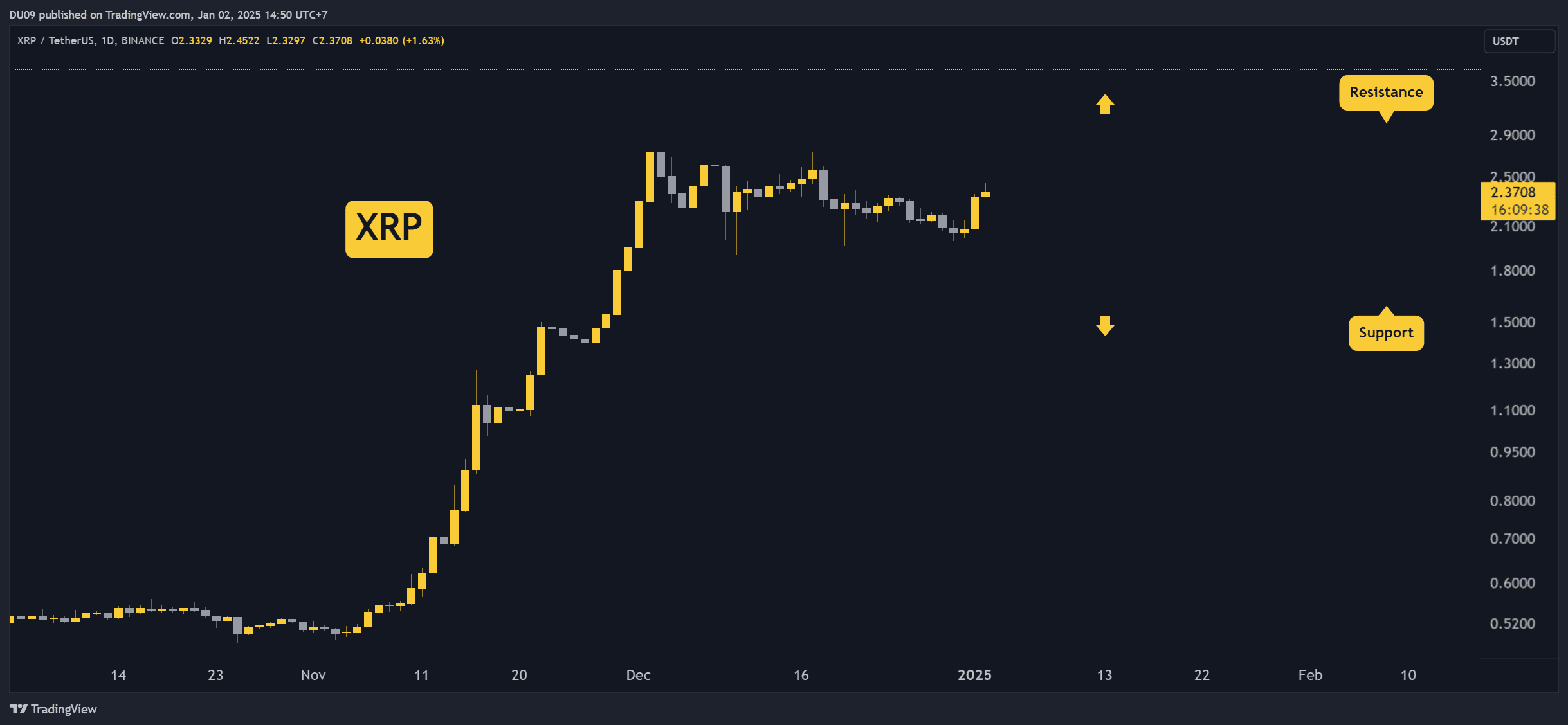

The cryptocurrency market is rallying in the face of a growing geopolitical crisis. In addition to increasing acceptance, the Ukraine crisis is yet another driver that has highlighted how Bitcoin and cryptocurrencies can act as a crucial mechanism to raise funds when traditional routes are cut off.

According to the latest report by Bloomberg, Allaire said Russia’s attack on Ukraine demonstrates the paradox of cryptocurrencies for both participants as well as regulators.

On one hand, as Russian forces invade the Ukraine frontlines, several vehicles have been formed to raise funds to purchase food, clothing, medicine, evacuation, and repairs for the general masses by accepting cryptocurrencies. On the other hand, there’s a possibility that Russian individuals and companies may try to use digital assets to dodge financial sanctions imposed by western countries.

On that note, the Circle exec stated,

“People are celebrating that. But it also allows people to evade things. The open internet is a double-edged sword, and that’s the case with crypto.”

Isolating Russian Economic Activity

Calls to freeze all Russian users’ blockchain addresses have intensified in tandem with the ongoing crisis. But in actuality, Allaire said the platforms do not have all the information despite being able to track “high-risk” activities identified on exchanges and flag suspicious activity to regulators. The exec stated,

“We don’t necessarily know – just like the U.S. doesn’t know – if piles of cash are being used by Russian oligarchs. So you don’t know.”

In a bid to destabilize and cut the financial connection to the western economies, NATO and the EU imposed several sanctions. As a result, Bitcoin (BTC) trading volumes against the Ruble climbed the highest level since May 2021, as revealed by the cryptocurrency market data provider – Kaiko.

Many industry experts think that this financial insecurity may trigger more cryptocurrency adoption in the region, due to which Mykhailo Fedorov, the Vice Prime Minister of Ukraine, urged several platforms to restrict all Russian users’ blockchain addresses and back Ukraine’s defense.

But so far, apart from Hong Kong-based blockchain gaming and NFT unicorn Animoca Brand, none of the venues have responded in affirmative. Binance, following Kraken’s suit, revealed that it will not terminate its services to Russian users. However, the exchange promised to restrict its services to those individuals of the region that have had sanctions “levied against them while minimizing the impact to innocent users.”

Featured Image Courtesy of CNBC