Altcoin Season Brewing as Bitcoin Price Stalls and Dominance Takes a Beating (Market Watch)

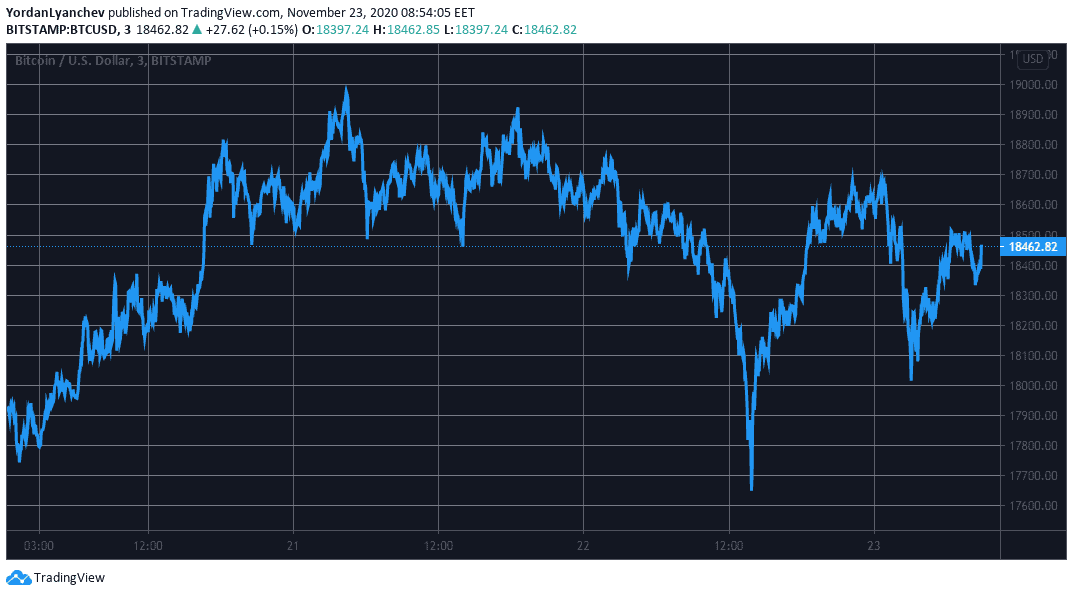

Bitcoin’s volatility continued over the weekend with a few $1,000 moves taking it from a high of $18,800 to $17,700 and back. The altcoins, however, have kept their recent momentum going and have reduced BTC’s dominance over the market to about 63%.

Bitcoin’s Volatile Weekend

The primary cryptocurrency displayed increased signs of volatility during the weekend. It started with charting a fresh yearly high on Saturday at nearly $19,000.

After coming just inches away from breaking the 2017 all-time high, BTC headed south with a vigorous nosedive of more than $1,000, resulting in a new intraday low at $17,650 (on Bitstamp).

The fluctuations intensified, but this time in the opposite direction as BTC jumped back to $18,700 a few hours later. After a subsequent retracement, Bitcoin sits now just above $18,400.

The technical indicators suggest that the cryptocurrency has to overcome the resistance lines at $18,950, $19,400, and $19,660 before potentially breaking the current ATH.

On the other hand, the support levels at $18,200, $18,000, and $17,700 could assist in case of another price breakdown.

Altcoins Rejoice And Reduce BTC’s Dominance

The alternative coins have enjoyed the past several days. Ethereum has experienced another 7% increase and has risen above $580 as staking interest has been expanding lately.

Ripple has also doubled-down on its recent impressive price performance. XRP has added 4% of value and sits above $0.45.

Bitcoin Cash (1%), Binance Coin (1%), Chainlink (1%), Polkadot (3%), and Litecoin (3.5%) are also in the green. However, the most notable performer from the top 10 is Cardano. ADA has surged by 20% and has neared $0.15. Just a few days ago, ADA was struggling with staying above $0.10.

The double-digit price increase club has several representatives from mid and lower-cap altcoins. Waves leads the way with a 37% increase on a 24-hour scale and a 77% surge in the past week.

Horizen’s daily gains are next with 30%. Numeraire (20%), VeChain (12%), Yearn.Finance (11%), and Celo (10%) follow.

Consequently, the altcoins have managed to decrease Bitcoin’s dominance over the market. The metric comparing BTC’s market cap with all alternative coins has dropped to 63.2%, while it hovered over 68% on November 19th.