The Shopification of Wealth

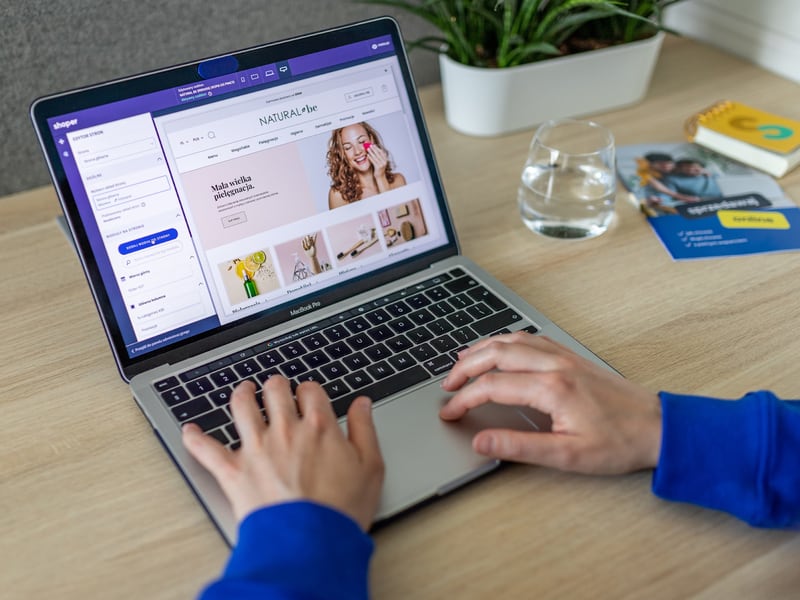

Before Shopify, building and running an e-commerce site was expensive, operationally intensive and a logistical nightmare. Only large retailers could afford to build and operate an online store that could truly serve a large customer base, which made e-commerce seem like a small market. Enter Shopify: by eliminating the supply constraints — enabling anyone with