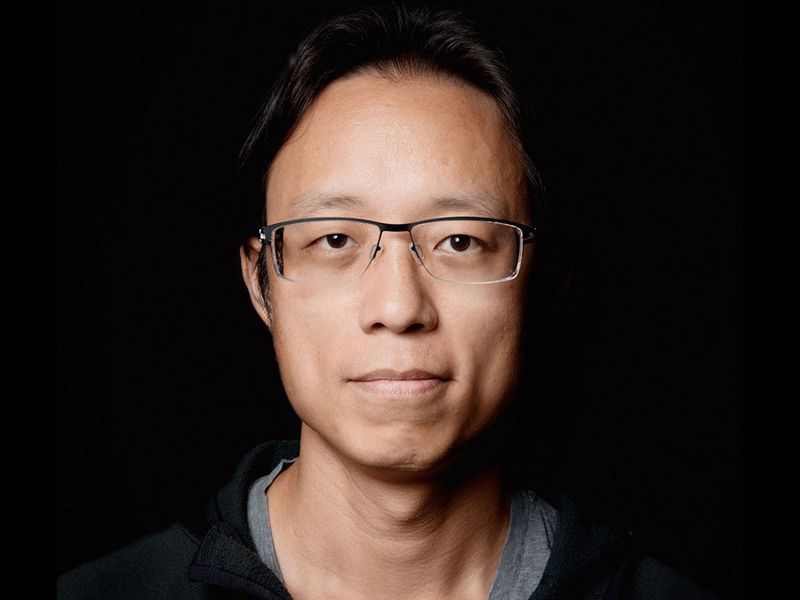

Ali Yahya, Andreessen Horowitz: ‘Many Fair Weather VCs Have Pivoted’

If you’re reading this, odds are you’ve heard the cliche that “Crypto Winter is the time for building.” It’s almost a mantra — even a lifeline — for those who believe in the underlying tech, have faith that the markets will bounce back, and are focused more on products than prices.

What’s less understood is that “crypto winter is the time for investing.” Or at least it is for the ones who are sticking around, such as the deep coffers of Andreessen Horowitz (a16z), which has now raised over $7 billion of capital for the crypto space, according to General Partner Ali Yahya.

Jeff Wilser is a book author, journalist, ghostwriter, and the host of the “AI-Curious” podcast.

“We’re still running the 85-person crypto team, and we’re 100% committed on crypto as a space,” says Yahya, who brushes off concerns that Marc Andreessen’s recent Techno-Optimist Manifesto did not specifically mention crypto. (Yahya explains that a16z’s other co-founder, Ben Horowitz, is the one who’s more crypto-focused.)

How can crypto winter lead to good investments? The way Yahya sees it, if you’re a founder and you’re launching in a bear market, that means you believe. You’re not here for a cash grab. You have conviction. “They have decided to bet their company, or even their career, in this space,” says Yahya. “Those are the people that we like to back.”

On a recent Zoom interview, Yahya appears upbeat, focused and fit. And by “fit” what I really mean is ripped. He’s bald, bearded, and wears a t-shirt that he looks ready to burst out of, Incredible Hulk-style. There’s even a sneaky connection to fitness and investing. “In power lifting, you’re essentially maxing out, and you are completely stressing your body all the way to its limit,” Yahya says, explaining that this requires discipline and focus, and that spills into the rest of his life.

This could even be a metaphor for crypto winter. “In some ways, the winter filters out the nonbelievers, right?” says Yahya, who shares what he looks for in a startup team, what he thinks it will take for crypto to reach true mainstream adoption, his advice for Web3 founders, why he now has a drive to “run into the fire, to almost seek out uncomfortable experiences, and then reframe them.”

Interview has been condensed and lightly edited for clarity.

Dude, you look fit. We’re immediately changing this interview to your fitness regimen.

Ali Yahya: Laughs. Thank you, I really appreciate it. I’m training for this competition at the end of the year.

It’s a power lifting competition in New York, the Tone House Lift Off.

This could be a stretch, but I’m guessing there’s a connection between the discipline in your fitness training and the discipline required for smart investing, and how you sharpen your mind.

So, let’s start with the fitness. What’s your routine like?

Well, I’ve always been into fitness, but most recently, I really got into this idea that you can reframe any kind of discomfort. So much of discomfort is actually in the mind. You can reframe it to actually feel like it’s constructive, like it’s a more pleasant or pleasurable feeling than it really is.

This sounds similar to the Stoic philosophy?

Yes, it’s very much inspired by Stoicism, and I think through a couple of very intense romantic relationships as well, a couple years ago. I went down this deep rabbit hole about how to process pain and how to deal with suffering.

And my inclination since then has been to run into the fire, to almost seek out uncomfortable experiences, and then reframe them. And as a result, kind of reshape the relationship that I have with pain.

One of the big challenges in a bull market is trying to get at the true motivations of the founders

This is where power lifting comes in?

In power lifting, you’re essentially maxing out, and you are completely stressing your body all the way to its limit. So that’s a direct manifestation of that. My training routine is basically three days of lifting every week, with a trainer who absolutely almost kills me. I come out of it feeling like I’m a new man, and that does kind of set the tone for everything else. Because now anything that feels uncomfortable day-to-day, that’s just a fraction of the way you feel when your body’s about to break. It creates a rhythm that keeps me disciplined and keeps me focused.

Okay speaking of “pain,” it’s not hard to see the parallel for the last year or so in crypto…

Yeah. In some ways, the winter filters out the nonbelievers, right? The people who are not fully bought in, who haven’t fully searched their souls and found the compelling nature of Web3 sort of within them.

So as a result, it’s a great time for consolidation, right? For the folks who are maybe here for the wrong reasons or here for more opportunistic reasons, to go and pivot to something else like AI.

And then the people who are actually hardcore, and who really do understand why the technology is truly valuable, will actually build the foundation for the next generation of the internet.

That makes sense for the space as a whole. How about on a company level?

For individual companies, going through this period forces a certain kind of discipline. Now you have to rely on your own conviction that the space will come back, right? That this all will work.

I think it tests the culture, it shapes the culture, it makes it stronger. It forges it into something that’s likely more durable. And it’s just the best time to do really good work. Because you’re not distracted by all the noise; it’s easy to just be heads-down and build. And then also from an investing standpoint, some of the best investments are made in the troughs right off winters like this.

How would you describe the VC landscape for crypto and Web3 right now?

It’s a similar dynamic, where many “fair weather” VCs have pivoted out of the space. And now they’re chasing the next hot thing, which is AI at the moment. So only a small number of investors who truly get the space — and who have been in it for a very long time — remain. For us, we’re not pivoting out, we’re open for business. There’s little competition and we’re able to make the investments we want to make.

That’s great for you guys at a16z, but I’m guessing from the perspective of Web3 founders, it’s tougher, right? There’s less funding supply in the space than there used to be?

There’s less dollars to go around, so it’s tougher for the average Web3 startup to get funding?

Yes, that’s right. It’s a less ideal time to raise money for sure. Fortunately, a lot of the great founders and great companies were able to raise money and capitalize themselves at the height of the last bull market, so now they have enough dry powder to weather the winter, and focus on building.

Are you still deploying capital into projects?

Yeah, definitely. It’s not as fast as it was in 2021, but we’re certainly still investing. I do think some of the best investments may come from times like this, in particular when we invest in companies that are starting now.

For founders who are actively choosing to start a crypto or Web3 company now, just consider what that says about them, right? The fact that they are not starting an AI company, they’re starting a crypto company in the depth of winter, that means that they must really believe. That means they have fully gone down the rabbit hole and understand why crypto is a promising space. They have decided to bet their company, or even their career, in this space. Those are the people that we like to back.

So we’re very much on the lookout for those people. And those would be very early-stage companies. Oftentimes it would be first money in, and so it’s a small amount of capital. That’s not a way to deploy a lot of capital quickly, but again, we believe that those might actually lead to some of the best investments and some of the best companies.

And by the way, this kind of dovetails with what we’re doing with our Crypto Startup School. It’s an accelerator program that targets very early-stage companies; we’re going to run this next one in London. We think it’s a perfect pairing for winter, because we want to go after these really early-stage companies with conviction.

How is evaluating investments in a bear market different from evaluating them in a bull market?

One of the big challenges in a bull market is trying to get at the true motivations of the founders. And so in a bull market, it’s very important to ask all sorts of questions to get at, “Why are you doing this?” It could be very opportunistic. It could be a cash grab. It could be because it seems like the sexy thing to do. So that’s a big difference.

Another difference is that we definitely have to think about the go-to-market in the short to medium term. So the fact that these companies are being started in the winter, and the fact that the winter might continue for a long time, means we have to factor that in our decision about whether or not to invest. So if the success of the company depends strongly on, you know, one thousand application developers to arrive fairly quickly and start building on top of whatever infrastructure they’re building, that’s harder.

There’s obviously been a ton of attention on Marc Andreessen’s “The Techno-Optimist Manifesto.” I know you didn’t personally write it, but how does the ethos of this manifesto guide the way you view investments? And then as a follow-up, should the crypto space be worried that the manifesto didn’t mention crypto?

I’ll take the second part first. Not at all. I think the manifesto is intended to target technology more broadly. And in fact, there was a follow up podcast with Marc and Ben Horowitz, and there’s a big section there about crypto in particular, because Ben tends to spend much more time with our crypto team than Marc. So I think it was less top-of-mind for Marc when he wrote it.

How big is the crypto team by the way?

We’ve raised about $7.5 billion for crypto, and we’re still running the 85-person crypto team and we’re 100% committed on crypto as a space.

And how does the ethos of the manifesto guide your view on investments?

Well, at its core, startups really only work when you have a kind of optimism about the future, and about the kinds of changes that you can make in the world through technology. So I think both from the lens of an investor and the lens of a startup founder, you have to have some sort of belief in the positive effect that technology can have.

We want to invest in people who have big visions for the future, who believe that the future can be much better than it is today. Like, any founder who believes that the future will be the same as it is today or will be worse, is almost by definition not someone that we could back.

On a more mundane note, how does regulation fit into all of this? I’ve spoken with founders who are so confused by the state of U.S. regulation, it impacts what products they will build. Does that have a similar impact on your investment analysis?

Yeah. It’s a very big factor. I mean, we are strong believers that regulation is necessary and we just have to have smart regulation. We’re working hard at trying to educate people in Washington, people who are policymakers, people who are in government about what the technology is, so that hopefully we end up with sensible regulation.

Another thing that we do is spend a lot of time with our portfolio, helping them navigate the regulatory landscape and helping them think strategically about the risks involved, especially when there’s a lot of uncertainty. You have to basically make a decision as to what risk you’re willing to take, and you need really smart legal people around the table to make those decisions. So we often play that role and we help our founders make hard choices when the law is really not clear.

What advice would you give Web3 founders who are building? I know the party line is to “build, build, build,” but on top of that, for those hoping to get funding at some point, what advice would you give?

So it depends strongly on the stage. For very early-stage, it ultimately comes down to the team that you’re able to bring together. Because we primarily invest in people that very early stage. That’s by far the dominant factor.

It’s always good to be able to show some kind of product-market fit. So that the thing that you have built is now being pulled out from you, from the company by the market, by your users, your customers, developers, whoever it may be. And really what you now have to do is just go faster because they cannot get it fast enough. And what you need is to kind of pour fuel on the fire to be able to go faster and meet the demand of the market more quickly.

Last question, and this goes back to our theme of optimism. What does your gut tell you will be the eventual driver of mainstream Web3 adoption?

It’s a really good question. We can’t just keep talking about why crypto is valuable. I think what will have to happen is that someone builds an application that drives real value, that ends up reaching 100 million users or more.

And I think this could happen in a number of different categories. It could be a company like Farcaster, which is building a decentralized social network that’s somewhat like Twitter, where the user controls their own identity and controls who they can follow and who follows them. Something like that could reach 100 million users. And that would be a very strong statement for why blockchains are powerful, especially given what’s going on with Twitter now.

It could also be a game, like a crypto-enabled game that has a full-on crypto economy that’s interoperable with the economies of other games, where you can own your character. There are many games that are in the works. It just takes a long time to build a game. So that could be one.

It could also be something like sound.xyz where you have a decentralized music streaming platform, where artists can connect with their fans directly. Like where you can essentially buy an NFT to be able to comment on the artist’s track on the interface, in the way that you could with SoundCloud back in the day.

It’s a super simple thing, but it’s a way of creating a community that has this financial element to it, such that now artists can have an economic relationship with their fans, right? That is direct. There are no intermediaries, no labels. Spotify doesn’t take a huge cut. So if a number of really major artists go through that process and are able to monetize their music in a way that becomes very public, then I could see that being a watershed moment where it’s like, holy shit, this is just a better model for creative people to monetize their work. So that could be another way.

Those are maybe three possibilities, but I think one of them at some point has to really break out in order for crypto to really get to the next level.

Love the optimism. Thanks again, and good luck with the power lifting competition.

Edited by Ben Schiller.